Ondo Wallet

Transform fixed income with Ondo! Launch into a new era of DeFi where access to yield-generating opportunities is revolutionized. Embrace the potential of structured products that aim to bridge the gap between traditional finance and the cryptocurrency world. Join a dynamic community of investors and innovators exploring the forefront of decentralized finance. Tap into the potential to reshape your investment strategy and unlock new revenue streams – start your Ondo journey today!

How to Create a Ondo Wallet

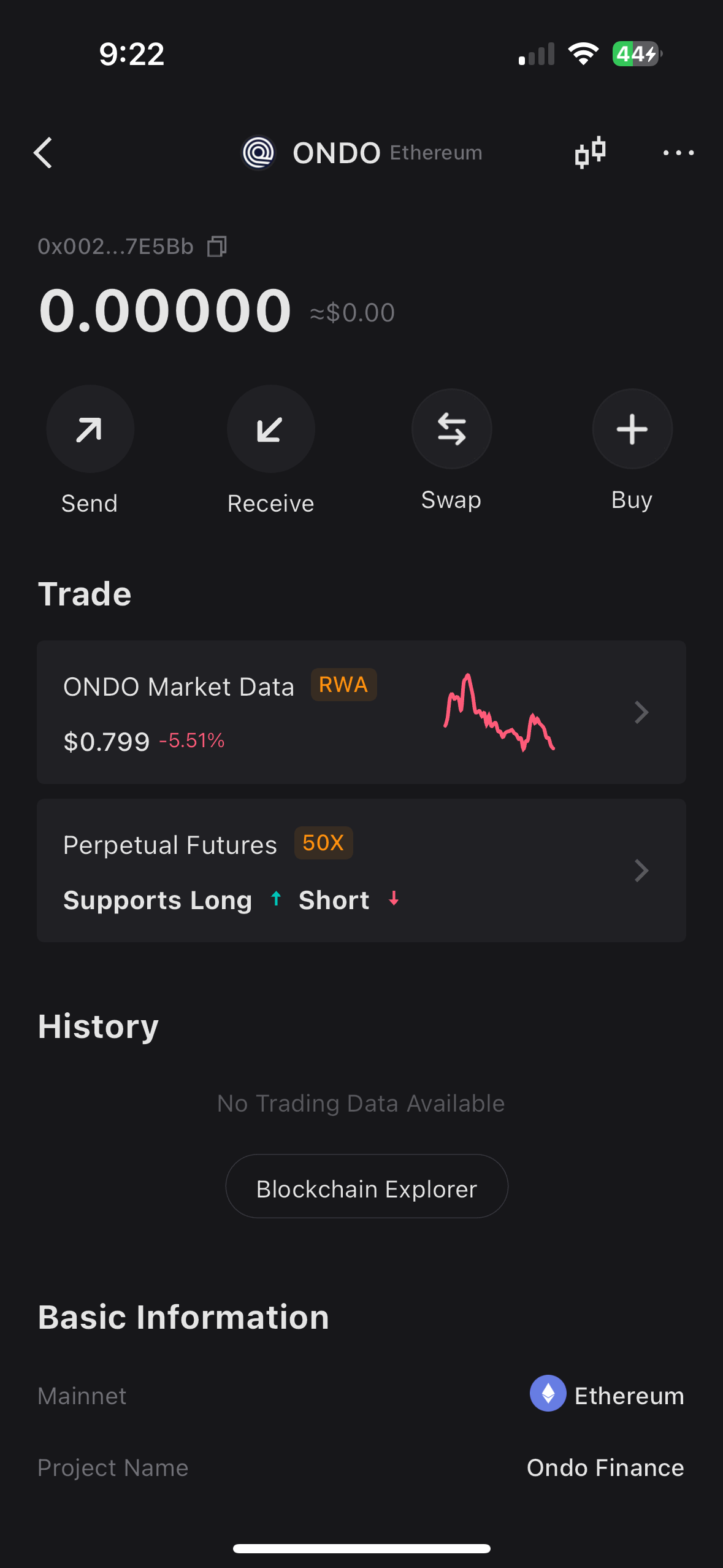

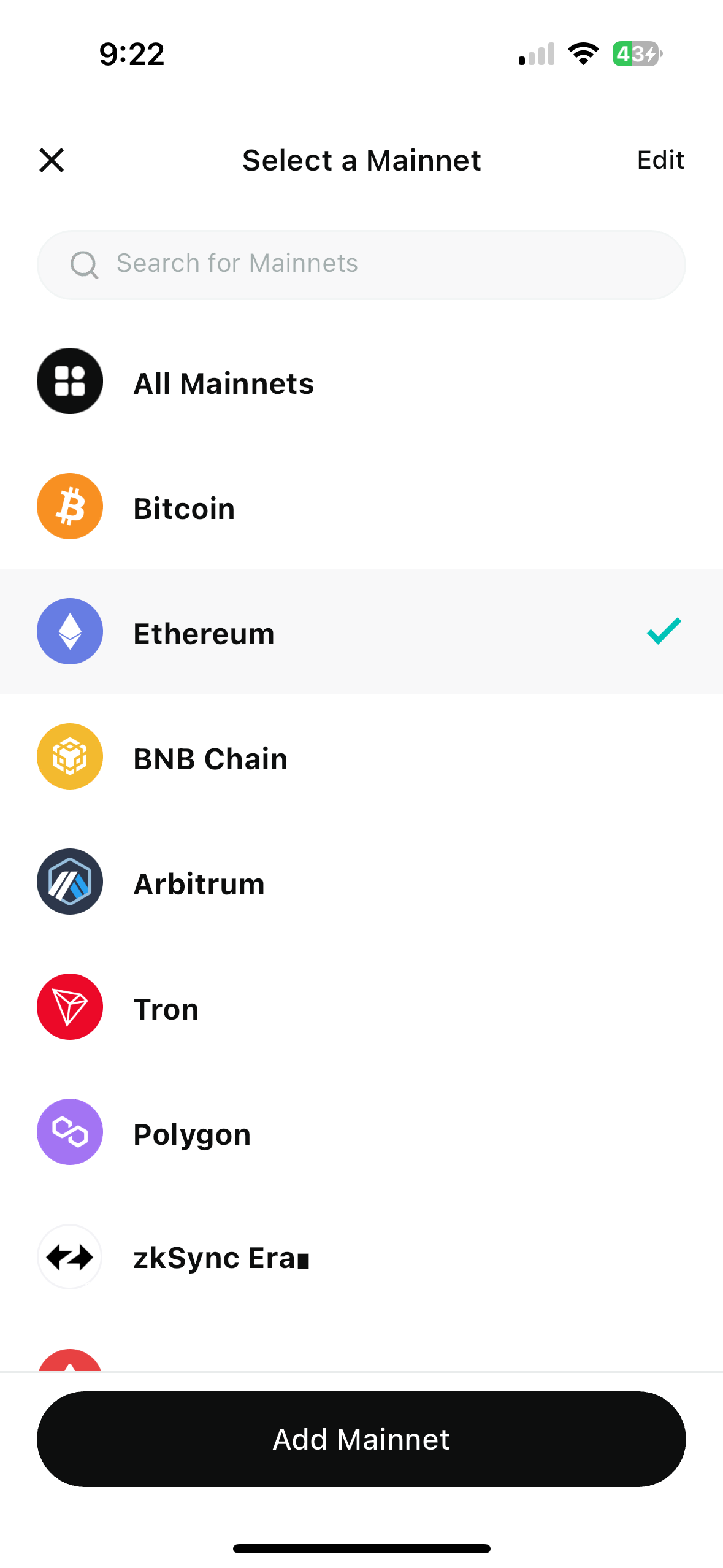

- 1. Create or import a wallet.

- 2. Select “Add Mainnet”.

- 3. Select “Ethereum”.

- 4. Return to the homepage of Bitget Wallet. The Ondo is now showing on the homepage!

You can also use our OTC feature to buy Ondo/USDT/USDC with fiat currency and swap for other tokens.

Ondo Wallet Features

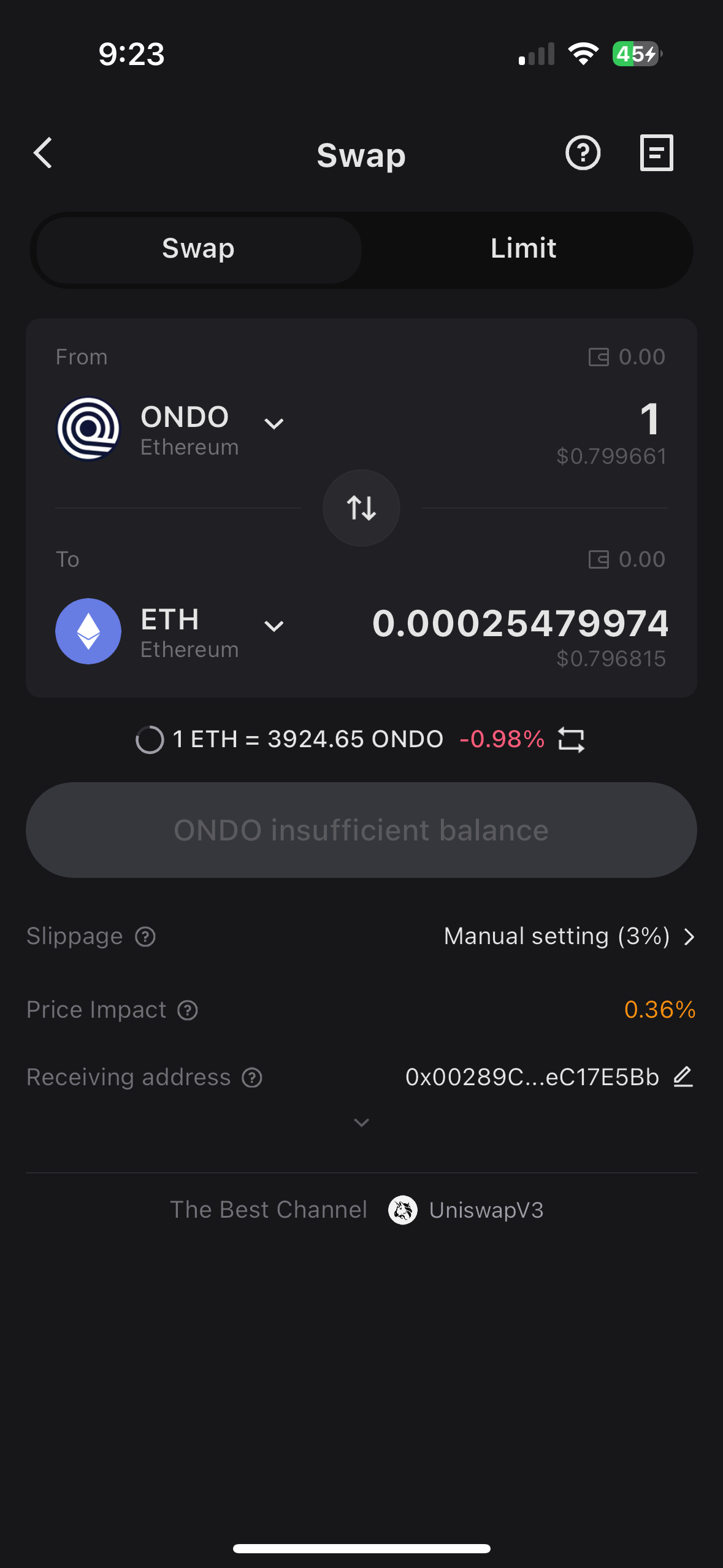

Swap on Ondo Wallet

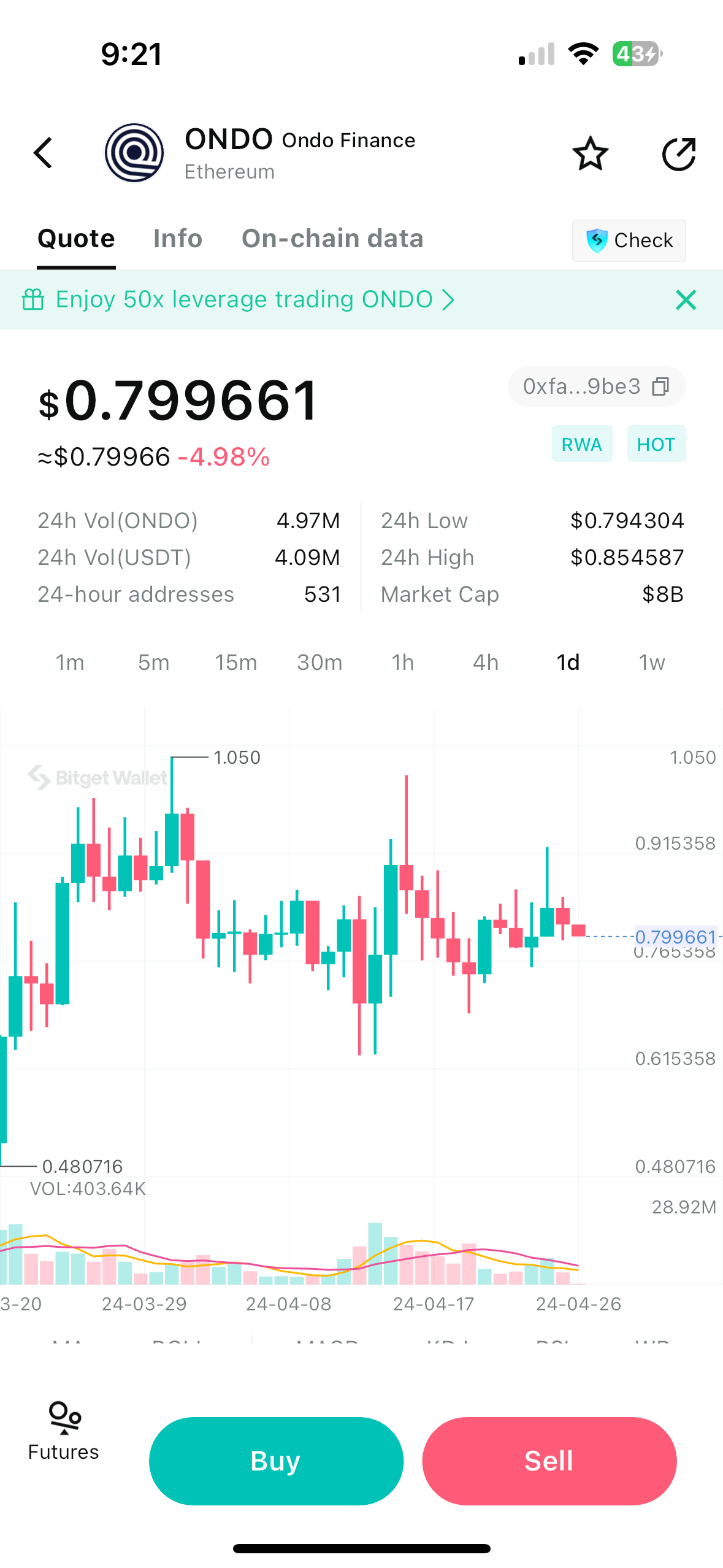

Bitget Swap has the most inclusive Ondo market intelligence, including: Real-time Quote, Token Price Chart (where users can choose to view by Day, Week, Month, or Year), Token Contract, Market Cap, Circulating Supply, Holders, transaction histories, data analysis.

Besuchen Sie Bitget Swap

FAQ

How to buy Ondo?

What's the best Ondo Wallet?

How do you download Bitget Wallet and create a Ondo Wallet?

About Ondo

What is Ondo?

Ondo Finance is a decentralized protocol that's transforming how we think about fixed income and yield generation within the world of DeFi. Imagine it as a bridge connecting two worlds: institutional investors seeking predictable returns and cryptocurrency enthusiasts eager to diversify their portfolios and access new types of investments. Ondo's innovative approach lies in creating structured product vaults that essentially divide yield-generating opportunities into different "tranches" catering to various risk appetites. This allows investors to select options that match their comfort with risk, from conservative strategies focused on minimizing risk to more aggressive approaches designed for potentially higher returns. Ultimately, Ondo's goal is to democratize access to a wider range of fixed-income opportunities within the exciting landscape of decentralized finance.

What makes Ondo unique?

Ondo stands out in the DeFi landscape due to its focus on bringing the world of fixed income and structured products to decentralized finance. By creating innovative vault structures, Ondo aims to bridge the gap between traditional financial instruments and the dynamic realm of cryptocurrencies. One of Ondo's core differentiators is the ability for users to customize their risk-return profile. Its structured product vaults separate investment opportunities into tranches based on potential risk and return, allowing users more granular choices in selecting a strategy that aligns with their specific goals and risk tolerance. Ondo has the potential to expand access to fixed-income products which have traditionally been limited to institutions or high-net-worth individuals, opening up potentially exciting yield-generating strategies in the DeFi space to a broader audience. Ondo fosters a strong community encouraging collaboration between developers, investors, and those interested in the intersection of traditional finance and blockchain, which could play a crucial role in shaping the protocol's future evolution. Strategic partnerships and integrations with other DeFi protocols are vital to Ondo's success, allowing for greater reach, innovative investment products, and a wider user base. Ondo's emphasis on cross-chain compatibility positions it well for a future where DeFi expands to diverse blockchains, allowing them to tap into greater liquidity pools and offer a wider variety of assets for its structured products. While offering a compelling proposition, it's important to consider factors inherent to any DeFi protocol, including the complexity of structured products, potential market volatility, and the evolving DeFi landscape, which present both potential benefits and risks for investors and developers within the ecosystem.

What is the future potential of Ondo?

Ondo's future rests on several key factors. If it can successfully attract both institutional investors seeking exposure to DeFi and everyday crypto enthusiasts looking to diversify their portfolios, the demand for its structured products could increase significantly. The growth of the broader DeFi market will also play a crucial role. A thriving DeFi ecosystem with a diverse range of assets would provide fertile ground for Ondo to create innovative investment products. Its ability to forge strategic partnerships within both traditional finance and the crypto sector could accelerate growth. Integrations with mainstream financial platforms or alliances with leading DeFi protocols could increase Ondo's visibility and adoption. Additionally, Ondo's focus on security and transparency will be crucial for its long-term success. As the DeFi space continues to mature, protocols that prioritize safeguarding user funds and fostering trust will likely gain a competitive edge. Ondo's ability to consistently adapt and innovate in a rapidly changing space will be critical. Navigating regulatory complexities and constantly evolving user expectations will be key challenges. While its future certainly holds potential, it's essential to be aware that Ondo, like any DeFi protocol, faces risks associated with the inherently volatile and experimental nature of the space.

Will Ondo price go up?

Like other cryptocurrencies, the price of ONDO is subject to market sentiment and the broader trends within the cryptocurrency space. Positive shifts in sentiment towards DeFi as a whole could benefit ONDO. The success of Ondo Finance as a protocol is crucial for the value of its token. If Ondo's structured products see significant adoption, attracting a large user base and substantial capital flows, the demand for ONDO tokens could increase, potentially driving its price higher. Partnerships with significant protocols, successful launches on additional blockchains, and the introduction of innovative new investment products could all serve as catalysts that positively influence ONDO's price. However, it's essential to remember that the cryptocurrency market is dynamic and prone to volatility. Factors beyond Ondo's specific ecosystem, including regulatory changes or broader economic uncertainty, could impact its price. As with any investment in the crypto space, thorough research and a balanced understanding of potential risks are essential.

Which crypto narrative does Ondo leverage?

Ondo taps into several powerful crypto narratives. Primarily, it embodies the narrative of bridging Traditional Finance (TradFi) and Decentralized Finance (DeFi) by creating structured products and investment opportunities that aim to close the gap between these two worlds. It offers a potential gateway for institutional investors to access the DeFi landscape while simultaneously opening up new yield-generating avenues for crypto enthusiasts. Additionally, Ondo aligns with the broader crypto narrative of democratization by potentially making fixed-income opportunities more accessible. Its structured vaults, with varying risk-return profiles, cater to a broader range of investors compared to some traditional financial products. Ondo also plays a role in the narrative of constant innovation within decentralized finance, as its focus on structured products and risk tranching expands the toolkit available to DeFi investors and pushes the boundaries of what's possible in terms of generating yield on-chain. While less dominant, Ondo indirectly contributes to the ongoing conversation about the future of finance, exploring how traditional concepts of fixed income might seamlessly integrate with the decentralized and permissionless nature of blockchain technology.

What is the value of Ondo token?

The value of the ONDO token is closely tied to market sentiment, the adoption of the Ondo protocol, and its broader role within the evolving DeFi landscape. Unlike traditional cryptocurrencies that might derive value from a specific utility within a platform, ONDO's value is influenced by factors like perceived potential, platform growth, and the overall excitement surrounding DeFi innovations. If Ondo successfully attracts both institutional and individual investors, establishes itself as a reliable platform for structured products, and consistently delivers value to its users, the demand for ONDO tokens could increase significantly. Additionally, positive sentiment towards the DeFi sector and the potential of fixed-income protocols could benefit ONDO's value. However, it's crucial to recognize the volatility inherent in the cryptocurrency market and the risks associated with investing in DeFi protocols. Market sentiment can shift quickly, and long-term success depends on factors like continued innovation, security, and Ondo's ability to navigate the ever-evolving regulatory landscape.