Dencun Upgrade

The Ethereum Dencun upgrade, named after a blend of Cancun and Deneb, is a major update planned for the Ethereum blockchain. It's all about a new feature called proto-danksharding, which is a bit technical but essentially aims to make things cheaper and faster on Ethereum, especially for rollups. Rollups are like express lanes for transactions. This upgrade uses something called blobs - think of them as big packets of transaction data - which help in reducing fees. These blobs are checked for accuracy using a special method, known as KZG commitments.

What are the benefits of Ethereum Dencun Upgrade?

- 1. Cheaper and Faster Transactions: The star of the show in this upgrade is something called proto-danksharding. It's a complex-sounding term, but its goal is simple: to make transactions on Ethereum, particularly through rollups, much cheaper. Rollups are like shortcuts for processing transactions, and with this upgrade, using them could cost you less.

- 2. Making Things Run More Smoothly: The upgrade introduces 'blobs' - these are like big packages of transaction data. While the main system of Ethereum, the Ethereum Virtual Machine (EVM), can't understand these blobs directly, there's a special way (called KZG commitments) to make sure they're valid. This should make the whole process of doing transactions more efficient.

- 3. Boosting Security: Security is key, and the Dencun upgrade isn't taking it lightly. It includes several updates (known as Ethereum Improvement Proposals or EIPs) focused on making Ethereum stronger against various online threats.

- 4. Better for Validators: Validators are the people who confirm transactions on Ethereum. This upgrade has some changes that are meant to make their life easier and their work more efficient. That's good news for everyone using Ethereum.

The Dencun upgrade is an exciting development for the Ethereum blockchain and Ethereum 2.0, and the above reasons are why it's a big deal.

Investment Opportunities in Dencun Upgrade

Layer 2 Scaling Solutions

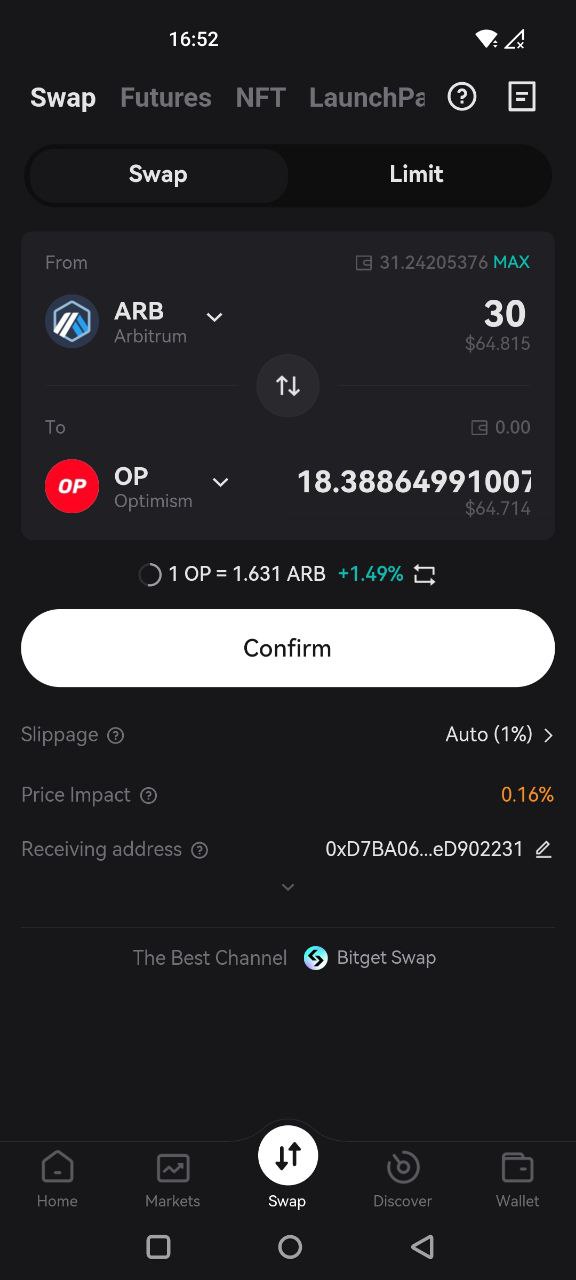

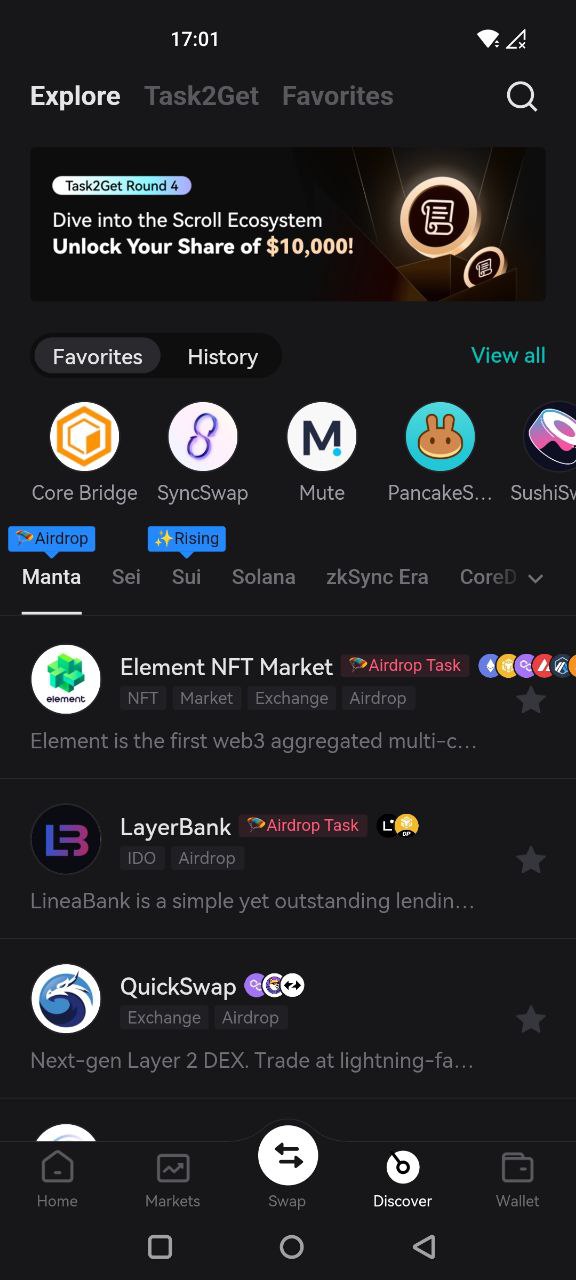

The Layer 2 scaling solutions, particularly prominent in the wake of the Dencun upgrade, are crucial for enhancing Ethereum's scalability and reducing transaction costs. Optimism, Arbitrum, and zkSync are leading the charge in this domain. Optimism, known for its use of optimistic rollups, has gained significant attention recently, partly due to its anticipated airdrop projects. These rollups are key to increasing transaction throughput while lowering gas costs. Arbitrum, another solution employing optimistic rollups, has shown promising potential for an uptrend in its token price, making it an attractive option for investors. zkSync, which uses zero-knowledge proofs to enhance transaction throughput and reduce costs, has also caught the market’s eye, particularly for its potential airdrop opportunities. These Layer 2 solutions are pivotal in the Ethereum ecosystem, offering faster and more cost-effective transaction processing, and are becoming increasingly attractive for both users and investors.

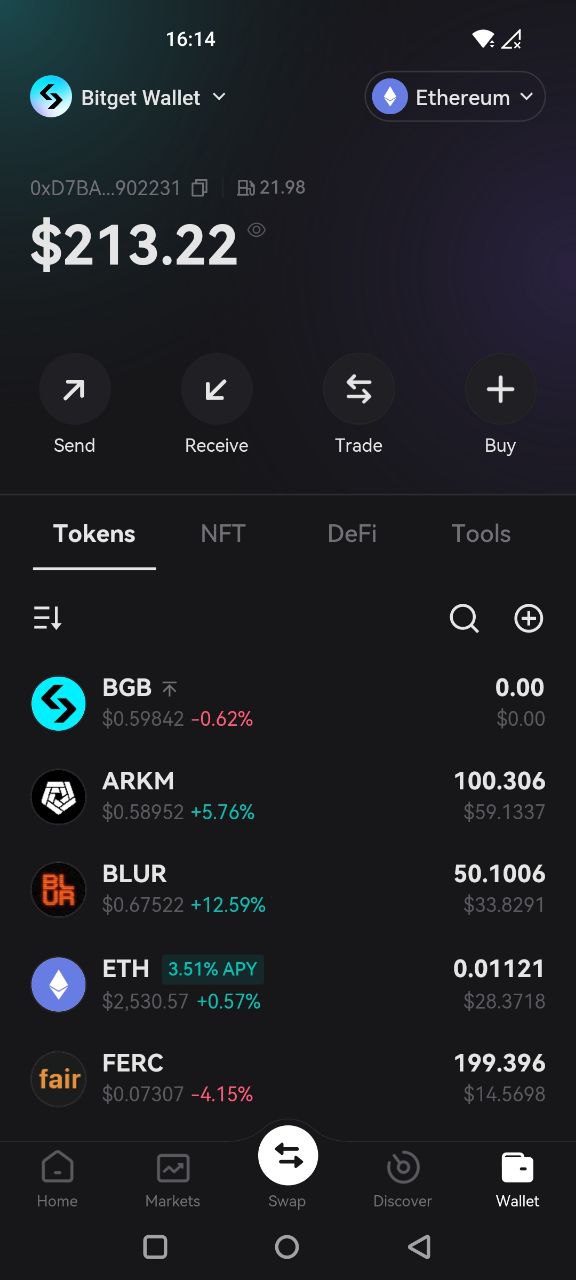

Visit Bitget Swap

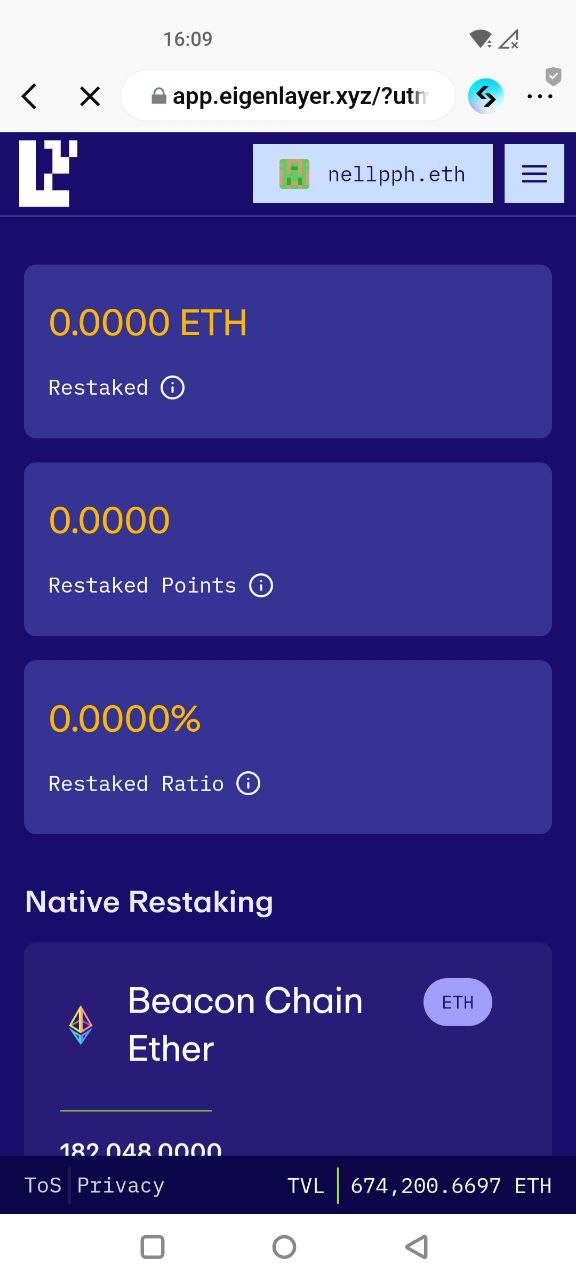

Restaking Through EigenLayer

Restaking is an emerging investment strategy in the crypto market, particularly gaining attention with the introduction of EigenLayer, a middleware built on Ethereum. EigenLayer facilitates protocols to utilize Ethereum’s secure trust network without the need for establishing their own set of validators, thereby significantly reducing operational costs. This innovation is critical as it allows new protocols to launch with less financial burden, potentially leading to more innovations in the Ethereum ecosystem. EigenLayer has already made a significant impact in the market, evidenced by its successful $50 million Series A funding round, attracting heavyweight investors like Blockchain Capital, Polychain Capital, Electric Capital, Coinbase Ventures, and Ethereal Ventures. The platform’s restaking marketplace is a novel concept where protocols can purchase pooled security from validators, and in turn, validators can offer pooled security to protocols. For users, this means the ability to restake their ETH and earn additional staking rewards. The popularity of EigenLayer’s approach was highlighted when the new limit for its Liquid Staking Token (LST) staking caps was quickly met upon launch.

Visit the Bitget DApp browser

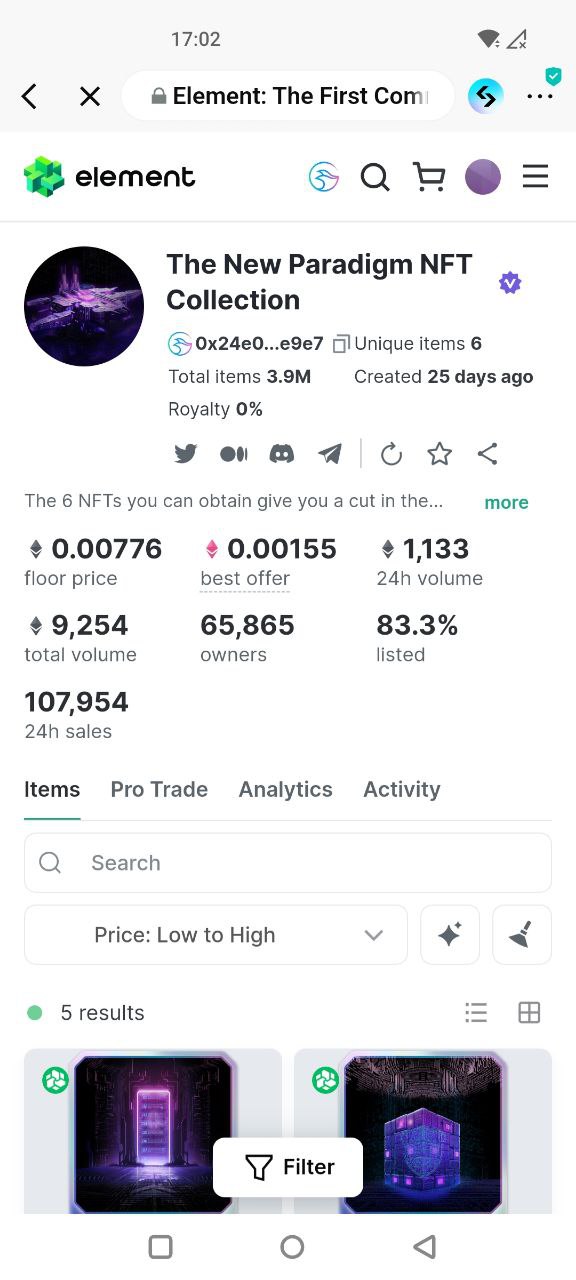

TVL-Based Projects and Airdrops

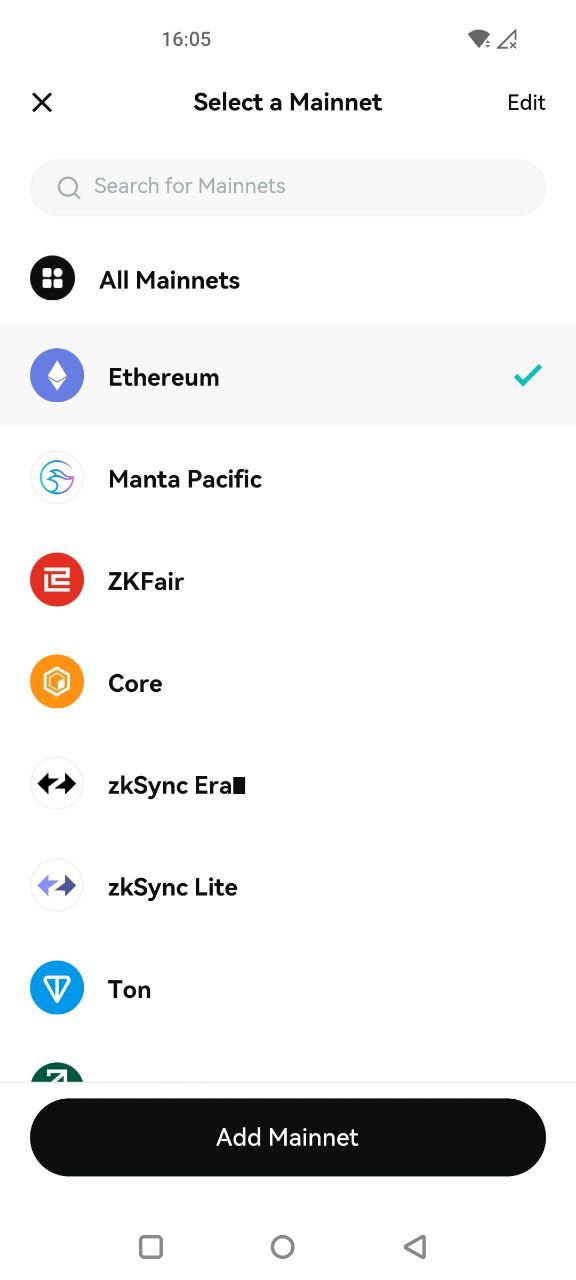

Total Value Locked (TVL) is a critical metric in the blockchain space, measuring the total value of assets locked within a blockchain protocol. Projects like Manta Pacific and Blast are making significant strides in this area. Manta Pacific, with a TVL of over $355 million, has launched an airdrop event called "New Paradigm", rewarding investors who lock a minimum amount of Ether or stablecoins. This approach differs from traditional methods, where blockchain's interactions were necessary for rewards. Blast, another emerging project with a TVL exceeding $822 million and a robust community of over 67,000 members, stands as one of the top Ethereum validators through the Lido DAO. Backed by influential venture capitals like Paradigm and Standard Crypto, Blast offers attractive yields on Ether and stablecoins, with the mainnet launch expected to open avenues for yield farming on Ethereum and prominent stablecoins. These TVL-based projects are redefining investment opportunities in crypto space, offering new ways for investors to engage and benefit from the evolving Ethereum ecosystem.

Visit the Bitget DApp browser

FAQ

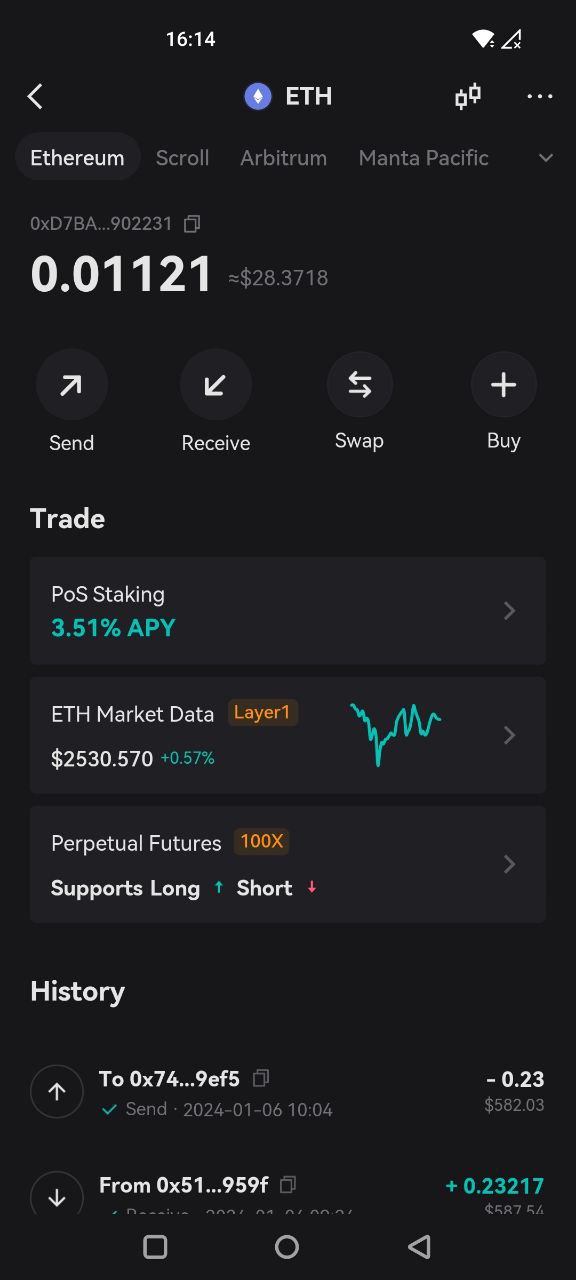

How to create an Ethereum (ETH) wallet?

How to buy Ethereum (ETH)?

How to bridge Ethereum (ETH) to other Layer 2 blockchains?

About Dencun Upgrade

What have been some past upgrades to Ethereum?

Frontier (July 2015): This was Ethereum's first version that everyone could use. Homestead (March 2016): The first big update with several improvements to make Ethereum more stable. Metropolis (October 2017): Split into two parts, Byzantium and Constantinople, this update made Ethereum more efficient and scalable. Istanbul (December 2019): This one focused on making Ethereum safer from certain types of cyberattacks. Muir Glacier (January 2020): It postponed the "difficulty bomb," a tool meant to push Ethereum towards a big future change. Berlin (April 2021): This update improved how smart contracts work and changed how transactions are priced. London (August 2021): A significant change happened here with EIP-1559, altering how transaction fees are calculated. Shanghai (April 2023): Also known as Shapella and Ethereum 2.0. This major upgrade allowed people to take back their staked Ethereum from the Beacon Chain. It marked a big step in Ethereum's shift to a new system where users help secure the network by staking their Ethereum. This update also made it possible for users who had staked their Ethereum since late 2020 to withdraw it, which was a big deal for those who had been waiting to access their funds.

When is the Ethereum Dencun Upgrade going live?

The Dencun upgrade for Ethereum is tentatively scheduled for the first part of 2024. However, remember, this date isn't set in stone. It might change depending on how things go in the test phases on different test networks. For the most accurate and latest information, keep an eye on Ethereum's official updates.

What could be the future impact of the Dencun Upgrade on Ethereum?

The Ethereum Dencun upgrade is anticipated to bring several noteworthy changes that could shape the future of Ethereum in various ways: Bigger Scale for Operations: With proto-danksharding in play, the Dencun upgrade could massively boost Ethereum blockchain's ability to handle transactions. This means it could process more transactions every second, making Ethereum more suited for larger applications and a broader user base. Lower Costs for Users: One of the most exciting aspects of this upgrade is the potential drop in transaction fees, especially in the realm of Ethereum rollups. This cost-effectiveness could make it more appealing for users to engage with apps built on Ethereum. Enhanced Efficiency and Security: The integration of blobs and KZG commitments in this upgrade aims to streamline transaction processes on Ethereum. Additionally, various updates and improvements (known as EIPs) are included to fortify the security of the network, making Ethereum more robust against potential threats. Influence on Ethereum's Price: While predicting market movements is always a tricky business, upgrades like Dencun have the potential to positively influence the price of Ethereum's native currency, ETH. This could be beneficial for ETH holders, but as always, it's wise to approach investment decisions with research and caution. Sparking Further Innovations: By highlighting and enhancing the role of rollups in scaling Ethereum, the Dencun upgrade might set the stage for more innovations in this area, further bolstering Ethereum's technological prowess and appeal.

Will Ethereum Dencun Upgrade impact the volatility of Ethereum (ETH) price?

The effect of the Dencun upgrade on the price volatility of Ethereum (ETH) is a bit of a wildcard, depending on several factors: Increased Demand and Attraction: If the upgrade delivers on its promises of better scalability and lower fees, it could attract a larger pool of users and developers. This new wave of interest could drive up ETH's price and, along with it, its volatility. Market Speculation Dynamics: In the run-up to the upgrade, market speculation could spike. Investors and traders trying to predict the outcome might lead to a flurry of trading activity, influencing price swings. Post-Upgrade Market Reactions: It's common to see a "sell the news" trend where, after a big event like an upgrade, investors might cash in, leading to increased price movements. The Unknowns and Technical Glitches: If the upgrade encounters unforeseen issues or technical challenges, it could impact ETH's price in unpredictable ways, possibly increasing volatility. As with any major update in the crypto world, the Dencun upgrade holds a mix of predictable and unforeseen impacts, making the landscape post-upgrade something to watch closely.

Which Layer 2 token is the better investment post-Dencun upgrade? ARB or OP?

When deciding between investing in Arbitrum (ARB) and Optimism (OP) tokens following the Ethereum Dencun upgrade, it's important to delve into a few key aspects: Impact of Dencun Upgrade on Layer 2 Solutions: The Dencun upgrade, designed to reduce transaction fees on Ethereum rollups, could be a significant boon for Layer 2 solutions like Arbitrum and Optimism. If the upgrade meets its objectives, we may witness increased interest and activity on these platforms. Token Utility in Their Ecosystems: Understanding how ARB and OP are utilized within their respective ecosystems is crucial. Investigate the specific roles and benefits these tokens provide to their users and how they contribute to the overall functionality of their networks. Community and Developer Engagement: The strength and activity of the communities and developers surrounding these projects are often good indicators of their long-term viability and potential. Assess the level of engagement and support that Arbitrum and Optimism are receiving from their respective user bases and developer communities. Strategic Partnerships and Integrations: The value and utility of a token can be significantly influenced by partnerships and integrations. Keep an eye out for any notable collaborations that Arbitrum and Optimism have established with other projects, platforms, or companies, as these can enhance their market position and technological capabilities. Broader Market Trends: Don't overlook the general market conditions. The overall sentiment in the crypto market, attitudes towards Ethereum and Layer 2 solutions, as well as global economic factors, play a vital role in shaping investor behavior and the performance of these tokens.