dYdX Wallet

Unlock advanced crypto trading with dYdX! This decentralized derivatives exchange empowers you with leverage, long/short positions, and a range of top crypto assets. Built on Layer 2, dYdX offers lightning-fast transactions and low fees, revolutionizing derivatives within the DeFi landscape. Join the dYdX community and experience the power of decentralized finance at your fingertips. Start your derivatives journey today!

How to Create a dYdX Wallet in Bitget Wallet

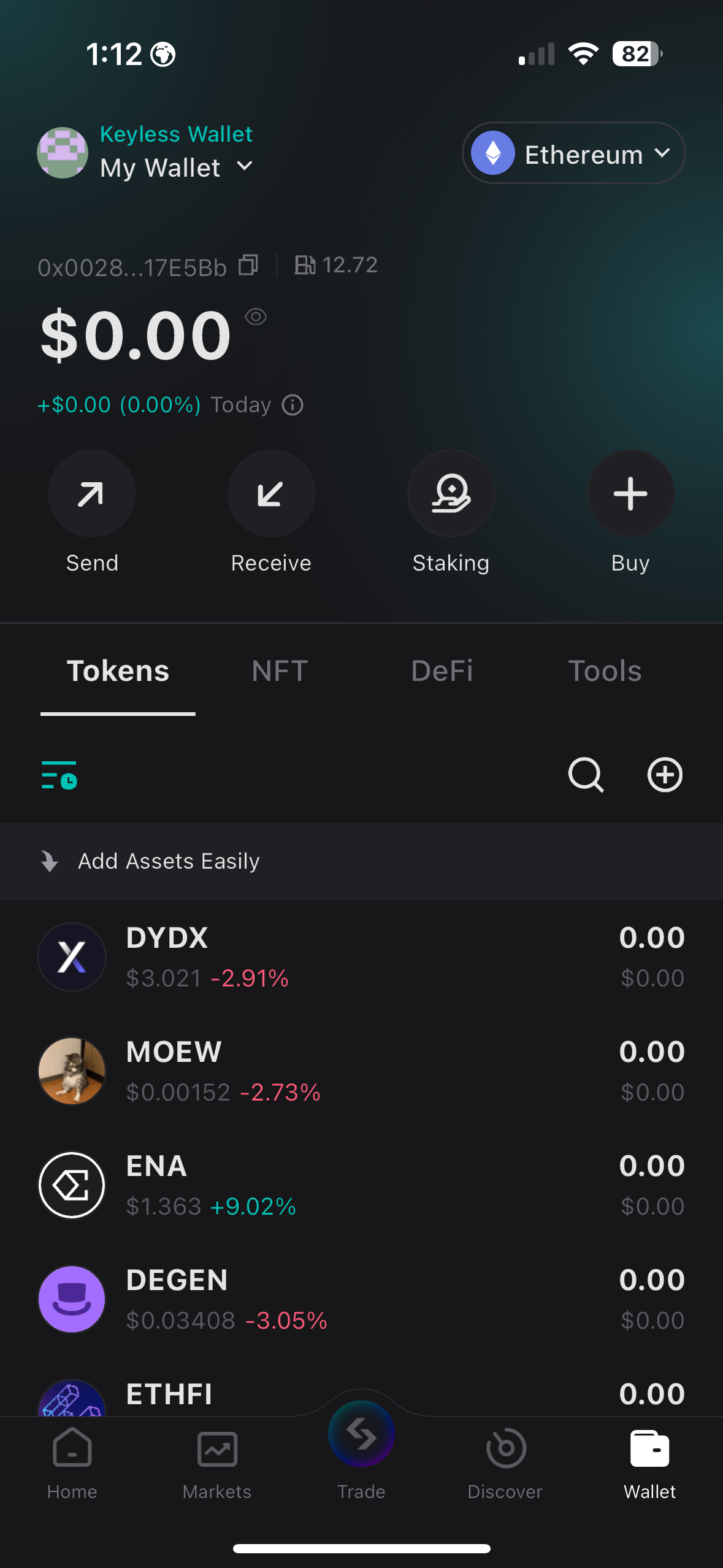

- 1. Create or import a wallet

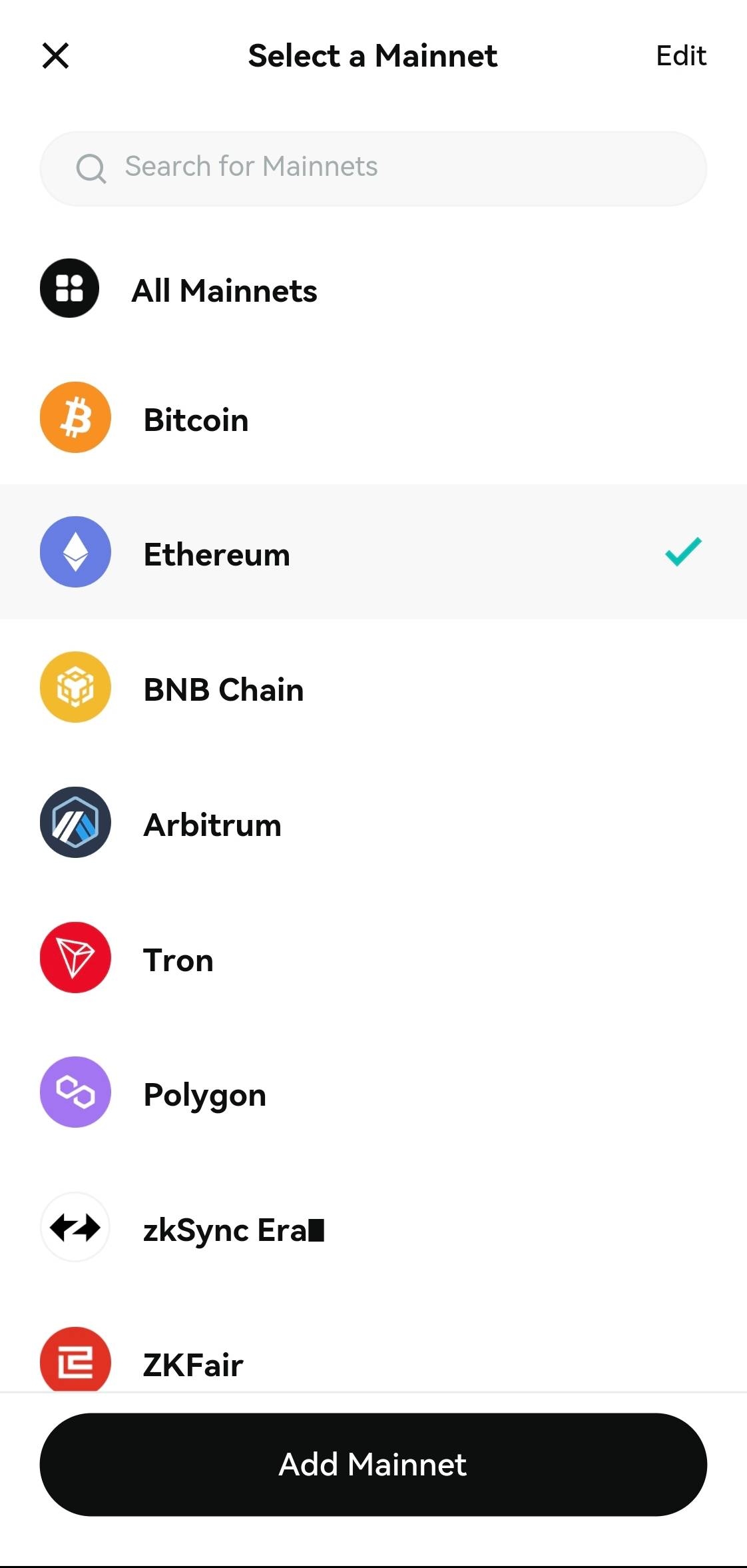

- 2. Choose to “Add a mainnet”

- 3. Choose “Ethereum Chain”

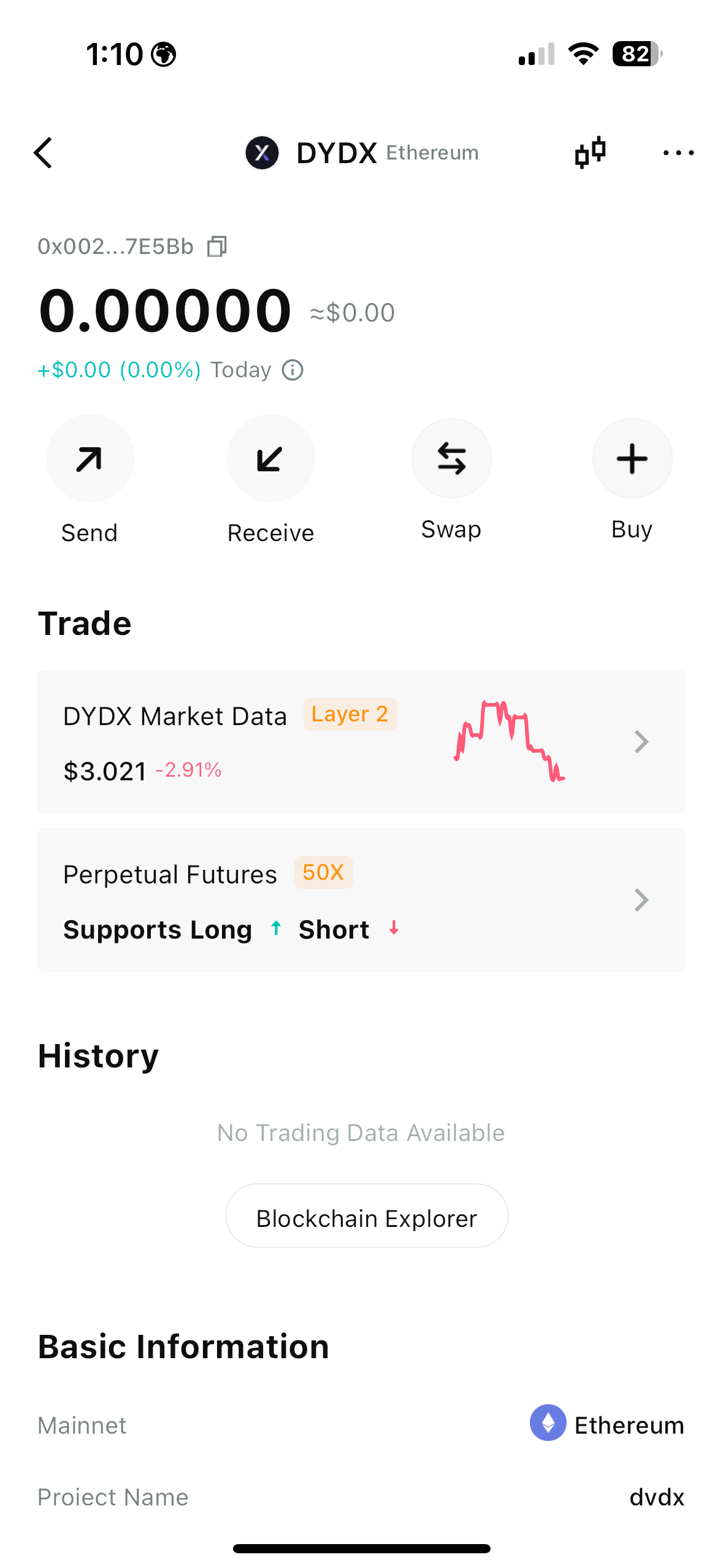

- 4. Return to the home page of Bitget Wallet to view the added mainnet and dYdX token

You can also use our OTC feature to buy USDT/USDC with Fiat currency and then swap for other tokens.

Bitget Wallet dYdX Wallet Features

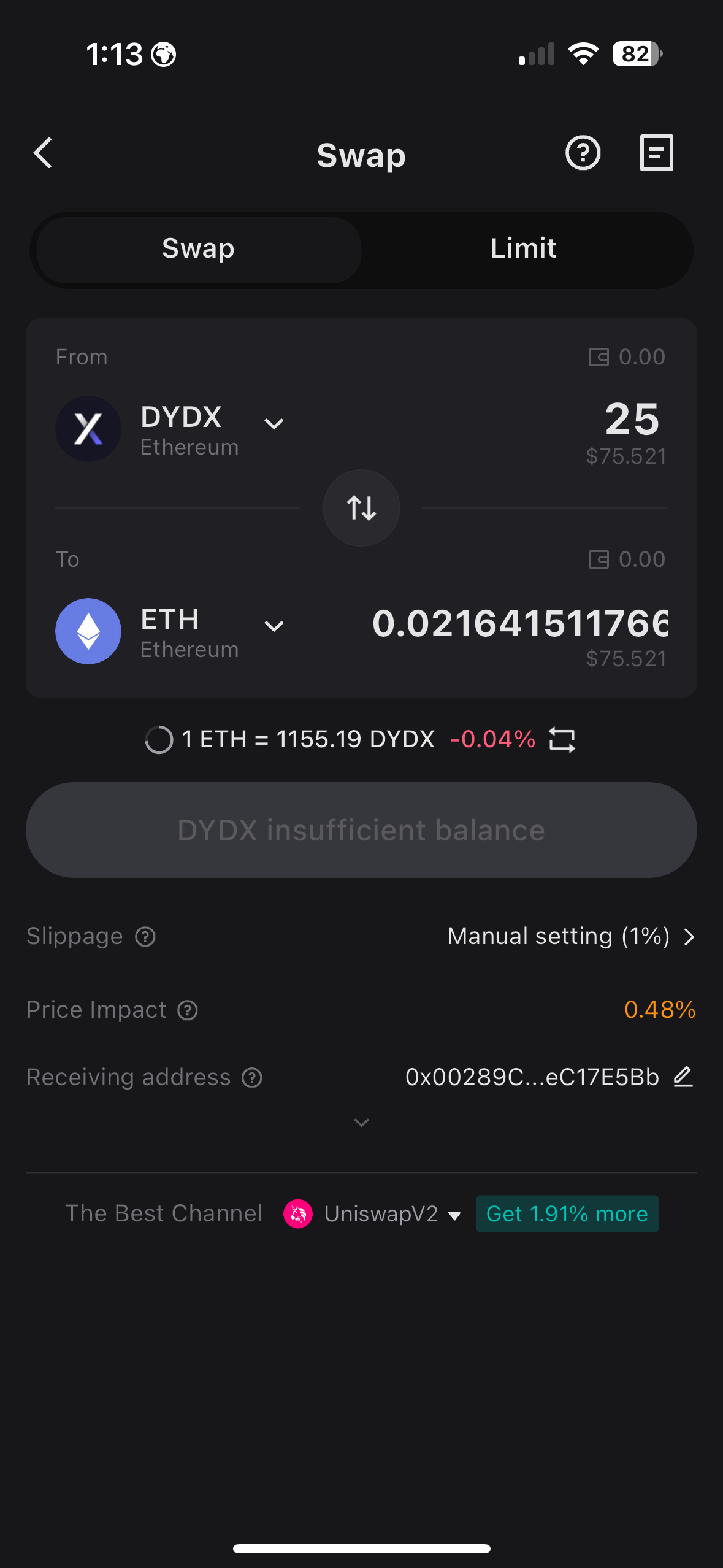

Swap on dYdX Wallet

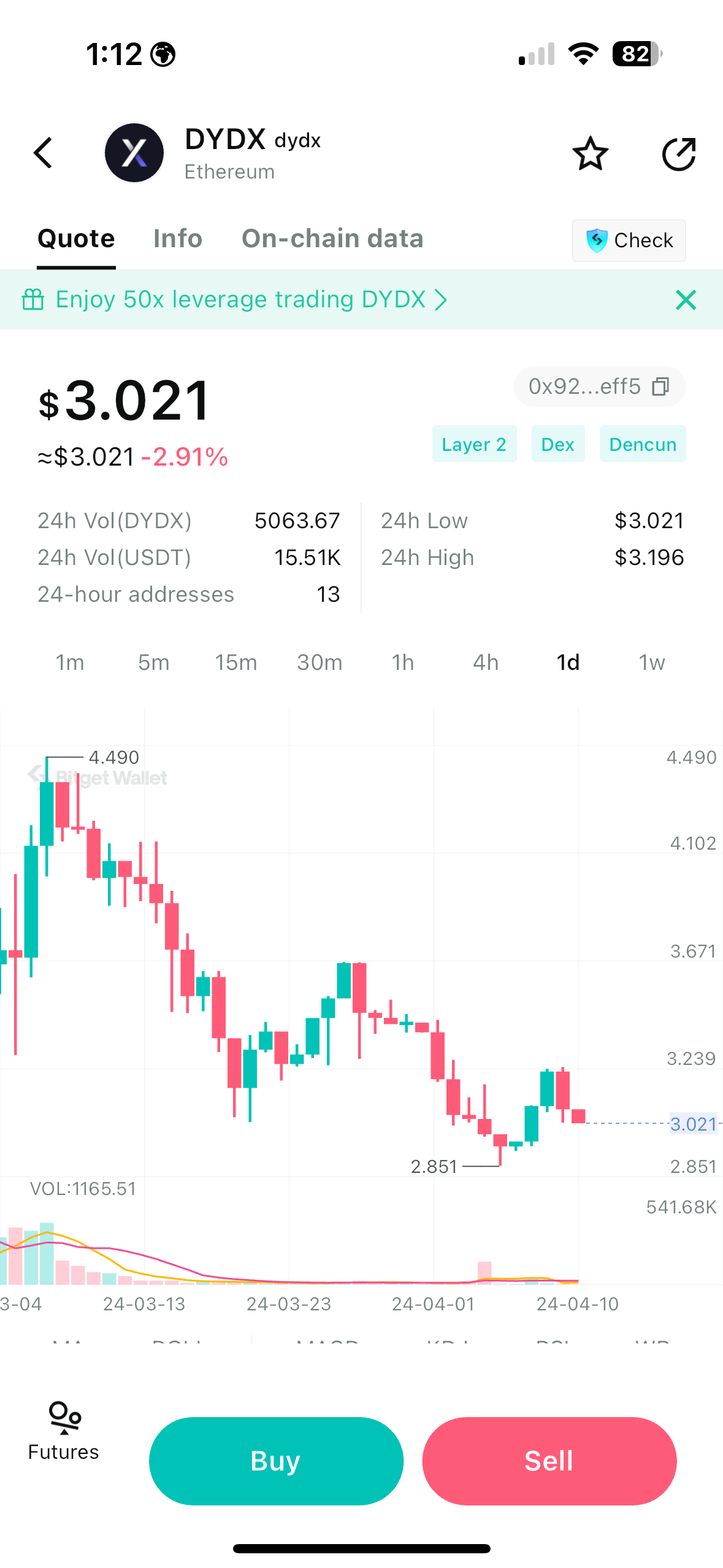

Bitget Wallet Swap has the most inclusive dYdX market intelligence, including: Real-time Quote, Token Price Chart (where users can choose to view by Day, Week, Month, or Year), Token Contract, Market Cap, Circulating Supply, Holders, transaction histories, data analysis. In addition, Bitget Wallet Swap supports dYdX's InstantGas Swap service, which allows you to exchange your existing dYdX assets for any token you want even when you don't have any dYdX on hand.

Bitget Swapに移動

FAQ

How to buy dYdX?

What's the best dYdX Wallet?

How do you download Bitget Wallet and create a dYdXWallet?

About dYdX

What is dYdX?

dYdX is a decentralized exchange (DEX) specializing in derivatives trading, particularly perpetual contracts. Unlike traditional DEXes focusing on spot trading of cryptocurrencies, dYdX allows users to trade contracts that derive their value from underlying assets like Bitcoin or Ethereum. This enables sophisticated trading strategies using leverage, going long or short on an asset, and hedging positions. Significantly, dYdX achieves this while maintaining its decentralized nature by building on Layer 2 scaling solutions, primarily using StarkWare's technology. This translates to increased transaction speeds and reduced fees compared to trading derivatives on many Layer 1 blockchains. Additionally, dYdX has its own governance token, DYDX, which gives holders a say in the protocol's future direction.

What makes dYdX unique?

dYdX distinguishes itself within the decentralized exchange and crypto derivatives landscapes through several key features. Firstly, its emphasis on providing decentralized derivatives trading sets it apart. Unlike centralized derivatives platforms or DEXes with partially centralized elements, dYdX prioritizes user control, transparency, and the potential for enhanced censorship resistance, aligning with core DeFi principles. Secondly, dYdX's integration with Layer 2 solutions (primarily StarkWare) is crucial. This enables it to mitigate the scalability limitations and high fees often found on Layer 1 DEXes, offering faster and more affordable derivatives trading – essential for active traders. Additionally, dYdX's use of an order book model, as opposed to the AMM approach common in many DEXes, provides advantages such as greater order type flexibility, potentially tighter spreads, and increased control for traders accustomed to a more traditional trading environment. Furthermore, the DYDX governance token plays a significant role within the dYdX ecosystem. Holders gain voting rights to influence the protocol's direction, and the token could potentially be integrated into fee discounts, staking rewards, or other mechanisms. This promotes community involvement and contributes to the decentralization of the platform. Finally, dYdX's strong emphasis on security is vital. Considering the inherent risks associated with derivatives trading and smart contracts, regular audits, transparency around security practices, and a cautious approach to updates are essential for building user trust and positioning dYdX as a reliable alternative to centralized derivatives platforms.

What is the future potential of dYdX?

dYdX's future potential is closely intertwined with the growth of decentralized derivatives markets and the continued development of Layer 2 scaling solutions. If the demand for decentralized, transparent, and user-controlled derivatives trading increases, dYdX is well-positioned to capitalize on this trend. Its Layer 2 foundation provides advantages in speed and cost, which could attract a larger user base seeking to escape the limitations of Layer 1 DEXes. The success of its DYDX governance token is another factor influencing dYdX's future. If token holders actively participate in shaping the platform, it could lead to innovative features, strategic partnerships, and a roadmap that aligns with the needs of the derivatives trading community. Furthermore, DYDX's potential integration into additional revenue-generating mechanisms within the protocol could positively impact its value and the overall sustainability of the platform. However, dYdX faces significant challenges. The DeFi landscape is incredibly competitive, with new derivatives platforms and Layer 2 solutions emerging frequently. dYdX must continuously innovate, maintain a strong focus on security, and demonstrate adaptability to stay ahead of the curve. Additionally, the regulatory landscape surrounding derivatives, even in the decentralized realm, is evolving. dYdX's ability to navigate potential regulatory changes will impact its long-term trajectory. Overall, dYdX's future holds both promise and uncertainty. If it successfully attracts a growing user base, fosters active token-holder governance, and embraces innovation, it has the potential to solidify its position as a leading player in the decentralized derivatives space. However, the competitive nature of DeFi, the complexity of derivatives trading, and potential regulatory hurdles mean its future success is far from guaranteed.

Which crypto narrative does dYdX leverage?

dYdX draws strength from its alignment with several core crypto narratives. Primarily, it's deeply rooted in the ongoing expansion of decentralized finance (DeFi). By providing decentralized derivatives trading, it broadens DeFi's scope and introduces more complex financial instruments into the permissionless landscape. Additionally, dYdX's integration with Layer 2 solutions exemplifies their potential to overcome scalability issues that often limit DeFi applications. It demonstrates how Layer 2 technologies can power sophisticated financial platforms in a cost-effective and efficient manner. Furthermore, dYdX's governance token (DYDX) and its emphasis on community participation underscore its connection to the narrative of decentralized decision-making, where users have a direct say in shaping the platform's evolution. dYdX also subtly plays into the potential narrative surrounding increased accessibility to derivatives within the crypto ecosystem. Derivatives are often viewed as complex tools, traditionally limited to experienced traders. By offering a decentralized, potentially more user-friendly derivatives platform, dYdX could contribute to a future where these instruments become more widely understood and utilized within the crypto landscape.