How to Use a Crypto Card: A Beginner’s Guide to Spending Bitcoin and Stablecoins

How to Use a Crypto Card has become one of the most common questions among beginners stepping into cryptocurrency payments. A crypto card works similarly to a traditional debit or credit card, except that it draws funds from your digital assets and converts them to fiat instantly at checkout. This makes it possible to spend Bitcoin, stablecoins, and other crypto assets anywhere that accepts Visa or Mastercard. For first-time users, the Bitget Wallet Card offers a simple and secure way to start making real-world crypto payments effortlessly.

With the rise in global crypto adoption, crypto cards are turning out to be one of the most practical bridges between digital assets and everyday spending. Recent trends have shown increased demand for crypto rewards, stablecoin payments, and globally supported debit cards across multiple regions. In this article, we’ll explore how crypto cards work, how to use a crypto card daily, key pros and cons, safety tips, and a complete practical guide to using the Bitget Wallet Card.

Key Takeaways

-

Crypto cards convert your Bitcoin or stablecoins into fiat instantly at checkout.

This lets you spend digital assets just like traditional money without manual swapping.

-

Users should understand fees such as conversion fees and ATM charges when using a crypto card.

Knowing these costs helps you avoid unexpected deductions and manage your spending effectively.

-

Using secure wallets like Bitget Wallet improves overall asset safety and transaction control.

A reputable multi-chain wallet ensures your funds remain protected while giving you full visibility over card activity.

What Is a Crypto Card and How Does It Work?

Crypto cards function much like traditional payment cards, but instead of pulling money from a bank account, they draw funds from crypto assets stored in a digital wallet. When you pay with the card, the issuer automatically converts your crypto to fiat using real-time exchange rates. This means you can spend your digital assets anywhere card payments are accepted, without manually swapping crypto beforehand.

How Does Instant Crypto-to-Fiat Conversion Work?

When you make a purchase, your crypto card provider instantly converts your cryptocurrency—such as USDT, USDC, Bitcoin, or Ethereum—into the local fiat currency used by the merchant. This conversion uses real-time market prices, meaning your final transaction amount may reflect crypto price movements. This process eliminates the additional step of converting crypto manually before purchases.

What Types of Crypto Cards Exist Today?

Most crypto cards fall into one of several categories:

- Crypto debit cards, which draw directly from your digital asset balance.

- Crypto credit cards, which allow users to earn crypto rewards based on spending.

- Virtual or prepaid crypto cards, ideal for online payments or immediate activation.

These card types generally support a wide range of assets, including Bitcoin, Ethereum, and stablecoins, with some providers offering 50+ supported cryptocurrencies.

Read more: What Is a Crypto Debit Card and How Does It Work?

How to Use a Crypto Card for Payments?

Using a crypto card for everyday spending is straightforward, and the Bitget Wallet Card works almost exactly like a traditional debit card. Whether you’re paying in-store with a physical card or online with a virtual card, the process is simple and beginner-friendly.

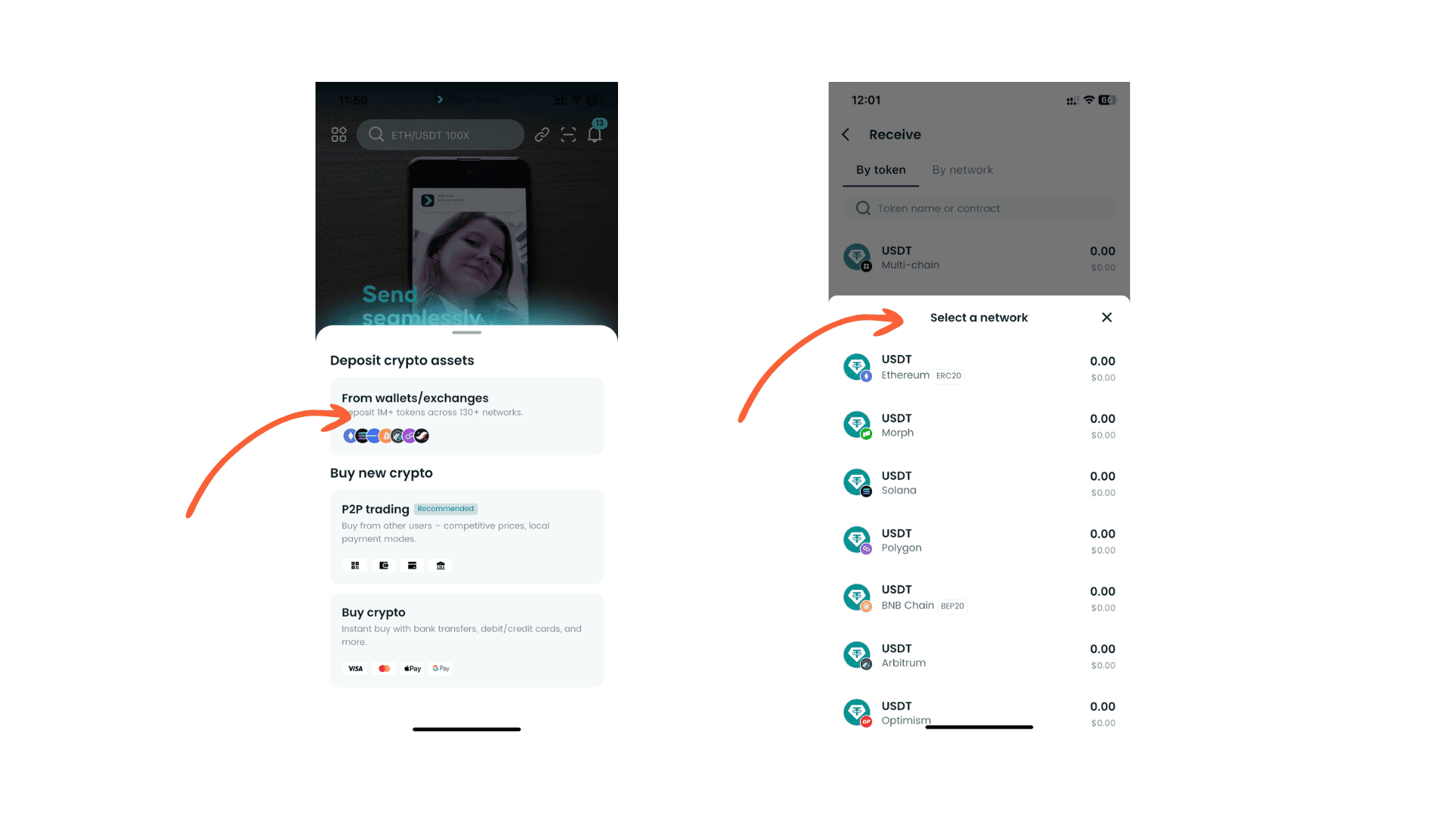

Step 1: Load Crypto Into Your Bitget Wallet

Before using the Bitget Wallet Card, top up your Bitget Wallet with supported assets—most commonly USDT or USDC for stable spending. You can transfer crypto from exchanges or other Web3 wallets. After KYC verification and card activation, your balance becomes ready for spending.

Step 2: Swipe, Tap, or Enter Card Details

Once active, you can use the Bitget Wallet Card just like a bank card. Pay in stores by tapping, swiping, or inserting the physical card. For online purchases, simply enter the virtual card number at checkout. Merchants always receive fiat, while your crypto is converted automatically in the background.

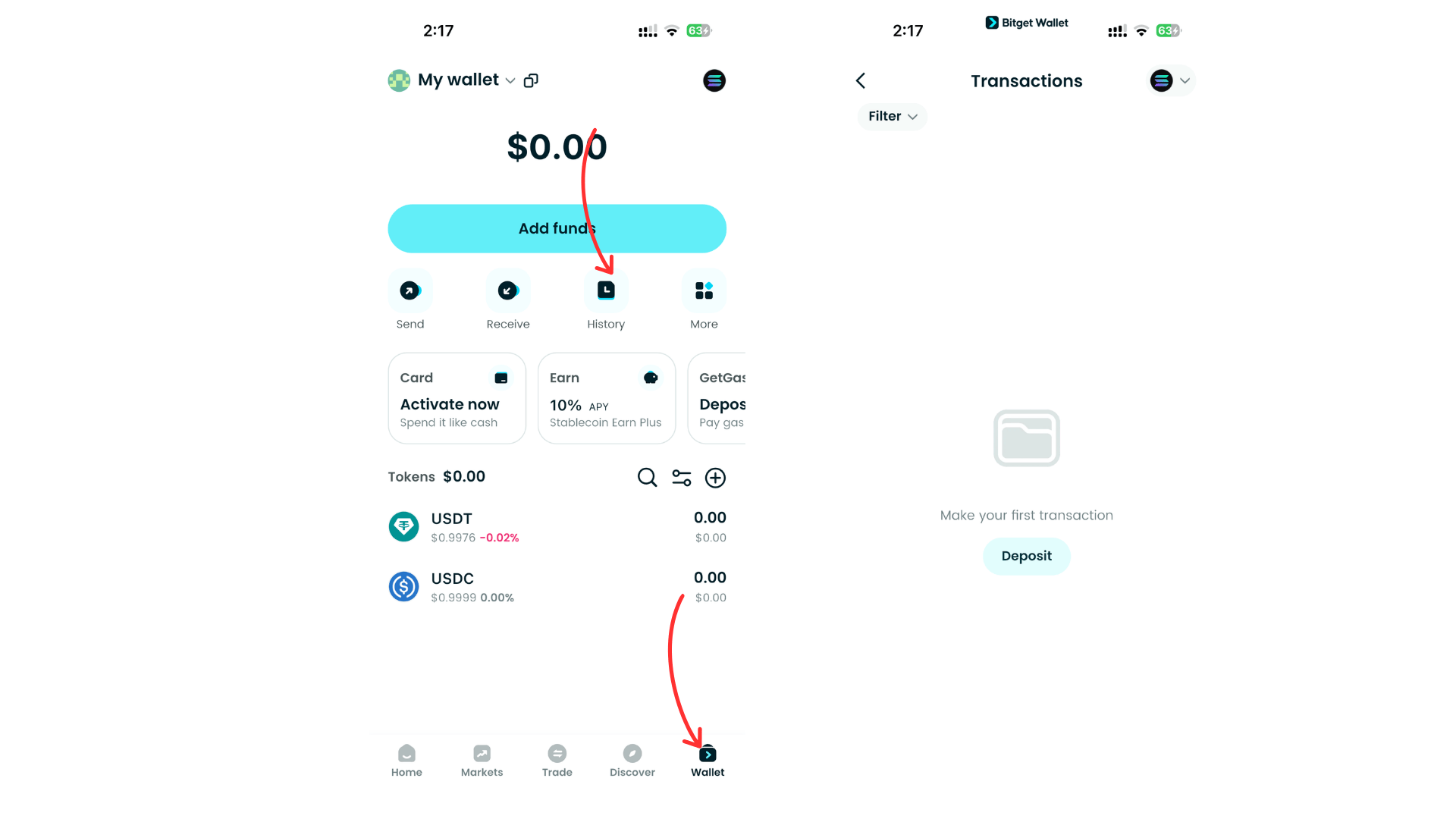

Step 3: Track Spending and Conversion Rates

All spending activity is visible inside the Bitget Wallet app. You can check conversion prices, monitor your remaining balance, and review your transaction history in real time. This helps you manage spending, track fees, and stay in control of your wallet funds.

Trade, store, and explore Web3 seamlessly — all in one place with Bitget Wallet.

Read more: How to Use a Crypto Card for Daily Transactions?

What Are the Pros and Cons of Using a Crypto Card?

Crypto cards make it easy to spend digital assets like Bitcoin and stablecoins in everyday life, offering a simple way to pay anywhere Visa or Mastercard is accepted. At the same time, they come with specific risks and limitations that beginners should understand before using them regularly.

Pros — Why Do People Use Crypto Cards?

Crypto cards come with several advantages that make them appealing for everyday spending. For many users, they offer a flexible and modern way to use digital assets without needing to convert them manually.

- Spend crypto anywhere traditional cards are accepted.

- Earn crypto rewards based on your spending.

- Lower foreign exchange fees compared to some bank cards.

- Faster settlement and seamless conversion at checkout.

Cons — What Should Beginners Watch Out For?

Despite their benefits, crypto cards also come with certain limitations that new users should understand before relying on them for daily purchases. Awareness of these factors helps avoid unexpected issues or costs.

- Each crypto-to-fiat conversion may trigger a taxable event.

- Volatility in crypto prices may affect the value of your spending.

- Some cards are limited by regional availability or require waitlists.

- Reward structures or monthly caps may vary significantly.

Pros vs. Cons of Using a Crypto Card

| Category | Pros | Cons |

| Spending Convenience | Spend crypto anywhere Visa/Mastercard is accepted | Regional restrictions may limit availability |

| Conversion & Payments | Instant crypto-to-fiat conversion at checkout | Volatility may affect the value of spending |

| Rewards | Earn crypto rewards such as Bitcoin or stablecoins | Reward structures and monthly caps vary widely |

| Fees | Lower foreign transaction fees compared to some bank cards | Possible conversion or ATM fees depending on issuer |

| Speed & Efficiency | Faster settlement and seamless payment processing | Waitlist or approval delays for some users |

| Asset Management | Integrates easily with secure wallets like Bitget Wallet | Requires understanding how to fund and manage crypto |

| Tax Exposure | — | Each conversion may trigger a taxable event |

Read more: Where Can You Use a Crypto Card in 2025? Real-World Spending, and Wallet Tips

Which Crypto Card Is Best for Beginners in 2025?

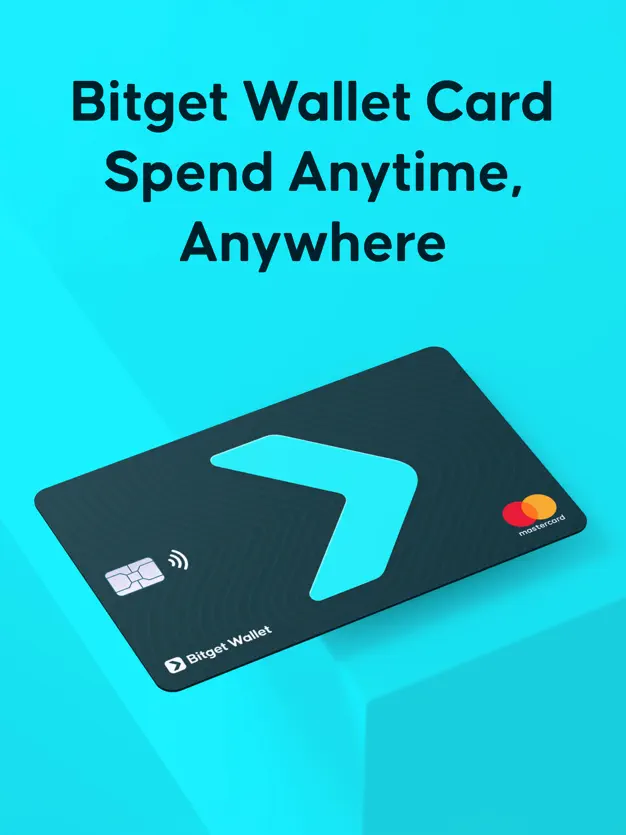

For new users who want a simple, secure, and globally accepted way to spend crypto, the Bitget Wallet Card stands out as the best beginner option in 2025. It offers seamless activation, zero-fee payments, and stablecoin-friendly spending—all directly integrated with the Bitget Wallet app.

Why Bitget Wallet Card Stands Out?

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn: Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks: Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market: Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued: Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience: Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion: Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

Apply for Bitget Wallet Card Right Now!

If you're looking for a legally issued crypto debit card with industry-low fees, instant crypto-to-fiat conversion, and seamless integration with your wallet and mobile payments — the Bitget Wallet Card is your best bet in 2025.

✅ Get $5 free just for verifying your account — no strings attached.

✅ Enjoy just 1.7% total fees — lower than 90% of the market

✅ Stake stablecoins and earn up to 8% APY

✅ Get extra cashback in your first 30 days

✅ No top-up or monthly fees, and quick KYC approval

👉 Ready to simplify your crypto spending?

Download Bitget Wallet and apply for your first crypto debit card in minutes!

Key Benefits for First-Time Users

For newcomers exploring crypto payments, the Bitget Wallet Card offers a simple, flexible, and secure way to spend digital assets in daily life. Its design focuses on convenience, stability, and seamless integration with your existing wallet.

- Stablecoin-friendly spending for consistent value.

- Virtual + physical card options for both online and offline shopping.

- Integrated with Bitget Wallet, allowing users to swap, earn, and spend seamlessly.

- Earn before you spend through Stablecoin Earn Plus (up to 10% APY).

- Cross-chain support across Solana, Ethereum, BNB Chain, Base, and more.

Are Crypto Cards Safe and How Do You Avoid Risks?

Crypto cards are generally safe, especially when paired with strong security tools, reputable wallet providers, and stablecoin-based spending strategies. Since all funds originate from your self-custodial or custodial crypto wallet, protecting your assets requires a combination of built-in security features and personal best practices. With the right setup, crypto cards can be just as secure—if not more secure—than traditional debit cards.

How Do Crypto Card Security Features Protect You?

Modern crypto cards include multiple layers of protection designed to safeguard user funds and prevent unauthorized transactions:

- Two-factor authentication (2FA) required for login, transfers, or high-risk actions, ensuring only you can authorize spending.

- Instant freeze/unfreeze controls, letting you disable the card from your wallet app within seconds if it’s misplaced or compromised.

- Bank-level encryption for transaction routing, which helps prevent fraud, data exposure, or unauthorized merchant activity.

- Spending limits and withdrawal caps, helping users reduce risk when using the card for everyday purchases.

- Enhanced protection when paired with trusted wallets like Bitget Wallet, which adds biometric login, MPC or seed-phrase-based security, and active scam-detection alerts.

These features combine to offer a secure environment where users maintain direct control over how, when, and where their funds are spent.

How Can You Avoid Volatility When Spending Crypto?

Volatility management is one of the most important factors when using a crypto card. Unlike traditional currencies, crypto values can swing rapidly—so the right strategy ensures your purchasing power stays stable:

- Use stablecoins (USDT, USDC) for predictable spending, as their value remains pegged 1:1 to fiat currency.

- Avoid using volatile assets like BTC, ETH, or SOL during periods of sharp market movement to prevent unexpected losses during checkout.

- Convert your assets into stablecoins ahead of time, especially if you plan a large purchase or international transaction.

- Maintain a stablecoin-only card balance, ensuring consistent and stress-free everyday payments.

- Enable price alerts or auto-swap features within Bitget Wallet to help you manage volatility more efficiently.

By combining strong card security tools with stablecoin-based spending habits, users can enjoy the full benefits of crypto cards—global access, fast payments, and financial flexibility—while avoiding unnecessary risks.

Read more: Crypto Debit Card vs. Traditional Debit Card: Which One Is Better for You in 2025?

How Do You Choose the Right Crypto Card for Your Needs?

-

Consider Your Usage Habits

Think about how you plan to spend: stablecoins for predictable value, multi-chain support for flexibility, or rewards for extra benefits. Decide whether you need a virtual card, a physical card, or both, and make sure it connects smoothly with your wallet for quick top-ups and conversions.

-

Compare Fees and Rewards

Review conversion fees, ATM charges, and any FX costs to avoid surprises. Look at cashback rates or reward structures and check if they come with caps or token-based limitations. The right card offers clear fees and rewards that match your spending style.

-

Check Regional Support and Network Compatibility

Confirm the card works in your country and is accepted by the networks you use most, such as Visa or Mastercard. If you travel or shop internationally, check for cross-border limits or extra fees to ensure the card works wherever you need it.

Read more: Crypto Credit vs Debit Cards: What's the Difference?

How to Use a Crypto Card With Bitget Wallet Card?

The Bitget Wallet Card offers a simple, secure, and globally supported way to spend your crypto in everyday life. Whether you’re paying online or shopping abroad, it provides a smooth experience designed for beginners.

What Makes Bitget Wallet Card Beginner-Friendly?

The Bitget Wallet Card is built to remove the complexity of crypto payments, making it easy for anyone to start spending digital assets. Its design focuses on simplicity, flexibility, and low fees.

- Zero-fee crypto payments.

- Global acceptance through Mastercard & Visa.

- Seamless cross-chain compatibility for stablecoin payments.

- Integrated directly into one unified app experience.

How To Get and Set Up a Bitget Wallet Card?

Bitget Wallet Card offers a simple sign-up experience:

- Download Bitget Wallet App

- Complete KYC (approval in minutes)

- Activate the card inside the wallet

- Choose spending crypto (BTC, ETH, USDT, etc.)

- Start using crypto card via Apple Pay, Google Pay, or wait for the physical card

Apply in app and start using within minutes:

How to Use Bitget Wallet Card for Global Payments

Once activated, the Bitget Wallet Card works just like a traditional card, but with the added power of crypto. You can spend stablecoins anywhere Mastercard or Visa is accepted, both online and in-store.

- Tap, swipe, or use the virtual card online for purchases.

- Spend USDT/USDC with instant conversion and no additional fees.

- Trade memecoins or RWAs with zero fees before loading funds.

- Utilize Stablecoin Earn Plus to earn up to 10% APY before spending.

Conclusion

How to Use a Crypto Card ultimately comes down to understanding how crypto-to-fiat conversion works, how to manage your assets safely, and how to choose the right card for your daily needs. With the ability to spend Bitcoin and stablecoins anywhere Visa or Mastercard is accepted, crypto cards unlock a seamless bridge between digital assets and the real world.

For beginners seeking the simplest and most secure experience, the Bitget Wallet Card offers global support, zero-fee payments, and effortless integration with cross-chain assets and stablecoins. Start exploring crypto payments today with Bitget Wallet and enjoy flexible, secure, real-world spending.

Spend stablecoins anywhere – beginner-friendly Bitget Wallet Card is here.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to Use a Crypto Card for everyday payments?

A crypto card works like a regular payment card: tap, swipe, or enter your card details, and your crypto automatically converts to fiat at checkout.

2. Do crypto card purchases create taxable events?

Yes. Each crypto-to-fiat conversion may be considered a taxable event depending on your region’s regulations.

3. Which cryptocurrencies can I spend with a crypto card?

Most crypto cards support Bitcoin, Ethereum, and major stablecoins like USDT and USDC, with some supporting dozens more.

4. Are crypto cards safe for beginners?

Yes. Using 2FA, card-freezing tools, and reputable wallets like Bitget Wallet significantly enhances safety.

5. Can I use a crypto card internationally?

Yes. Crypto cards typically work anywhere Visa or Mastercard is accepted, though regional restrictions may apply.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.