BCH Wallet

Experience the power of Bitcoin Cash (BCH)! Join a global network dedicated to fast, low-fee peer-to-peer transactions, envisioning a future where cryptocurrency is readily used for everyday purchases. Tap into Bitcoin Cash's vibrant community focused on making cryptocurrency a practical payment solution for the world. Designed to fulfill the original vision of Bitcoin as electronic cash, Bitcoin Cash aims to bring greater scalability and accessibility to the world of cryptocurrency payments. Start your Bitcoin Cash journey today!

How to Create a BCH Wallet in Bitget Wallet

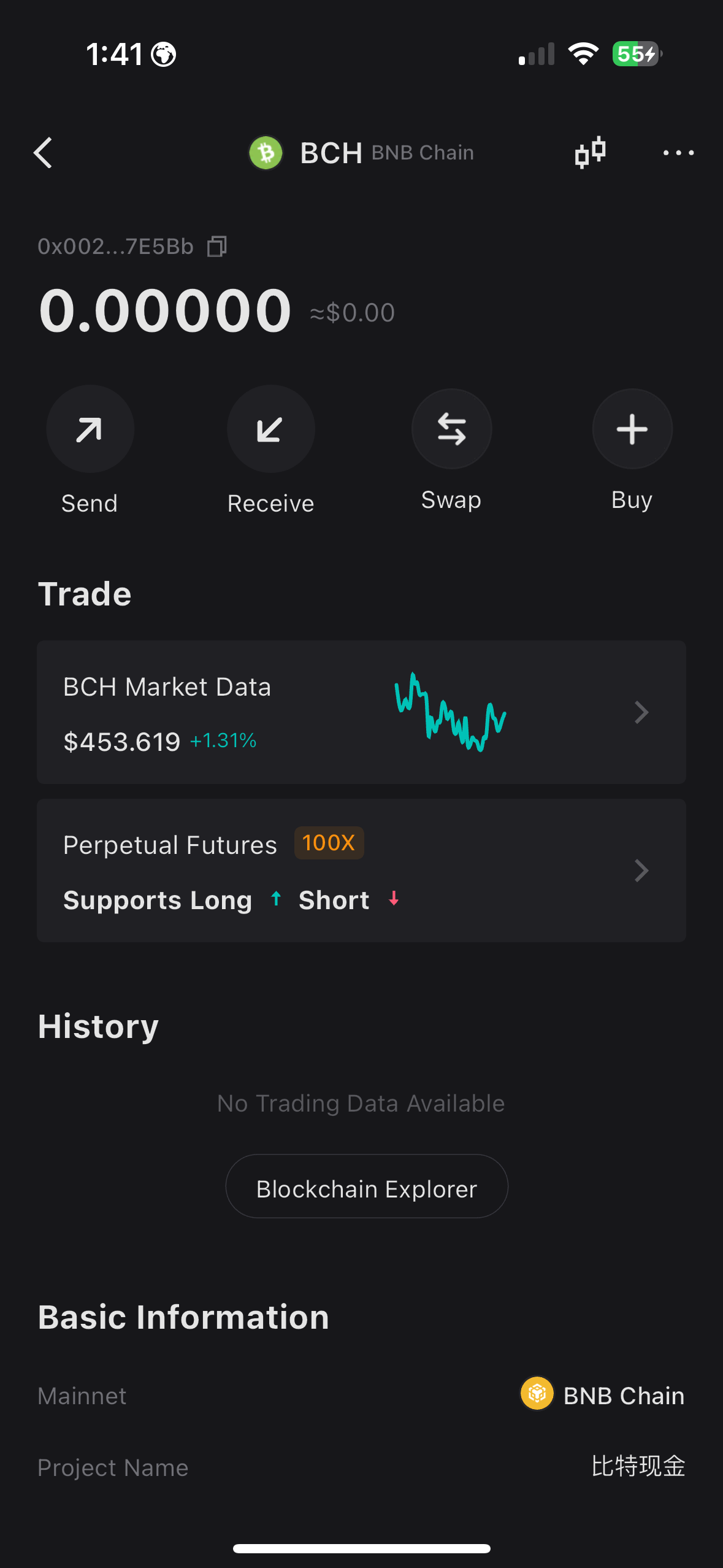

- 1. Create or import a wallet

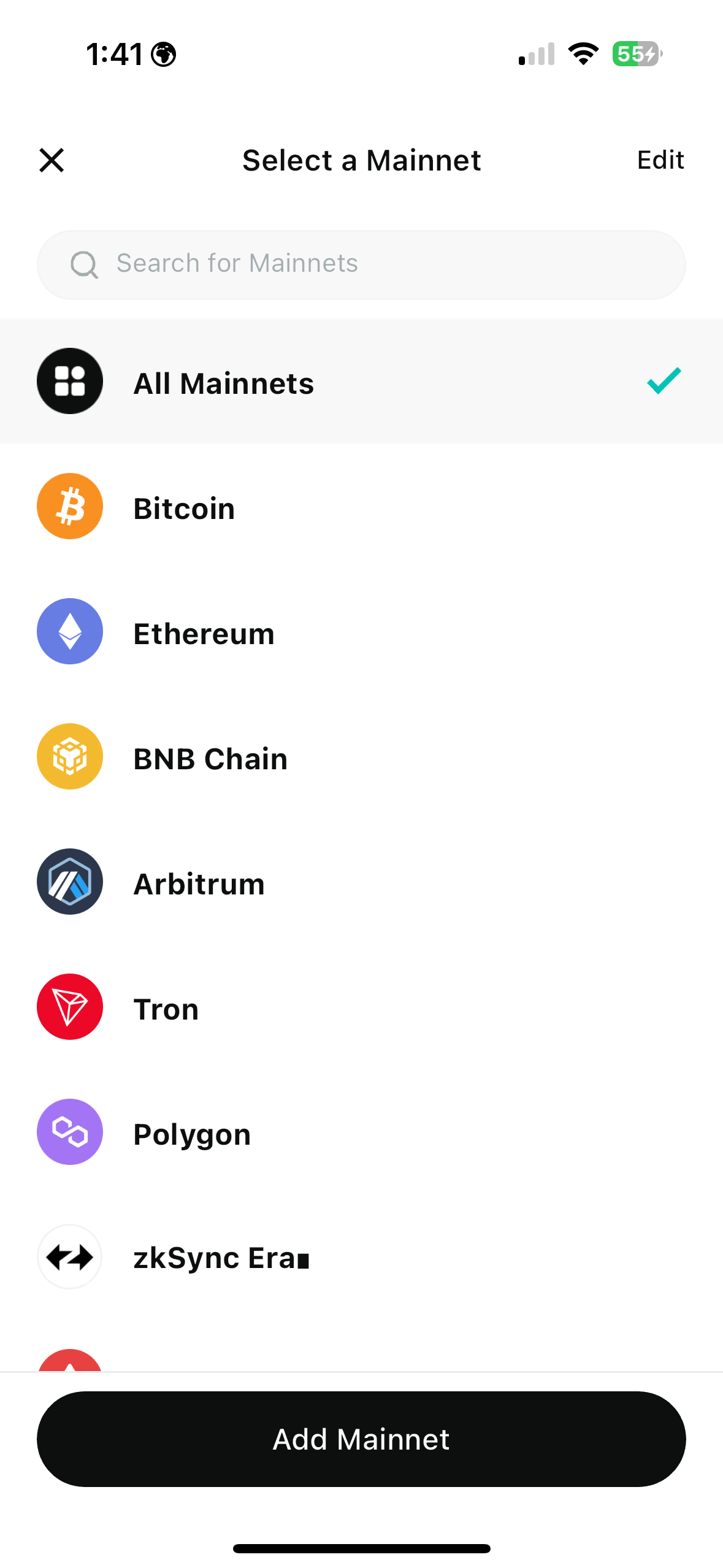

- 2. Choose to “Add a mainnet”

- 3. Choose “smartBCH”

- 4. Return to the home page of Bitget Wallet to view the added mainnet and BCH token

You can also use our OTC feature to buy USDT/USDC with Fiat currency and then swap for other tokens.

Bitget Wallet BCH Wallet et Features

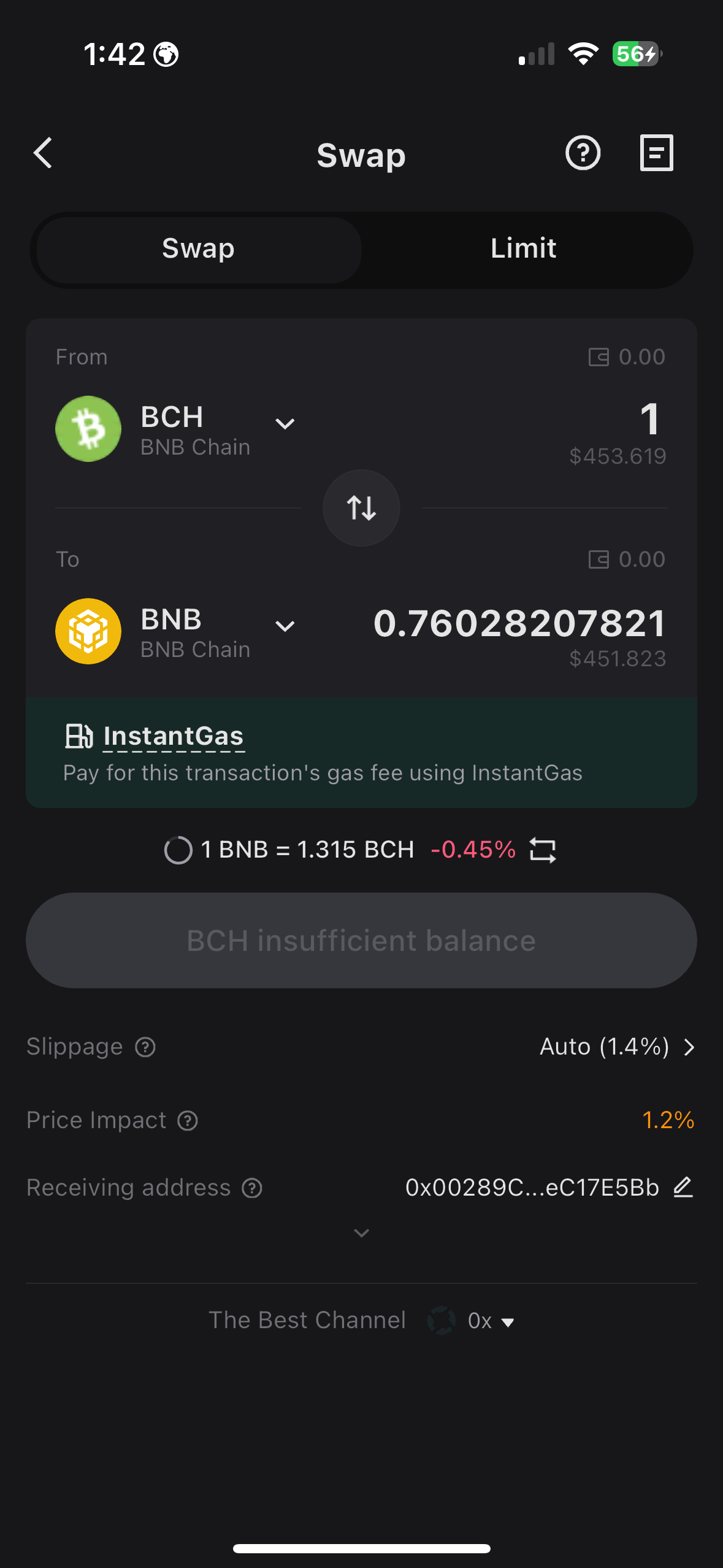

Swap on BCH

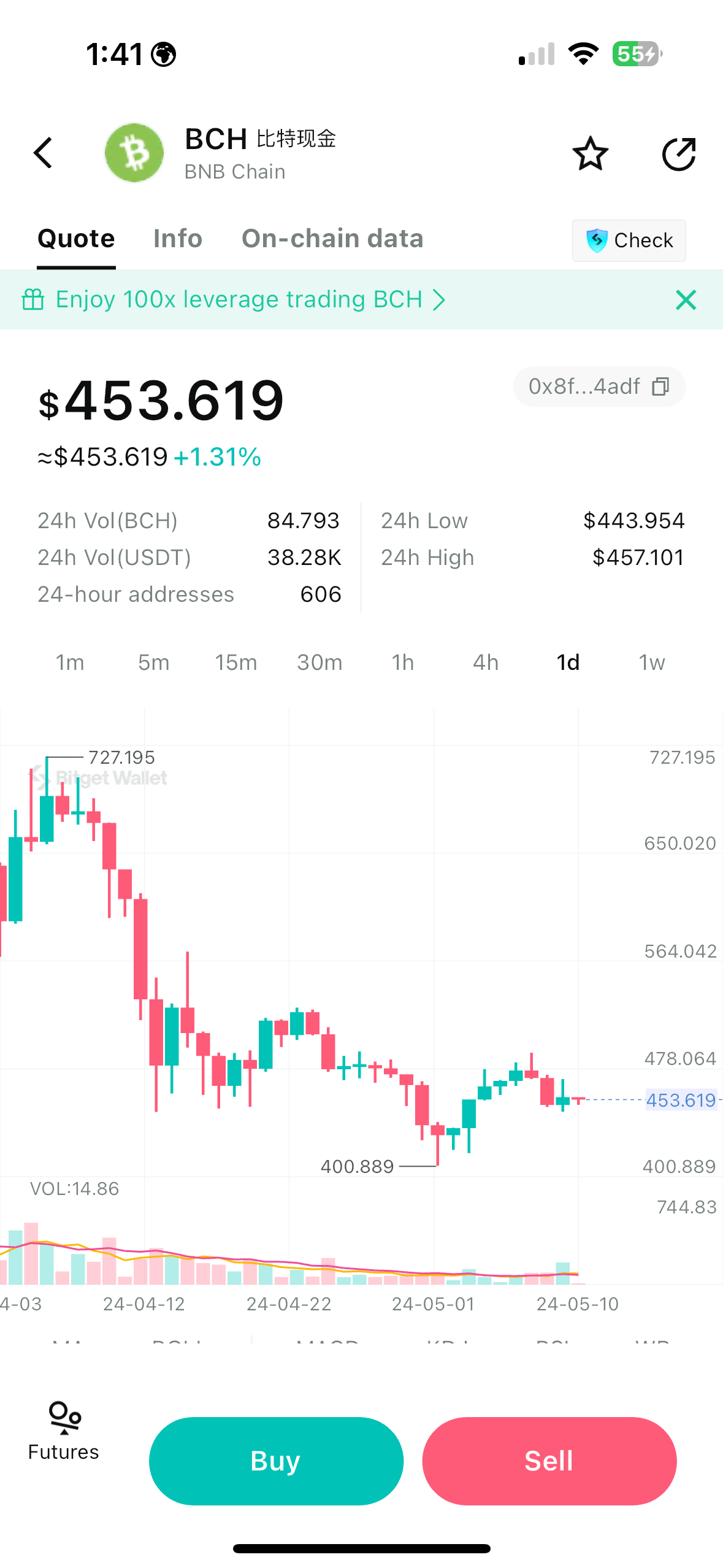

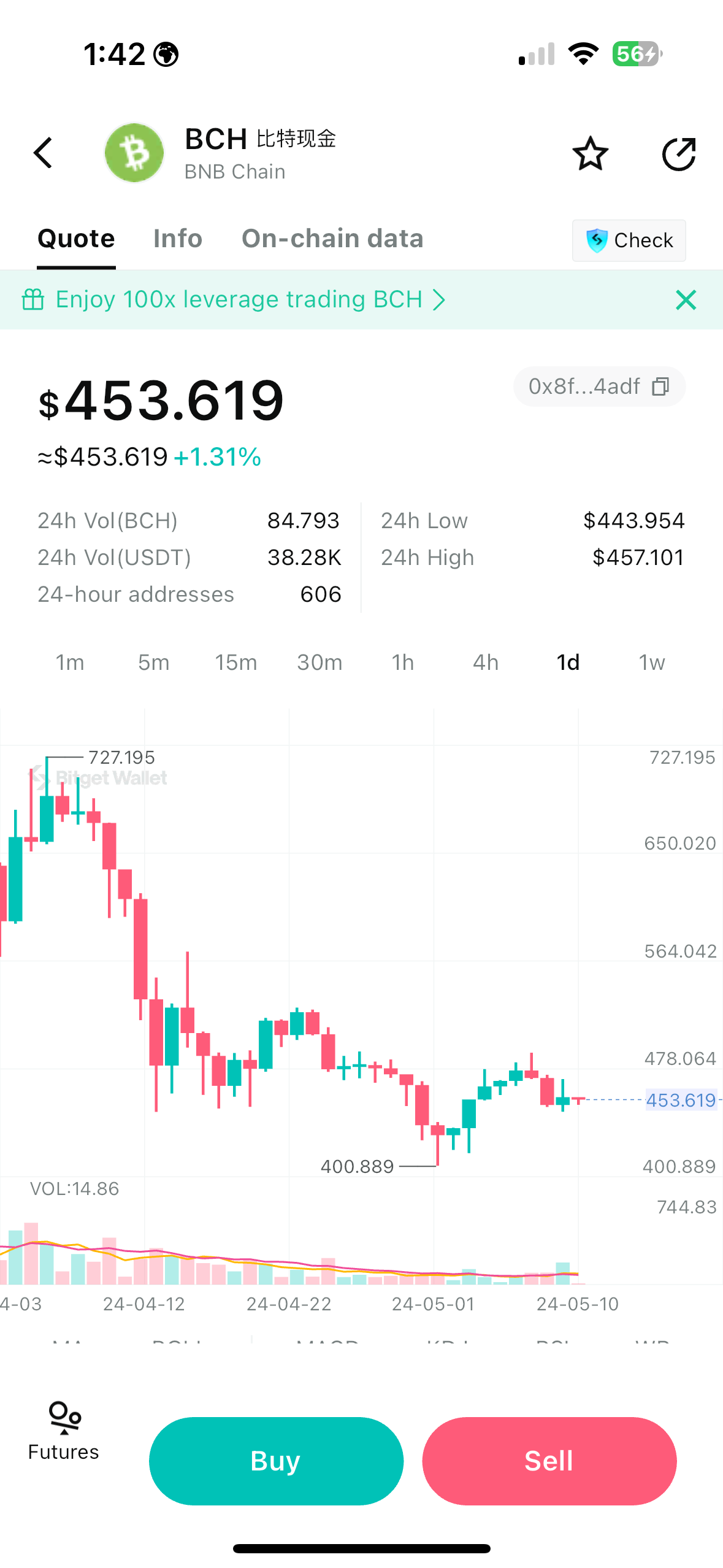

Bitget Wallet Swap has the most inclusive BCH market intelligence, including: Real-time Quote, Token Price Chart (where users can choose to view by Day, Week, Month, or Year), Token Contract, Market Cap, Circulating Supply, holders, transaction histories, data analysis.

Bitget Swap पर जाएं

FAQ

How to buy BCH?

What's the best BCH Wallet?

How do you download Bitget Wallet and create a BCH Wallet?

About BCH

What is BCH?

BCH is a cryptocurrency that emerged from a hard fork of the original Bitcoin blockchain in 2017. This fork, motivated by a disagreement within the Bitcoin community about how to address scalability limitations, resulted in the creation of a new cryptocurrency with key distinctions from its predecessor. At its core, Bitcoin Cash prioritizes faster transaction speeds and lower fees, aiming to position itself as a more practical solution for everyday payments and a fulfillment of Bitcoin's original vision as peer-to-peer electronic cash. It achieves this primarily through an increased block size compared to Bitcoin, allowing it to process a greater volume of transactions within each block. Bitcoin Cash advocates see it as promoting wider adoption and fulfilling the original promise of accessible, fast, and low-fee transactions.

What makes Bitcoin Cash unique?

Bitcoin Cash's primary distinction lies in its emphasis on scalability for everyday transactions, with its larger block size aiming to facilitate faster transaction confirmations and keep fees low, addressing potential barriers to adoption faced by the original Bitcoin network. This positions Bitcoin Cash as a potential contender for widespread use in payments, both online and in brick-and-mortar settings. Additionally, Bitcoin Cash proponents argue that it aligns more closely with Satoshi Nakamoto's original whitepaper outlining a "peer-to-peer electronic cash system," emphasizing its potential as a currency rather than a primarily store-of-value asset. The Bitcoin Cash community often centers around the idea of practical cryptocurrency use, with discussions and development efforts frequently revolving around real-world merchant adoption, ease of use, and ensuring BCH remains a viable alternative for daily transactions. Beyond the increased block size, Bitcoin Cash has implemented technical changes compared to Bitcoin, including a revised difficulty adjustment algorithm aimed at maintaining more consistent block times, removal of SegWit (Segregated Witness), and the initial implementation of replay protection to prevent accidental transactions after the fork. While Bitcoin Cash shares origins with Bitcoin, it is a distinct project with its own roadmap, with its community and developers continuing to propose and implement updates aimed at improving scalability, enhancing user experience, and potentially exploring features focused on its use-case as electronic cash.

What is the future potential of BCH ?

Bitcoin Cash's future potential rests on its capacity to successfully position itself as a widely adopted cryptocurrency for everyday payments and its ability to navigate the ever-evolving cryptocurrency landscape. If it can achieve widespread merchant adoption, with businesses readily accepting BCH for goods and services, it could solidify its role as a practical alternative to traditional payment methods. Continued development focusing on user experience, scalability, and potential advancements enhancing its payment capabilities could further bolster its position. Growing awareness and understanding of Bitcoin Cash among the general public could drive broader adoption. Successful marketing efforts, a focus on accessibility, and partnerships with businesses may play a crucial role in achieving this. Like many cryptocurrencies, the regulatory landscape surrounding Bitcoin Cash will influence its trajectory. Clarity around regulations could impact both user and merchant adoption. Additionally, broader shifts in the cryptocurrency market and competition from other payment-focused projects could influence its path. Its ability to demonstrate consistent utility and offer advantages over its competitors will be crucial for its long-term success.

Will the BCH token price go up?

Like other cryptocurrencies, BCH's price is subject to overall market sentiment and the broader trends within the cryptocurrency space. Positive shifts in sentiment towards cryptocurrencies focused on payments could benefit BCH. Additionally, the success of Bitcoin Cash as a payment network is crucial. If it sees significant adoption by merchants and individuals for everyday transactions, the demand for BCH could increase, potentially driving its price higher. Partnerships with businesses that integrate BCH as a payment option, technological improvements aimed at further enhancing its scalability and ease of use, and growing awareness of Bitcoin Cash could all act as catalysts for increased interest. Furthermore, BCH's position within the broader cryptocurrency landscape, including its perceived value compared to Bitcoin and other payment-focused cryptocurrencies, could influence investor sentiment. However, it's essential to be aware of the inherent volatility in the cryptocurrency market. Market sentiment can rapidly shift, and factors beyond Bitcoin Cash's specific ecosystem, including regulatory changes or broader economic uncertainty, could impact its price. As with any investment in the crypto space, it's vital to conduct thorough research and maintain a balanced understanding of potential risks.

Which crypto narrative does BCH leverage?

Bitcoin Cash strongly aligns with the narrative surrounding the original vision of Bitcoin as a peer-to-peer electronic cash system designed for everyday transactions, with its emphasis on scalability, low fees, and fast confirmations aiming to address limitations faced by the Bitcoin network and make cryptocurrency payments practical for a wider audience. It firmly contributes to the broader crypto narrative of developing cryptocurrencies focused on real-world payments and adoption beyond speculative investment, championing the idea of using cryptocurrency for daily purchases, remittances, and replacing traditional payment systems. To a lesser extent, Bitcoin Cash touches upon the narrative of challenging established systems and decentralizing power, as a fork of Bitcoin, demonstrating the potential for community-driven evolution and the creation of alternatives within the cryptocurrency landscape.

What is the value of the BCH token?

The value of the BCH token is closely tied to market sentiment, the adoption of Bitcoin Cash as a payment method, and its broader role within the evolving landscape of cryptocurrencies. Unlike traditional cryptocurrencies that might derive value from a specific utility within a single platform, BCH's value is influenced by factors like perceived potential, its success in facilitating low-cost payments, and the overall trajectory of cryptocurrencies focused on scalability and adoption. If Bitcoin Cash demonstrates growing adoption by merchants and users for everyday transactions, establishes partnerships that expand its use cases, and consistently delivers on its promise of practical electronic cash, the demand for BCH tokens could increase significantly. Additionally, positive sentiment towards cryptocurrencies focused on payments could benefit BCH's value. However, it's crucial to recognize the volatility in the cryptocurrency market and the risks associated with investing in cryptocurrencies. Market sentiment can rapidly shift, and long-term success depends on factors like continued innovation, security, and Bitcoin Cash's ability to stay relevant amidst a competitive landscape.