Crypto Cards Pros and Cons: What Users Should Know Before Applying

Crypto Cards Pros and Cons are becoming a key topic for users exploring how to spend digital assets in real life. Crypto credit cards and crypto debit cards bridge traditional finance and blockchain by allowing users to earn rewards in cryptocurrency or spend directly from a crypto wallet. As adoption grows globally, these cryptocurrency cards appeal to travelers, digital nomads, and long-term crypto holders alike.

However, while rewards and global usability are attractive, volatility and fees remain important considerations. Later in this guide, we explain how Bitget Wallet helps users spend, manage, and convert crypto securely. This article breaks down the advantages, disadvantages, card mechanics, global usage, and how to choose a crypto card safely in 2026.

Key Takeaways

- Crypto cards allow users to spend or earn cryptocurrency through everyday purchases

- Rewards potential comes with volatility and fee-related risks

- Crypto debit cards and crypto credit cards serve different user needs

- Global acceptance is improving, but regional limits still exist

- Choosing the right card depends on fees, supported assets, and security

What Are Crypto Cards and How Do Crypto Cards Work in Real Life?

Crypto cards are payment cards linked to cryptocurrency wallets or platforms, allowing users to pay at merchants that accept traditional card networks like Visa or Mastercard.

Source X

How Do Crypto Credit Cards and Crypto Debit Cards Differ?

Crypto credit cards function similarly to traditional credit cards but offer rewards in cryptocurrency instead of cash back. Users earn Bitcoin or other digital assets based on spending volume.

Crypto debit cards, on the other hand, draw directly from a connected wallet balance, converting crypto to fiat instantly at checkout.

Visa crypto cards and Mastercard-supported cryptocurrency cards are now accepted by millions of merchants worldwide.

Read more:

Crypto Credit vs Debit Cards: What's the Difference?

How Does Real-Time Crypto-to-Fiat Conversion Operate?

When a user makes a purchase, the card provider automatically converts crypto into the local fiat currency at the point of sale. Funds may come from Bitcoin, Ethereum, or stablecoins, depending on card settings.

- Conversion happens instantly at the point of sale

- Users can select crypto or stablecoins for spending

- Market volatility can affect final spending value

Read more:

How to Convert Your Crypto to Cash: 5 Easy Ways for Beginners

What Are the Pros of Using Crypto Cards?

Understanding Crypto Cards Pros and Cons starts with the advantages that make crypto cards appealing for everyday use, global payments, and reward earning. These benefits explain why both crypto credit cards and crypto debit cards are gaining adoption worldwide.

Source X

Why Are Crypto Cards Convenient for Everyday Spending?

Crypto cards make it easier to use digital assets for daily expenses without converting crypto manually or relying on exchanges. This convenience helps bridge crypto and traditional finance in real-life scenarios.

- Pay for groceries, subscriptions, travel, and online shopping

- No need to pre-convert crypto into fiat

- Useful for remote workers, freelancers, and digital nomads

What Rewards Do Crypto Rewards Credit Cards Offer?

Crypto rewards credit cards allow users to earn cryptocurrency instead of cash back, adding long-term upside potential to everyday spending.

- Earn Bitcoin or other crypto rewards per purchase

- Rewards may increase in value if crypto prices rise

- Some crypto debit cards also offer cashback programs

How Globally Accessible Are Cryptocurrency Cards?

Cryptocurrency cards are designed to work within existing global payment networks, making them suitable for international use.

- Supported by Visa and Mastercard networks

- Enable cross-border purchases without manual currency exchange

- Available across many regions, depending on local regulations

What Security Features Do Crypto Cards Include?

Modern crypto cards integrate security tools that help users manage spending safely while maintaining control over digital assets.

- Two-factor authentication and encrypted transactions

- Real-time spending notifications

- In-app controls to freeze cards or manage balances

Read more:

- Crypto Card Without KYC: Spend Your Crypto Privately in 2025

- Crypto Credit vs Debit Cards: What's the Difference?

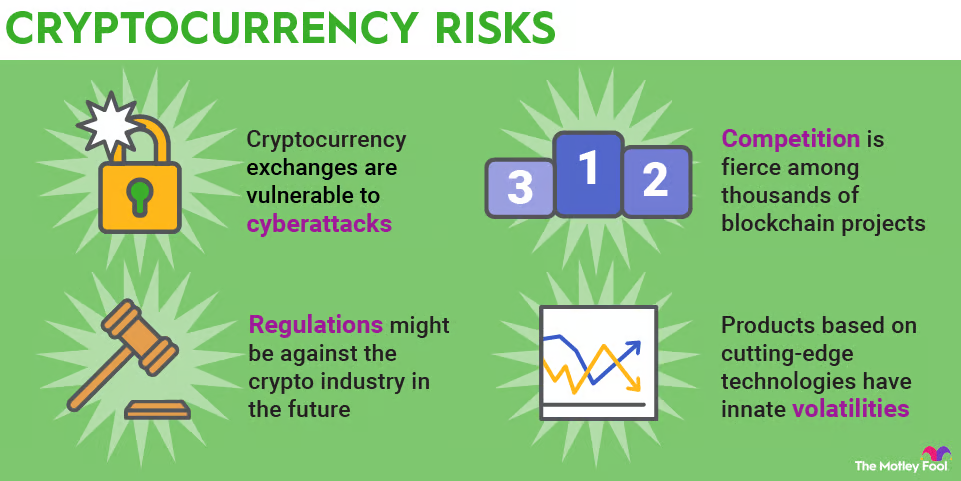

What Are the Cons and Risks of Crypto Cards?

While the benefits are appealing, understanding Crypto Cards Pros and Cons requires evaluating the risks that may affect costs, usability, and long-term value.

Source X

Why Can High Fees Affect Your Crypto Card Usage?

Fees can reduce the net value of rewards and increase the cost of everyday transactions.

- Crypto-to-fiat conversion fees at checkout

- ATM withdrawal and international transaction fees

- Annual or tier-based card fees depending on provider

How Does Crypto Volatility Affect Your Spending Power?

Because crypto prices fluctuate, the value of assets used for spending can change quickly.

- Price drops reduce real purchasing power

- Market swings may impact spending outcomes

- Stablecoins can help reduce exposure to volatility

Why Is Merchant Acceptance Still Limited in Some Regions?

Despite broader adoption, crypto cards may not be universally accepted everywhere.

- Regulatory restrictions in certain countries

- Some banks or merchants block crypto-linked payments

- Acceptance varies by region and provider

What Regulatory Issues Should Users Be Aware Of?

Crypto card services operate under evolving legal frameworks.

- Availability differs by country

- Identity verification and compliance checks may be required

- Regulatory changes can impact card functionality

→ Read more:

How to Convert Your Crypto to Cash: 5 Easy Ways for Beginners

What Are the Key Differences Between Crypto Credit Cards and Crypto Debit Cards?

Crypto credit cards and crypto debit cards serve different purposes depending on spending habits, risk tolerance, and reward preferences.

Which Type Is Better for Rewards?

Rewards structures differ significantly between card types.

- Crypto credit cards typically offer Bitcoin reward programs

- Rewards are earned based on monthly spending

- Some crypto debit cards provide cashback tiers

Which Type Is Better for Everyday Spending?

Daily usability often determines the best card choice.

- Crypto debit cards spend directly from wallet balances

- No repayment or interest involved

- Credit cards require repayment and credit management

Which Option Is Safer for Beginners?

New users often prioritize simplicity and cost control.

- Debit cards offer clearer funding limits

- Credit cards introduce credit and repayment risk

- Simpler structures reduce beginner mistakes

Read more:

- Crypto Debit Card vs. Traditional Debit Card: Which One Is Better for You in 2025?

- Top 5 USDT Debit Cards for Everyday Spending

How Should Users Choose the Right Crypto Card in 2026?

Choosing the right crypto card depends on personal spending goals, supported assets, and regional availability.

What Factors Matter Most—Fees, Rewards, or Regions?

Different users prioritize different features when selecting a crypto card.

- Compare card tiers and cashback percentages

- Review transaction and conversion fees

- Confirm supported countries and regions

Which Cryptocurrencies and Stablecoins Should Your Card Support?

Asset support directly impacts flexibility and risk management.

- BTC and ETH for long-term holders

- USDT and USDC for daily spending

- Multi-asset support improves usability

How Important Is Wallet Integration and Security?

Strong wallet integration improves visibility and control.

- Secure KYC and authentication processes

- Spending alerts and transaction tracking

- Multi-currency and multi-chain compatibility

What Are the Crypto Cards Pros and Cons for Different User Types?

The Crypto Cards Pros and Cons vary depending on how users interact with crypto in daily life.

Are Crypto Cards Good for Beginners?

For newcomers, Crypto Cards Pros and Cons revolve around simplicity versus exposure to price fluctuations. Crypto cards allow beginners to use digital assets without complex trading steps, but they also introduce market volatility into everyday spending.

- Pros: easy onboarding, small spending limits, no need for manual conversions

- Cons: crypto price volatility can impact spending value

- Cons: limited merchant acceptance in certain regions

Are Crypto Cards Useful for Frequent Travelers?

For travelers, Crypto Cards Pros and Cons focus on convenience versus fees. Crypto cards remove the need to exchange currencies manually while traveling, but cross-border usage may involve additional costs.

- Pros: global Visa and Mastercard acceptance

- Pros: seamless cross-border payments without FX exchanges

- Cons: ATM withdrawal and international transaction fees in some countries

Are Crypto Cards Beneficial for Long-Term Crypto Holders?

Long-term holders experience Crypto Cards Pros and Cons differently, as spending crypto may conflict with holding strategies. While rewards can add value, spending reduces exposure to future price appreciation.

- Pros: earn crypto rewards while spending

- Pros: convert small portions of holdings into real-world utility

- Cons: spending decreases long-term asset accumulation

How Can Users Stay Safe When Using Crypto Cards Online and Offline?

Managing Crypto Cards Pros and Cons responsibly requires strong security habits. Proper safeguards help reduce fraud risks, limit losses, and improve overall card safety in both digital and physical environments.

What Security Best Practices Should Users Follow?

Security practices play a key role in minimizing risks associated with crypto card usage.

- Enable two-factor authentication (2FA)

- Use strong, unique passwords for wallet access

- Freeze the card immediately if suspicious activity occurs

How Can Users Minimize Volatility Risk?

Crypto price fluctuations are one of the main Crypto Cards Pros and Cons users must manage proactively.

- Spend stablecoins for daily purchases

- Avoid loading large crypto balances at once

- Monitor market conditions before high-value transactions

How Can Users Avoid Unexpected Card Fees?

Unexpected costs can reduce the advantages of crypto cards if not managed carefully.

- Review crypto-to-fiat conversion rates

- Check ATM withdrawal limits and policies

- Compare card tiers and fee structures in advance

How to Use Bitget Wallet to Spend Crypto Safely and Conveniently

Bitget Wallet offers a practical solution for users seeking the advantages of crypto cards without unnecessary complexity. With Visa and Mastercard support, zero-fee spending, and instant crypto-to-fiat conversion, Bitget Wallet enables secure and globally compatible payments for everyday use.

- Visa and Mastercard network compatibility

- Zero-fee spending with global coverage

- Suitable for travel, remittances, and daily purchases

- Multi-chain asset support

- Instant crypto-to-fiat conversion at checkout

- Advanced security architecture

Step-by-Step Guide to Using Bitget Wallet

Getting started with Bitget Wallet is simple and user-friendly.

- Download and install Bitget Wallet

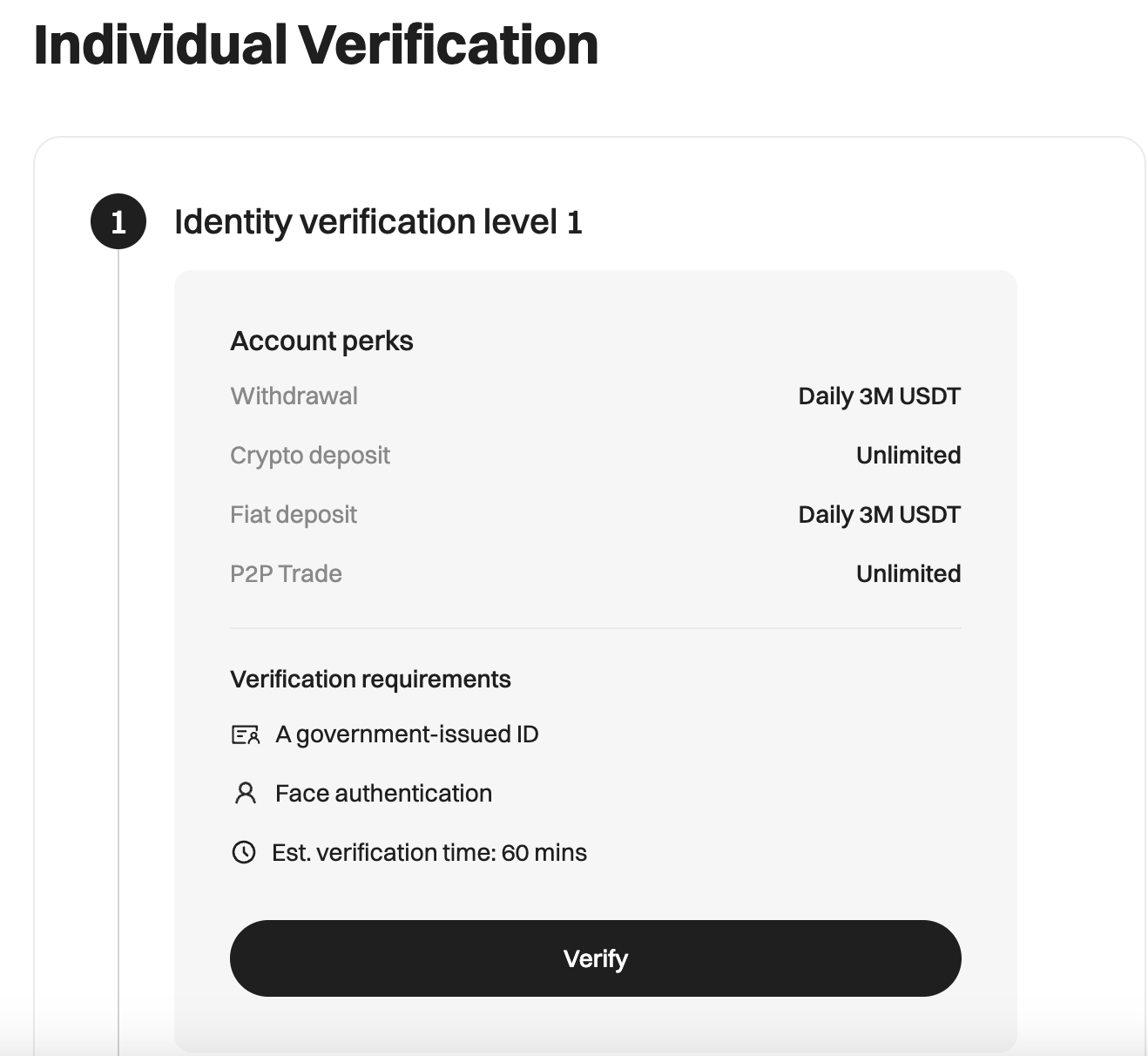

- Complete identity verification if required

-

Top up crypto or stablecoins

-

Enable the card feature

- Spend online or offline globally

- Track transactions using in-app analytics

Read more:

- How to Travel with Crypto and Crypto Card: Save Money on Hotels and Spend Smarter Abroad

- How Can You Buy Bitcoin and Crypto with a Mastercard Instantly in 2025?

Conclusion

Crypto Cards Pros and Cons highlight how digital assets are becoming more practical for everyday spending. Crypto cards offer rewards, global usability, and payment convenience, while risks such as volatility, fees, and regional limitations remain important considerations. Users should assess their spending habits, travel needs, and risk tolerance before choosing a card.

For those seeking a secure and globally supported way to spend crypto directly, Bitget Wallet delivers seamless conversion, multi-chain support, and a crypto card designed for real-world purchases.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

What are the main Crypto Cards Pros and Cons users should consider?

The main Crypto Cards Pros and Cons include convenience and rewards versus volatility and fees. On the positive side, crypto cards allow users to spend digital assets globally, earn crypto rewards, and avoid manual conversions. On the downside, market price fluctuations, conversion fees, and limited acceptance in some regions can impact everyday usability.

Are crypto cards worth it for everyday spending in 2026?

Whether crypto cards are worth it depends on how users balance the Crypto Cards Pros and Cons. For small daily purchases, stablecoin spending and low-fee cards can offer smooth payment experiences. However, users should remain aware of volatility risks, card fees, and regional restrictions before relying on crypto cards as a primary payment method.

How can users reduce risks when using crypto cards online and offline?

To manage the Crypto Cards Pros and Cons effectively, users should follow security best practices such as enabling two-factor authentication, spending with stablecoins, monitoring conversion rates, and reviewing fee structures regularly. Choosing wallets with strong security architecture and real-time controls also helps minimize risk.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Top 5 USDT Debit Cards for Everyday Spending2025-10-01 | 5 mins