Avalon trading records

Avalon trading records

24h address transactions

Number of on-chain transactions for avl in the last 24h.

Buying addresses : 15,034

Selling addresses : 15,465

24h fund data analysis

Comparison of fund inflow vs outflow for avl, identifying the market momentum.

Inflow : $17,104,562

Outflow : $17,794,925

24h fund flow analysis

Type of players driving the momentum in avl: Whales, dolphins or fish.

Buy : $16,973,227

Sell : $17,651,326

Large

$0 Buy

$0 Sell

Medium

$1,352,515

$1,352,515

Small

$15,620,712

$16,298,811

About Avalon

Avalon Labs is creating an on-chain financial center for Bitcoin, offering a wide range of innovative solutions, including BTC-backed lending, a Bitcoin-backed stablecoin, yield-generating accounts, and even a credit card. The goal is to create a scalable, transparent, and accessible financial network that empowers Bitcoin holders and enables the use of Bitcoin as a dynamic economic asset. AVL is the governance token of Avalon Labs ecosystem. Avalon Labs has redefined the landscape of Bitcoin-backed finance. From its beginnings as the world’s largest issuer of Bitcoin-backed CDPs, Avalon has continuously innovated to create a dynamic, Bitcoin-centered financial ecosystem. Starting with lending, Avalon expanded its offerings to include DeFi lending, CeDeFi fixed-rate models, and, most recently, the launch of stablecoins. This strategic progression, always driven by community demand, has positioned Avalon as the heartbeat of the next generation of on-chain finance. And now, with the introduction of AVL, we are taking community-driven governance to new heights, allowing users to actively shape the future of Avalon.

FAQ

News

Swap

What do you think of avl today?

$1,214,441

AVL

5,249,840

USDT

608,395

USDT : AVL

1:8.662

$3,687

AVL

15,857

KOGE

39

AVL : KOGE

1:0.002405

$2,466

AVL

407

USDT

2,419

USDT : AVL

1:8.662

Type

Amount/Token

User

Top 10 coins

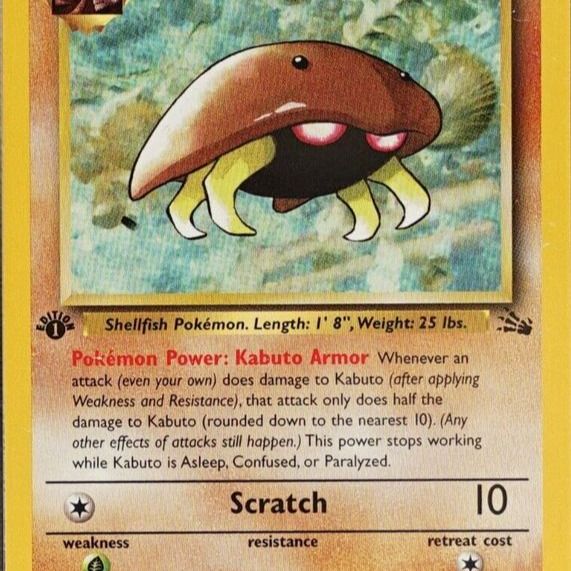

Kabuto

KABUTOMubarakah

MubarakahSHITCOIN

SHITCOINBIG

BIGFranklin The Turtle

FranklinThe White Whale

WhiteWhalePieverse Token

PIEVERSESentism AI Token

SENTISFolks Finance

FOLKSBeat Token

BeatLabels