Uniswap (UNI) Crypto

Uniswap is a decentralized exchange (DEX) on various major blockchains that allows users to swap and trade a comprehensive list of cryptocurrencies. In contrast to CEXs that use an order book to match buyers and sellers, Uniswap uses a "liquidity pool" funded by users who contribute ERC-20 tokens to the trading pair in that pool. Among different kinds of DEXs, Uniswap is specifically a "constant-product automatic market maker (CPAMM)", which means that the pricing on Uniswap is determined by the ratio of token quantities in a given liquidity pool. As tokens are added or removed from the pool, their quantity ratio changes, so their prices adjust accordingly. The larger the liquidity pool, the less impact an individual trade has on the price.

What are the main upgrades of each Uniswap version?

- 1. Uniswap V1, launched in November 2018, served as a foundational DeFi protocol on Ethereum, facilitating trading between ETH and ERC-20 tokens. Its main drawback was that trading between two ERC-20 tokens required multiple swaps, adding inefficiency and extra costs.

- 2. Uniswap V2, introduced in 2020, marked a significant upgrade by enabling direct swaps between any two ERC-20 tokens. It also introduced "Flash Swaps" for collateral-free token borrowing and an improved price oracle with time-weighted average prices (TWAP), enhancing the protocol's utility and security.

- 3. In May 2021, Uniswap V3 brought "concentrated liquidity," allowing liquidity providers to target specific price ranges for their capital, significantly boosting capital efficiency. It also shifted from issuing liquidity tokens to using NFTs for representing pool positions, providing greater flexibility.

- 4. Uniswap V4, planned for 2024, aims to further innovate by adding "hooks" for custom logic in liquidity pools and moving to a "singleton" contract model to reduce deployment costs and simplify operations.

Uniswap's progression from V1 to V4 illustrates a continuous improvement in efficiency, functionality, and security, highlighting its evolving role in the DeFi ecosystem.

Uniswap (UNI) Trading

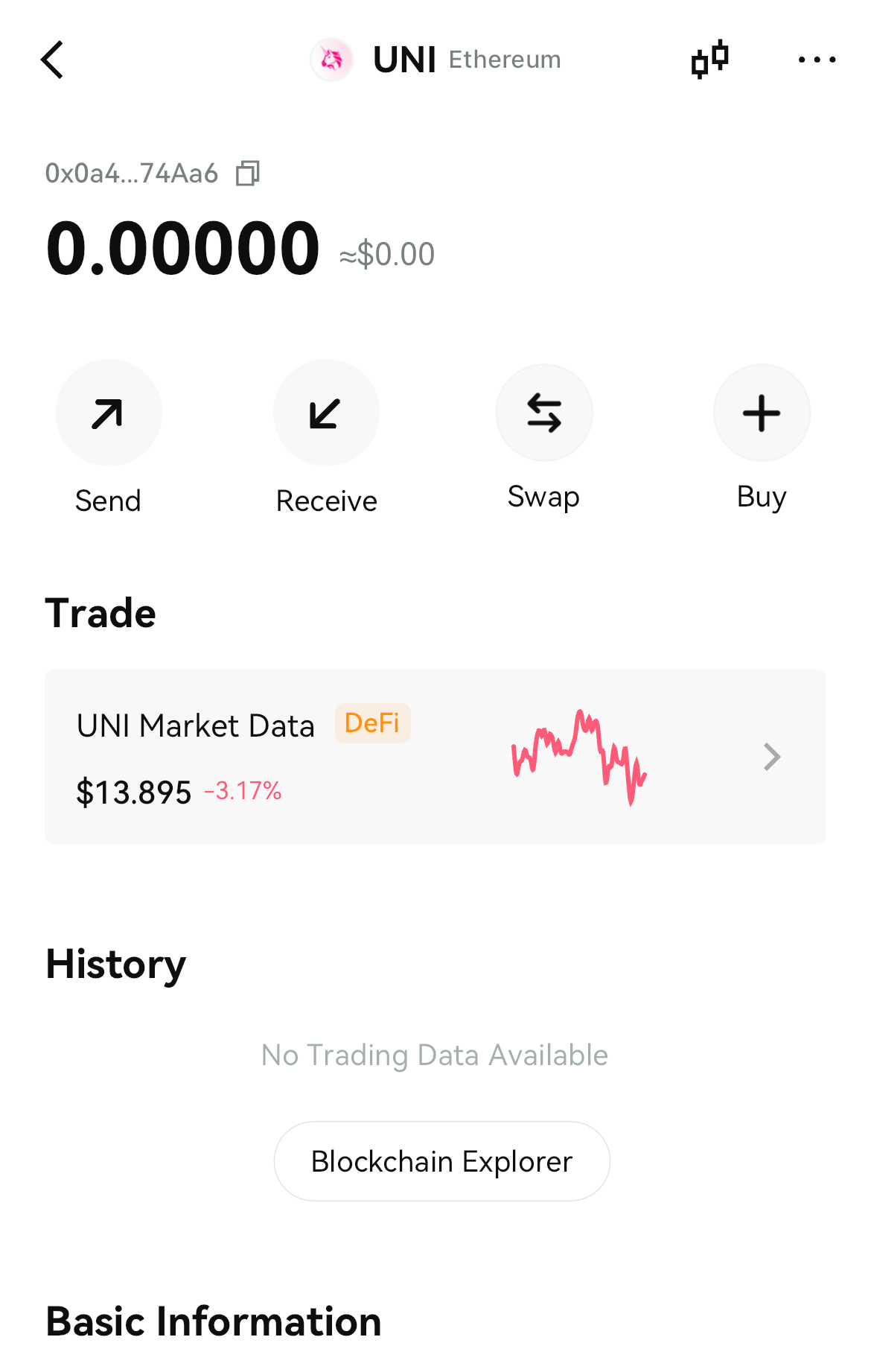

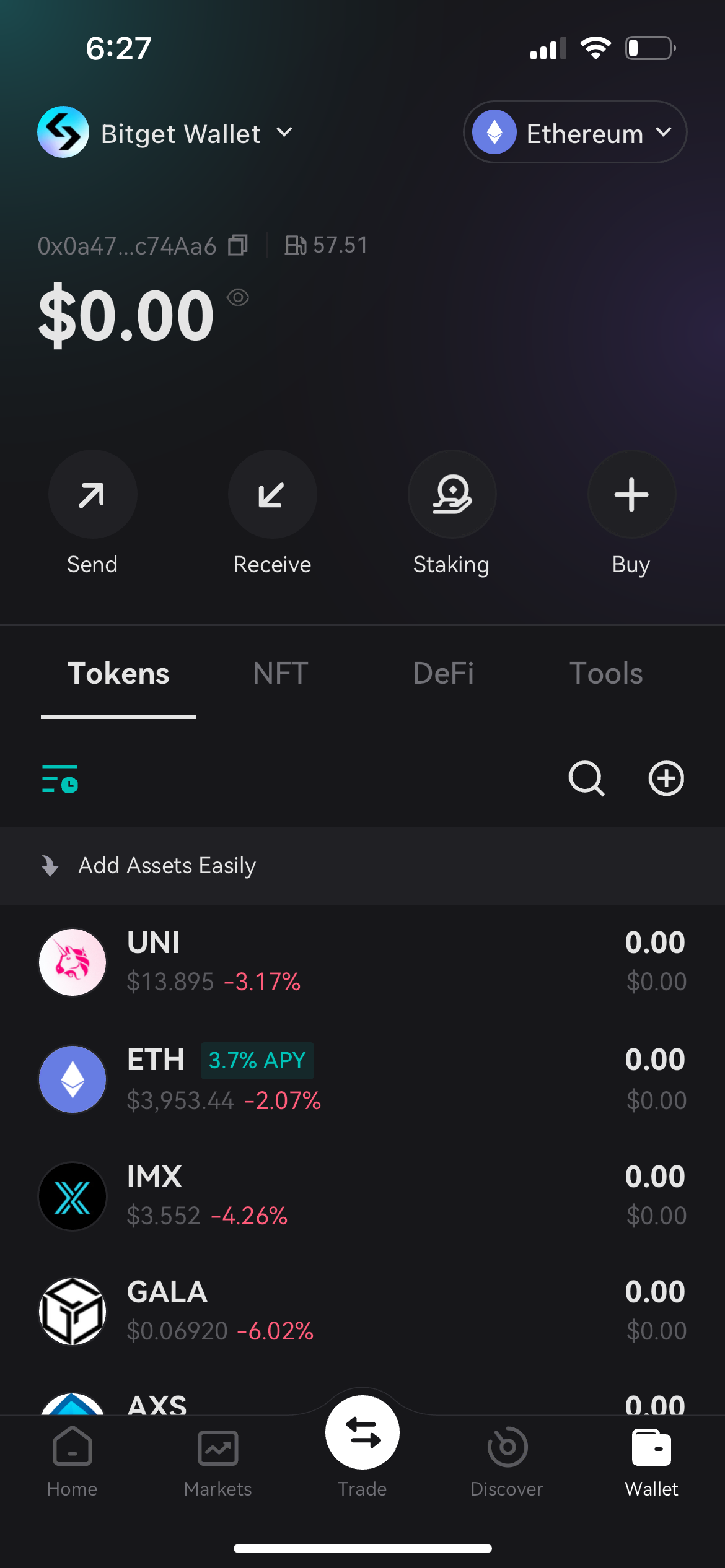

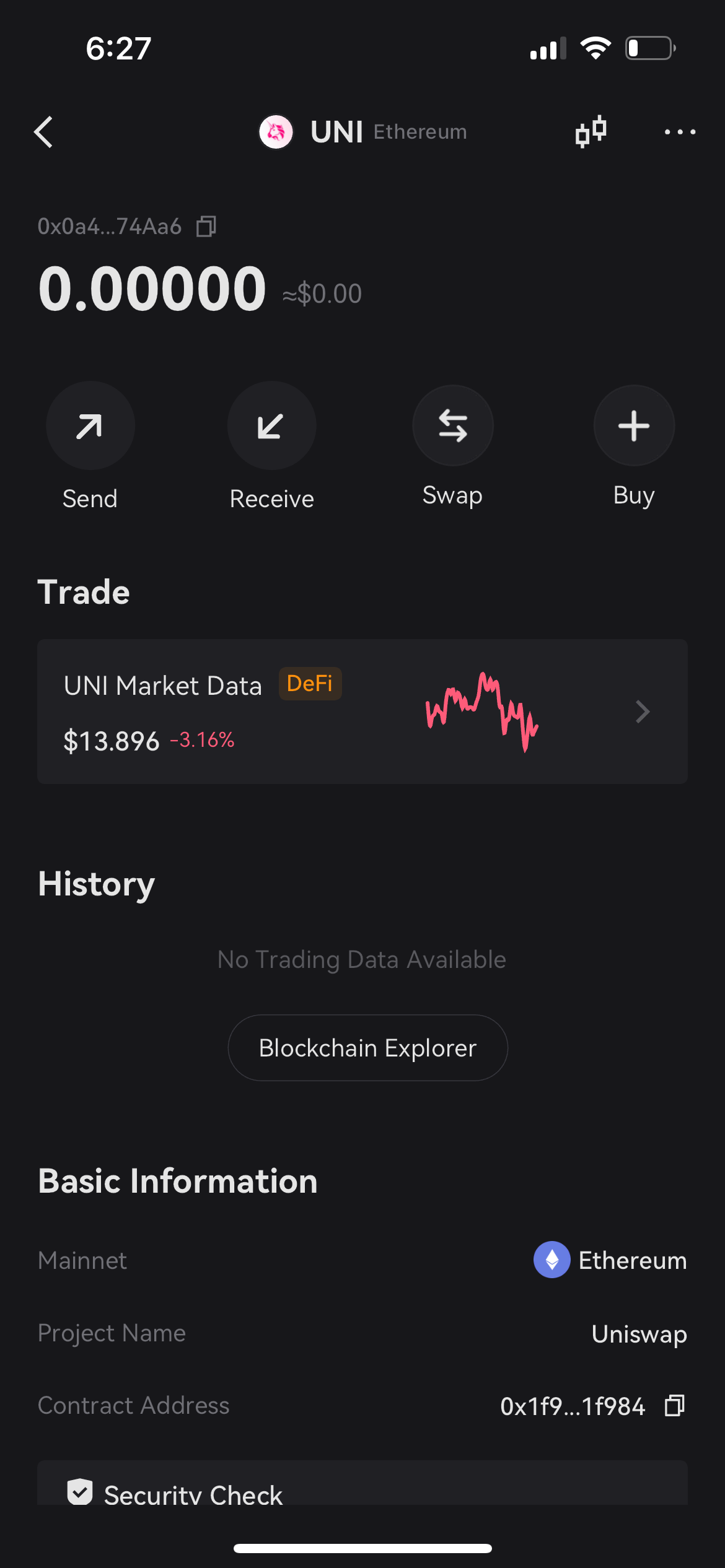

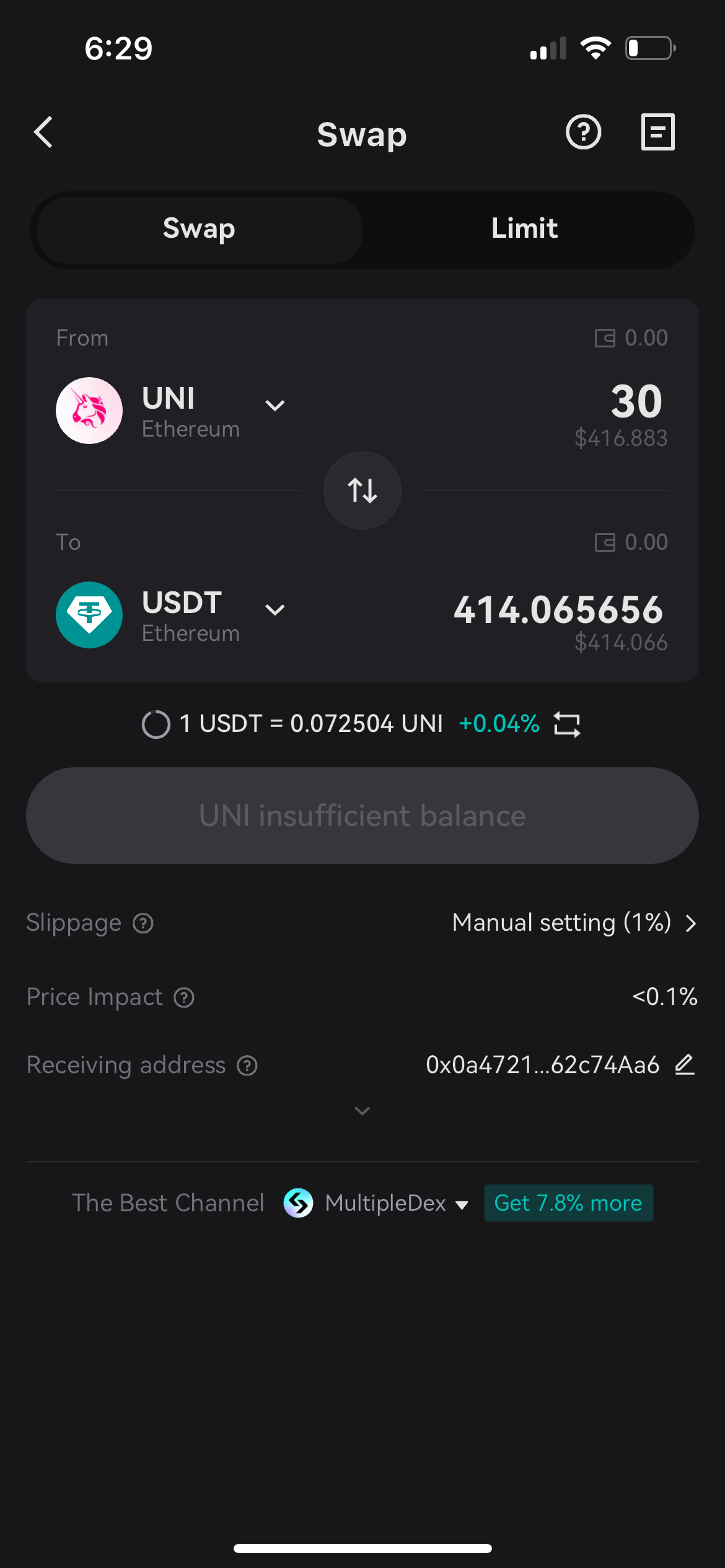

Swap Uniswap (UNI)

Bitget Swap has the most inclusive Uniswap (UNI) market intelligence, including Real-time Quote, Token Price Chart (Daily, Weekly, Monthly, and Yearly Chart), Token Contract, Market Cap, Circulating Supply, Holders, Transaction Histories, and Data Analysis. Bitget Wallet supports cross-chain swap involving the Uniswap (UNI) token, ensuring a seamless and convenient user experience.

Kunjungi Bitget Swap

FAQ

How to create a Uniswap (UNI) Wallet?

How to buy Uniswap (UNI)?

What’s the best wallet to store Uniswap (UNI)?

About Uniswap (UNI) Crypto

Is Uniswap a DEX in the Ethereum Ecosystem?

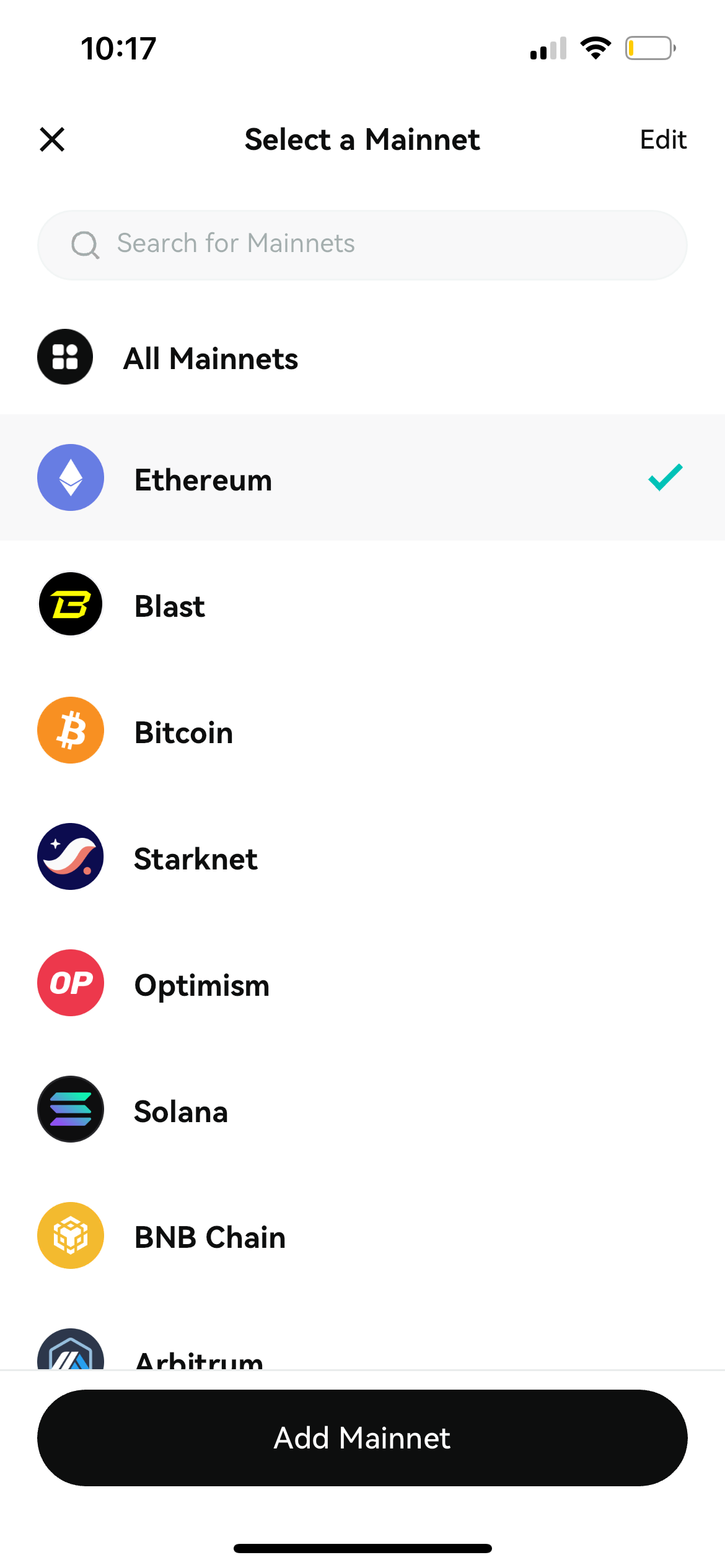

Yes, Uniswap is a decentralized exchange (DEX) built on Ethereum. But, its network support covers far more than just Ethereum, also including Polygon (PoS), Optimism, Arbitrum One, Base, BNB Chain, Celo, and Avalanche.

What is Uniswap (UNI)'s tokenomics?

In September 2020, Uniswap Protocol minted 1 billion UNI tokens that were scheduled to vest over the course of 4 years. The original token allocation was designed such that 60% of tokens were reserved for the community (15% airdropped and 43% retained in treasury), 21.51% were awarded to the team, 17.80% were allocated to the investors, and advisors received the remaining 0.69% of the total supply. As of early March 2024, 96% of UNI tokens have been unlocked. Upon vesting completion, Uniswap will introduce a perpetual, annual inflation of 2%, which incentivizes active participation in the protocol and negatively impacts passive UNI holders.

What can you do with UNI tokens?

As Uniswap's native token, UNI has three main functions: - Governance: UNI holders with 1% or more of the total UNI supply may submit development proposals, and all UNI holders are able to vote on these proposals, as long as they have delegated their UNI tokens to themselves or to an address. - Staking / Liquidity Provision: You can stake your UNI tokens in Uniswap's liquidity pools to earn a percentage of the trading fees generated on the platform, effectively making you a "liquidity provider (LP)". When you provide liquidity to a pool, you also receive "liquidity tokens" representing your share of that pool's liquidity. - Investment: UNI is an investable, tradeable cryptocurrency that frequently sees $400+ million in 24h trading volume. Since UNI tokens represent one of the largest and most popular crypto projects, they may appreciate in price and prove to be a valuable investment opportunity. However, please do your own research before making any investment decision.

What caused Uniswap (UNI)'s price surge in 2024?

Uniswap (UNI) token price jumped 130% in February 2024 and briefly hit $17 on March 6 for the first time since January 2022. This dramatic surge in price is mostly because of a proposal submitted by Uniswap Foundation's governance lead, Erin Koen, to overhaul Uniswap's governance system by rewarding UNI token holders who stake and delegate their tokens. In Koen's proposal, he recommends upgrading Uniswap's fee mechanism to reward active UNI owners with protocol fees, which are collected from traders during token swaps as a small percentage of the traded amount. According to Token Terminal's data on February 25, Uniswap receives more than $626 million in annualized protocol fees. If approved in a community vote, Koen's proposal could pay out $62 million to $156 million in total to UNI owners, according to Coindesk. This potential governance change obviously brings economic benefits to UNI holders, which likely sparked optimism among investors and drove up UNI's price recently.

Is Uniswap (UNI) token a good investment in 2024?

Uniswap (UNI)'s recent price surge has attracted a lot of investors to its name, so now is a good time to look back in time and review its performance since launch. UNI started trading at around $3.44 in September 2020. After gaining attention as the leading DEX on Ethereum, UNI's price reached its all-time high of $42.88 on May 4, 2021, likely due to Uniswap V3's game-changing innovation, called concentrated liquidity. Following this ATH, UNI experienced some significant turbulence for about a year, and returned to sustained lows starting in May 2022. Remarkably, after almost two years of subdued performance, UNI price saw a resurgence in late February 2024, which was triggered by Erin Koen's governance proposal. UNI's recent price surge underscored renewed investor interest in the Uniswap platform, indicating its potential for future growth. Nonetheless, investors should still exercise caution, conduct thorough research, and assess their risk tolerance before investing in UNI in 2024.

How to transfer Uniswap (UNI) to other crypto wallets?

To transfer Uniswap (UNI) from your Bitget Wallet to other crypto wallets or exchanges, simply: 1. Go to the Bitget Wallet homepage and select "Send". 2. Select either Ethereum network and find UNI. 3. Input the recipient's address and the amount, and confirm the transaction. Remember, it's crucial to double-check the address and confirm network compatibility before completing the transfer process.