What is Rayls (RLS): Hybrid Institutional Blockchain Powering RWA Tokenization and Compliant Settlement

What is Rayls (RLS)? Grounded in the value of institutional trust and financial transparency, Rayls (RLS) seamlessly connects legacy finance with next-generation blockchain innovation in the RWA tokenization and institutional blockchain space. By utilizing a hybrid public-and-private chain architecture, it preserves the integrity of regulated financial systems while integrating them into the evolving digital economy.

With the backing of key industry players, early exchange listings, and growing institutional interest, Rayls (RLS) is shaping the evolution of compliant digital assets and creating new access points for investors, enterprises, and large-scale adopters. Beyond functioning as a financial token, it actively supports secure settlement, staking, and real-world asset tokenization, ensuring sustainable relevance and long-term utility.

This article aims to shed light on Rayls (RLS) — revealing its core purpose, defining features, and expanding market potential. Whether you’re exploring practical use cases, assessing investment prospects, or keeping up with blockchain innovations, this guide provides the essential insights you need.

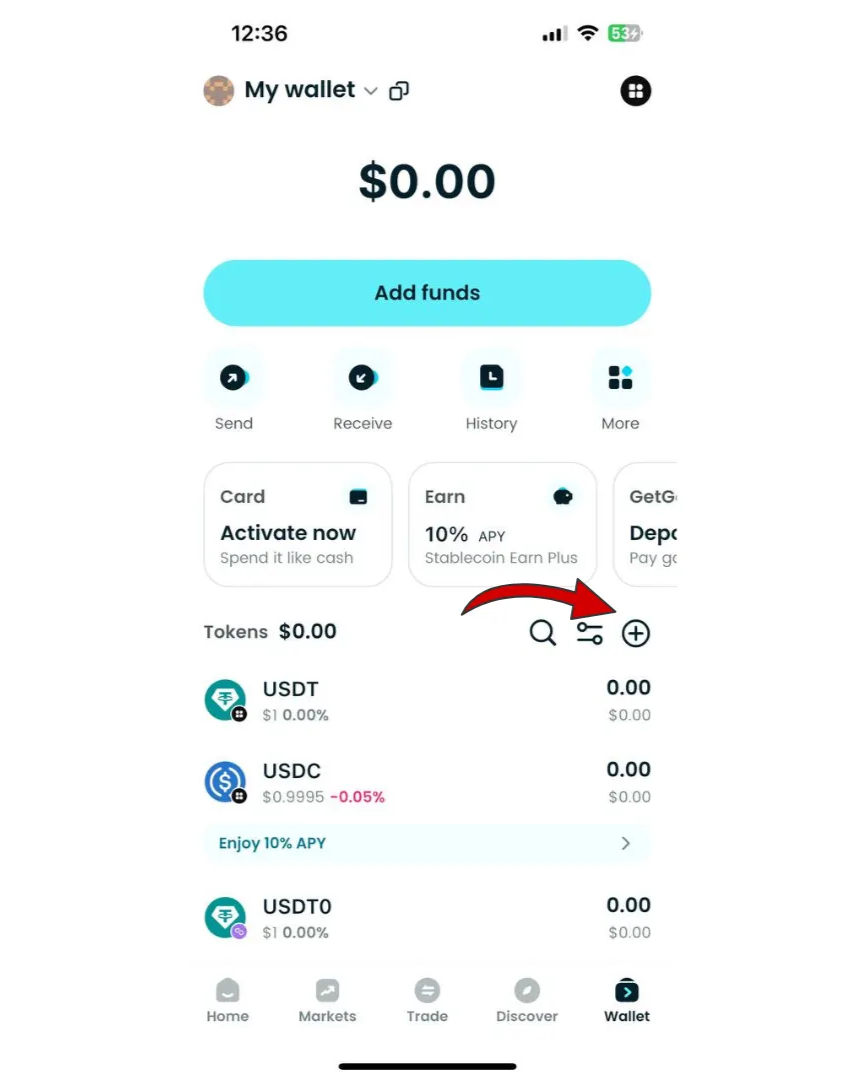

Bitget Wallet: The beginner-friendly gateway for stablecoins, memecoins, and cross-chain trading.

Key Takeaways

- Rayls (RLS) bridges traditional finance and blockchain, offering a hybrid institutional network designed for compliant RWA tokenization and secure asset settlement.

- RLS is the ecosystem’s native utility token, enabling gas fees, staking, governance, and cross-network operations within the Rayls infrastructure.

- Institutional adoption remains the primary growth catalyst, positioning Rayls as an emerging backbone for banks, fintech firms, and regulated enterprises.

- Bitget Wallet provides a seamless way to store, trade, and manage RLS, giving users secure, multi-chain access to Rayls while simplifying participation in its expanding ecosystem.

A Deep Dive into Rayls: What Is $RLS?

Rayls (RLS) is a utility and governance token built on a hybrid institutional blockchain architecture that combines a public EVM chain with private institutional subnetworks. It represents a modern evolution of financial infrastructure, designed to merge traditional finance with decentralized innovation. The project embodies the following core values:

- Institutional-grade trust and compliance

- Transparency and efficient on-chain settlement

- Innovation through secure RWA tokenization

Rayls (RLS) not only inherits the spirit of trusted financial systems but also applies it to the broader blockchain and RWA industry, building a sustainable, credible, and collaborative environment for enterprises, developers, and investors worldwide.

Source: X

Rayls recently gained attention following new exchange listings and increased institutional exploration of its hybrid blockchain model. With growing interest in real-world asset tokenization and compliant blockchain infrastructure, RLS is emerging as a potential contender in the institutional DeFi landscape, driving curiosity among early adopters and enterprise partners alike.

Rayls (RLS) Listing: Key Details and Trading Schedule

Key Listing Information

Here are the important details about the Rayls (RLS) listing:

- Exchange: Bitget

- Trading Pair: RLS/USDT

- Deposit Available: December 1, 2025 — 10:00 (UTC+8)

- Trading Start: December 1, 2025 — 20:00 (UTC+8)

- Withdrawal Available: December 2, 2025 — 16:00 (UTC+8)

Don’t miss your chance to start trading Rayls (RLS) on Bitget and be part of this rapidly emerging institutional blockchain ecosystem.

- Please refer to the official announcement for the most accurate schedule.

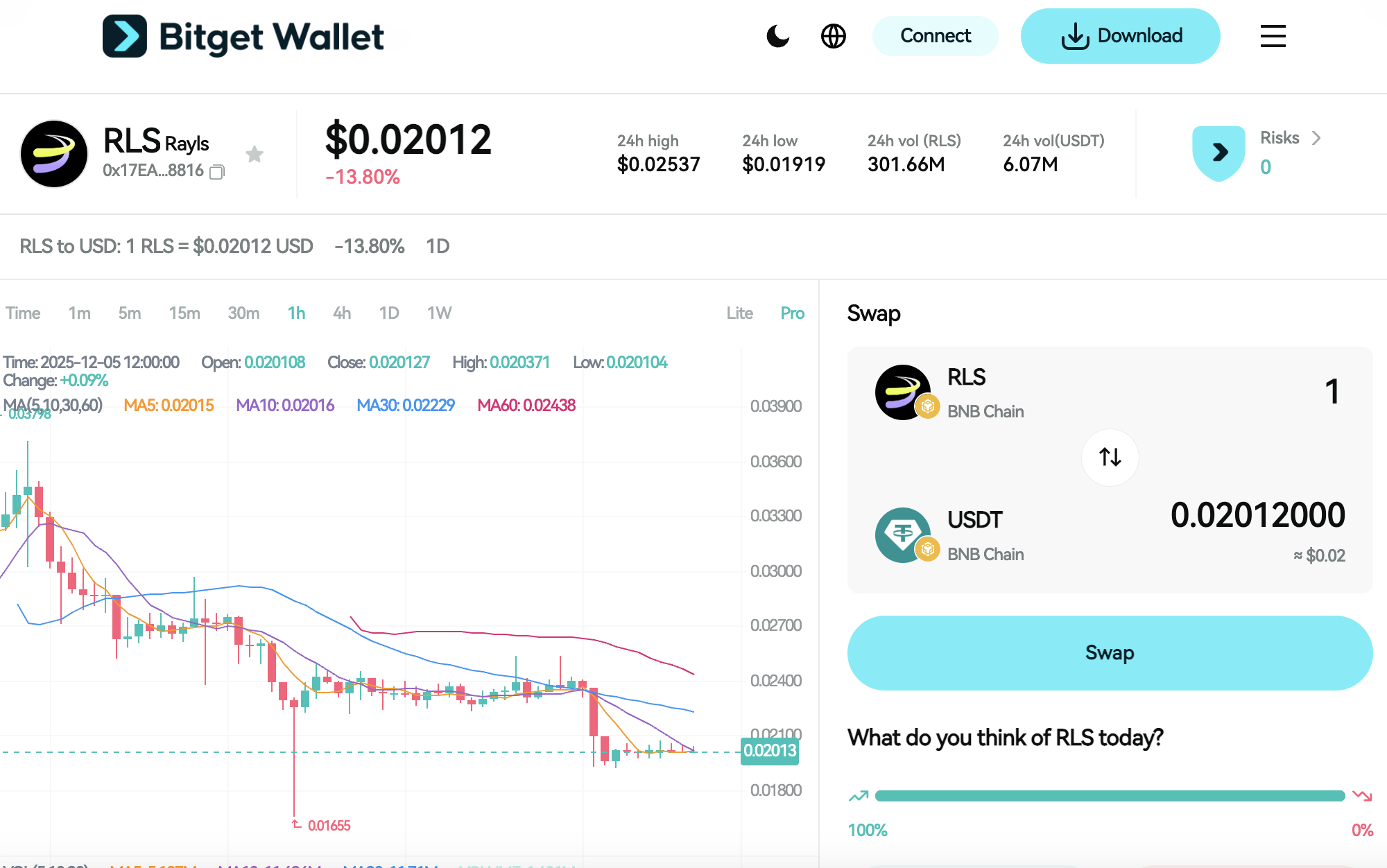

Rayls (RLS) Market Trends & Price Predictions 2025

Rayls (RLS)’s price is influenced by overall market trends, ecosystem strength, and adoption levels. With its recent exchange listings and growing presence in the institutional blockchain and RWA sector, Rayls (RLS) could maintain a stable trading range of $0.020–$0.035 throughout 2025. Future network expansion and deeper involvement in institutional-grade asset tokenization may push its long-term valuation toward $0.08–$0.12.

Factors Influencing the Price of Rayls (RLS)

Several crucial aspects contribute to the growth potential of Rayls (RLS):

-

Market Trends:

Increasing institutional interest in real-world asset (RWA) tokenization and compliant blockchain infrastructure strengthens demand for platforms like Rayls.

-

Adoption & Real-World Utility:

Rayls’ hybrid public-chain and private-subnet model is built for enterprises, banks, and regulated institutions. Real-world adoption of settlement or asset-tokenization workflows would significantly increase RLS utility.

-

Project Advancements:

Exchange listings, public-chain releases, hybrid architecture upgrades, and enterprise partnerships act as critical catalysts for market confidence and price appreciation.

Long-Term Growth Potential

Should Rayls (RLS) continue its expansion within the institutional blockchain and RWA industry, demand for its utility token is likely to strengthen. Analysts suggest that continued innovation and enterprise adoption could support a move toward $0.08–$0.12, though investors must remain aware of regulatory changes, unlock schedules, and broader market volatility.

Source: Bitget, CoinMarketCap, Rayls Documentation

Source: Bitget Wallet

Rayls (RLS) Key Innovations: Top Reasons to Watch

The standout features of Rayls (RLS) include:

1. Hybrid Institutional Blockchain Architecture

Rayls combines a public EVM-compatible chain with private institutional subnets, enabling regulated entities, banks, and enterprises to operate on-chain with privacy, compliance, and customizable network logic. This dual-layer architecture allows Rayls to serve both open DeFi users and high-trust institutional use cases simultaneously.

2. RWA Tokenization and Secure Settlement Layer

Rayls is purpose-built for real-world asset (RWA) tokenization, allowing institutions to issue, settle, and manage tokenized assets on-chain with transparency and auditability. Its architecture supports institutional workflows such as KYC-enabled subnets, controlled access, and compliant transaction validation — a major differentiator in the rapidly expanding RWA sector.

3. Utility-Rich Native Token (RLS)

The RLS token powers gas fees, staking, governance, and cross-network operations across the Rayls ecosystem. As network activity grows — from enterprise subnet deployments to RWA issuance and settlement — demand for RLS increases proportionally. This positions the token as the economic backbone of Rayls’ long-term growth.

How Does Rayls (RLS) Work?

The operation of Rayls (RLS) is based on its hybrid institutional blockchain architecture, which combines a public chain with private, customizable institutional subnets. This design supports compliant real-world asset tokenization, secure settlement, and enterprise-grade blockchain workflows.

1. Hybrid Public Chain + Institutional Subnets

Rayls enables institutions to deploy private subnets with permissioned access, custom compliance rules, and isolated execution environments. These subnets connect to the Rayls public chain for interoperability, liquidity access, and verifiable settlement, allowing enterprises to operate securely without exposing sensitive data.

2. RLS-Powered Gas, Staking & Governance

The native token RLS fuels the entire ecosystem. It is used for transaction fees, validator staking, governance decisions, and settlement across subnets and the public chain. As subnet usage and RWA tokenization activities increase, so does the demand for RLS, reinforcing its role as the network’s core utility asset.

3. Enterprise-Ready RWA Tokenization Layer

Rayls provides infrastructure for issuing and managing real-world assets on-chain, enabling institutions to tokenize bonds, financial instruments, and compliant digital assets. Through its privacy-preserving and auditable architecture, Rayls facilitates regulated workflows such as KYC-enabled transactions and controlled asset transfers.

By integrating institutional trust, enterprise collaboration, and a rapidly growing interest in asset tokenization, Rayls (RLS) aims to become a sustainable and influential project within the evolving crypto ecosystem.

Rayls (RLS)'s Team, Vision, and Partnerships

| Section | Details |

| The Team | Led by the Rayls Foundation and core contributors with extensive experience in institutional blockchain infrastructure, cryptography, and enterprise system design. Their goal is to make Rayls (RLS) a trusted standard for compliant, institution-ready blockchain networks. |

| The Vision | Focused on building a hybrid public–private blockchain for regulated financial markets, the project aims to develop a sustainable ecosystem that represents transparency, compliance, and high-integrity settlement within the RWA and institutional finance industry. |

| Partnerships | Rayls (RLS) collaborates with early ecosystem partners, exchange platforms, and institutional technology providers to strengthen its infrastructure and expand into RWA tokenization, enterprise blockchain adoption, and compliant financial sectors. |

Rayls (RLS): Practical Applications & Use Cases

Rayls (RLS) serves a variety of purposes across institutional blockchain infrastructure and real-world asset tokenization, including:

-

Gas Fees & Network Operations

RLS is used to pay for transactions across the Rayls public chain and institutional subnets, ensuring smooth execution, settlement, and interoperability.

-

Staking & Validator Participation

Validators stake RLS to secure the network, validate transactions, and maintain the integrity of both the public chain and enterprise subnets.

-

RWA Tokenization & Institutional Settlement

RLS powers the issuance, management, and settlement of real-world asset tokens, enabling compliant financial workflows for banks, fintechs, and enterprise partners.

These applications highlight the practical value of $RLS in the institutional blockchain and RWA tokenization industry.

Roadmap of Rayls (RLS)

The roadmap for Rayls (RLS) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q3 2025 | Expansion of institutional subnet pilots; onboarding early enterprise testers; initial RWA tokenization framework deployment. |

| Q4 2025 | Listing on major exchanges, including Bitget; strengthening validator network; preparing for public-chain feature upgrades. |

| Q1 2026 | Launch of enhanced hybrid infrastructure tools; improved compliance modules for regulated institutions; expanded API access for developers. |

| Q2 2026 | Full rollout of enterprise-grade RWA issuance tools; expansion into traditional finance markets; broader partnership integrations. |

These milestones highlight the practical value of $RLS in the institutional blockchain and real-world asset tokenization industry.

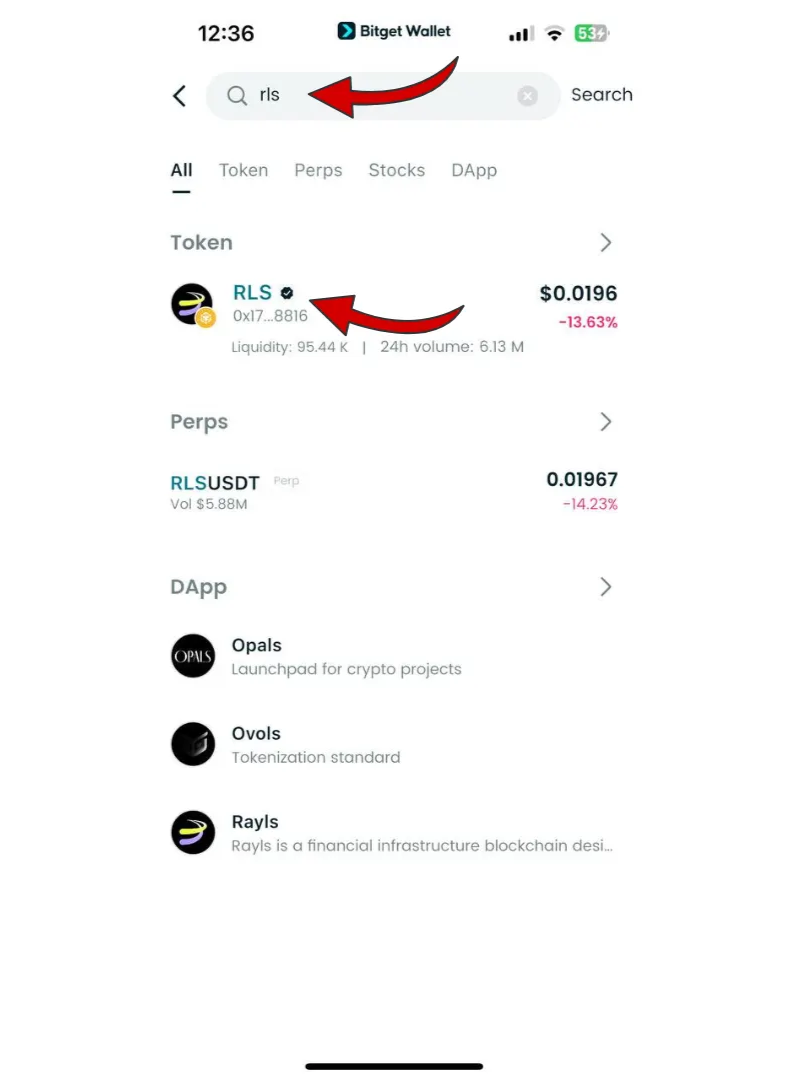

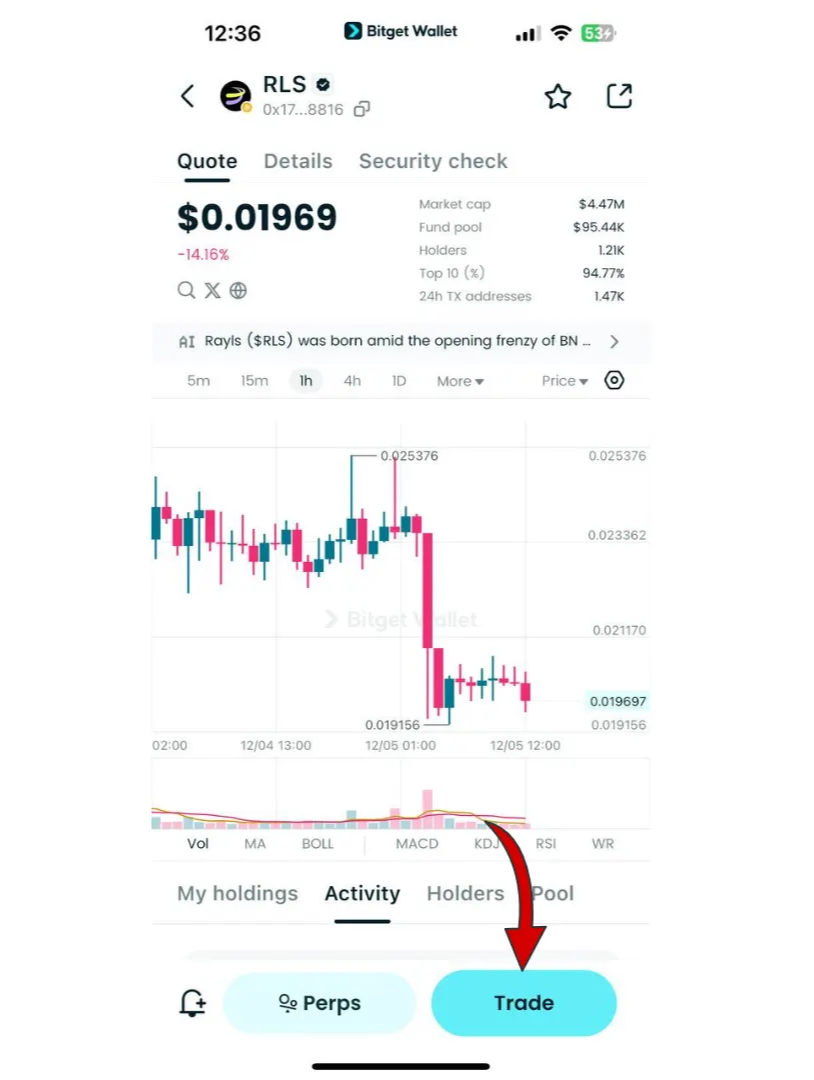

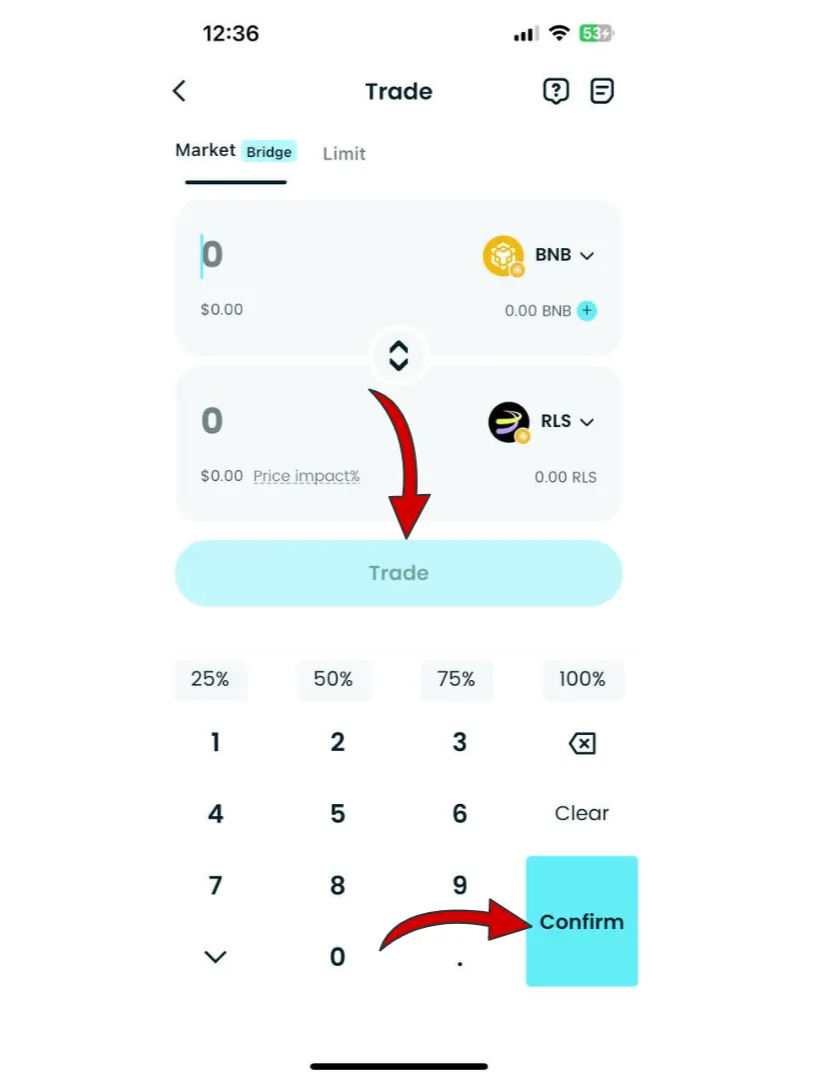

How to Buy Rayls (RLS) on Bitget Wallet?

Trading Rayls (RLS) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app.

Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading Rayls (RLS).

Step 3: Find Rayls (RLS)

In the Bitget Wallet interface, navigate to the market section.

Use the search bar to find Rayls (RLS). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as RLS/USDT.

This will allow you to trade Rayls (RLS) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price).

Enter the amount of Rayls (RLS) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the Open Orders section.

Once the order is executed, you can check your balance to see your newly acquired Rayls (RLS).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Rayls (RLS) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶ Learn more about Rayls (RLS):

Conclusion

Rayls (RLS) represents a major step forward in institutional blockchain infrastructure, combining a hybrid public–private architecture with real-world asset tokenization capabilities. This article explored its vision, technology, practical use cases, roadmap, and market outlook—showing how Rayls aims to become a foundational layer for compliant financial ecosystems. With its strong focus on transparency, enterprise-grade tools, and regulated adoption, Rayls positions itself as a promising project for users, developers, and institutions looking to participate in the next evolution of blockchain.

Using Rayls (RLS) through Bitget Wallet amplifies these advantages by giving traders a secure, smooth, and feature-rich environment for managing and exchanging the token. Bitget Wallet’s benefits—such as multi-chain support, stablecoin storage, hot memecoin trading, cross-chain swaps, MPC security, and optimized gas routing—make it one of the best wallets for interacting with Rayls. Whether you're buying RLS, exploring RWA opportunities, or managing your portfolio, Bitget Wallet delivers speed, convenience, and industry-leading protection, ensuring that every user can access Rayls’ ecosystem confidently and efficiently.

Own your Web3 journey easily with Bitget Wallet – secure, fast, and beginner-ready.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Rayls (RLS) used for?

Rayls (RLS) is the native utility token of the Rayls hybrid blockchain, powering gas fees, staking, governance, and settlement across institutional subnets. It supports real-world asset tokenization and compliant enterprise transactions, making it essential to the platform’s long-term operation. As adoption grows, RLS becomes increasingly important for network functionality.

2. Why is Rayls gaining attention in the RWA sector?

Rayls is designed specifically for institutions, offering privacy-controlled subnets and a public chain for transparent settlement. As interest in tokenizing real-world assets expands, Rayls’ architecture aligns closely with what banks and enterprises need for compliance and scalability. This positions it as a strong contender in the institutional blockchain space.

3. Can I store and trade Rayls (RLS) on Bitget Wallet?

Yes. Bitget Wallet supports seamless storage, swapping, and management of Rayls (RLS), offering users a secure and beginner-friendly environment. With multi-chain support, MPC protection, and optimized trading tools, Bitget Wallet provides an efficient way to access Rayls’ ecosystem.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Arc (ARC) Airdrop Guide: How to Participate and Claim $ARC Rewards2025-12-03 | 5 mins