Banks Holding Bitcoin Japan - What the FSA’s New Rules Mean

With FSA reforms underway, Japan’s banks may soon hold Bitcoin—impacting megabanks, custody, and trust from investors. Bitget Wallet is self-custody.

Having banks hold Bitcoin in Japan may soon be a possibility as the FSA in Japan may allow Finance Institutions to hold Bitcoin and other crypto assets. This could be the first step in changing the Japans banking system while still maintaining a degree of control and caution. With the likes of MUFG , SMBC , and Mizuho all being major players in the system and preparing for change, the reform of regulations will impact trust in the system and overall investment in the country. This article will breakdown what Japan’s new regulations will mean for crypto, the megabanks and the average retail user.

Key Takeaways

- Japan’s FSA is reviewing laws to permit banks holding Bitcoin under controlled frameworks.

- Major megabanks (MUFG, SMBC, Mizuho) are already preparing Bitcoin custody Japan models.

- Institutional adoption could boost Japan crypto regulation clarity and public trust.

- Bitget Wallet remains a non-custodial alternative for secure, user-managed crypto storage.

Why Japan’s FSA Is Moving Toward Letting Banks Hold Bitcoin

Banks holding Bitcoin Japan is not just a regulatory milestone — it’s a signal of how deeply the nation’s financial system is embracing digital transformation. As global institutions integrate cryptocurrencies into their balance sheets, Japan’s Financial Services Agency (FSA) recognizes that maintaining competitiveness requires flexibility. Allowing banks to directly engage with Bitcoin could strengthen national financial resilience and attract international investors seeking stability under Japan’s strict compliance framework.

What triggered Japan’s shift from restriction to reform?

Until recently, Japan’s financial institutions faced tight limits under Japan crypto regulation, restricting direct crypto ownership. However, with global institutional adoption accelerating, the FSA Japan crypto rules are evolving. The goal is modernization — ensuring Japanese banks remain competitive while keeping consumer protection intact.

By 2025, reforms may officially permit banks holding Bitcoin Japan, marking a departure from the conservative stance of 2020.

How could FSA approval reshape the banking landscape?

If the FSA allows banks to hold Bitcoin, Japan could pioneer Asia’s most advanced crypto-banking framework. These institutions could integrate Bitcoin into their balance sheets, diversify portfolios, and attract new capital inflows. Moreover, clear FSA crypto investment rules Japan would boost market transparency and risk management.

This change isn’t only regulatory — it’s structural, signaling Japan’s readiness for the Web3 era.

SourceX

How Banks Plan to Handle Bitcoin Custody Under New Regulations

As banks holding Bitcoin Japan moves closer to regulatory approval, one critical aspect draws attention — Bitcoin custody Japan. The Financial Services Agency (FSA) aims to ensure that banks entering the crypto space adopt world-class risk management and security standards. This framework will determine how megabanks integrate digital assets safely into Japan’s financial infrastructure.

What is Bitcoin custody, and why does it matter for Japan’s banks?

Bitcoin custody Japan refers to how financial institutions safeguard clients’ Bitcoin and digital assets through regulated, institution-grade systems. Unlike self-custody wallets where individuals manage private keys, banks use advanced encryption, offline storage, and compliance monitoring to minimize risk.

For banks holding Bitcoin Japan, regulated custody means they can finally participate in the crypto market without compromising security or customer protection. This model reassures investors that their Bitcoin is protected under Japan’s financial law — a key factor in driving institutional crypto adoption Japan.

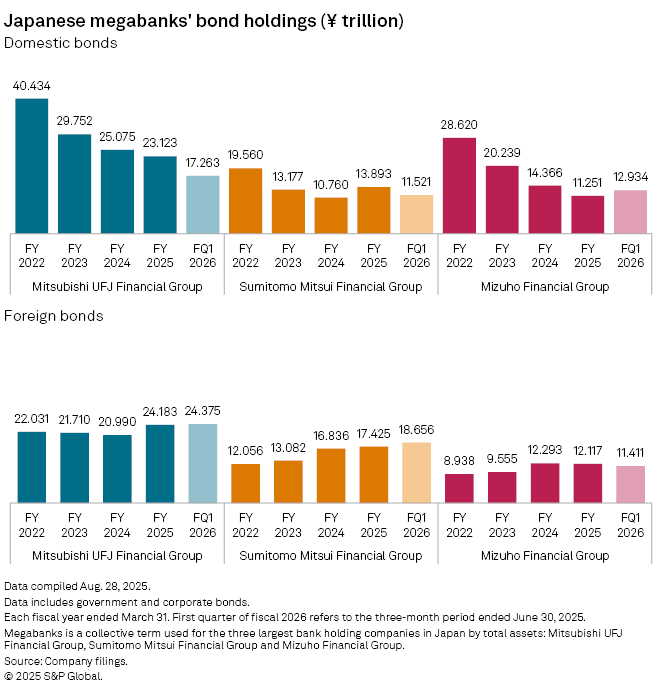

Which Japanese megabanks are leading the move?

Several leading banks are already shaping the Japan megabanks Bitcoin custody landscape.

- MUFG has introduced Progmat, a digital platform built for tokenized assets and compliant Bitcoin custody Japan services.

- SMBC and Mizuho are following suit, testing blockchain-based custody systems and stablecoin pilots aligned with Japan stablecoin regulation.

These initiatives show how banks holding Bitcoin Japan are building bridges between traditional finance and digital assets. By combining custody, stablecoin issuance, and blockchain settlements, megabanks are preparing to dominate Japan’s new crypto banking era.

Source X

What safeguards will banks adopt?

Security and compliance are at the heart of this transformation. The FSA Japan crypto rules require banks to implement strict cybersecurity frameworks, third-party audits, and multi-signature wallet protections.

Under these guidelines, Japan megabanks’ Bitcoin custody systems must demonstrate resilience against hacks and operational risks. As a result, the banks holding Bitcoin Japan initiative will likely set global standards for regulated crypto custody, blending Japanese precision with blockchain transparency.

In line with FSA crypto investment rules Japan, these safeguards are expected to inspire confidence among institutional and retail investors alike — ensuring that Japan’s entry into crypto banking is both secure and sustainable.

How Will This Shift Impact Japanese Investors and the Crypto Market?

The approval of banks holding Bitcoin Japan is more than a policy update — it represents a cultural and financial turning point for the nation’s investment landscape. As traditional banks begin offering direct exposure to Bitcoin, investor trust, market participation, and long-term adoption are expected to rise dramatically.

How might investor sentiment change if banks hold Bitcoin?

For years, many Japanese investors hesitated to engage with digital assets due to uncertainty surrounding Japan crypto regulation. Now, the FSA’s evolving stance could reverse that sentiment.

When banks holding Bitcoin Japan become a reality, it will signal that the government views Bitcoin as a legitimate and investable asset class. Institutional participation brings credibility — encouraging retail investors to follow.

This confidence may also lead to new on-ramps for crypto investments within conventional financial apps and accounts. As a result, both retail and institutional activity could see a significant boost, reinforcing the momentum of institutional crypto adoption Japan.

Could this drive Bitcoin’s price higher or stabilize the market?

The macroeconomic impact of banks holding Bitcoin Japan could echo what happened after U.S. ETF approvals. When large financial institutions buy and hold Bitcoin, circulating supply decreases, while long-term demand strengthens.

If major megabanks start accumulating digital assets for reserves or client portfolios, the result could be a more stable and mature market.

Institutional involvement typically brings better liquidity, more regulated trading environments, and stronger compliance frameworks. For Japan, this means less speculative volatility and more consistent price behavior — all aligned with Japan crypto regulation standards that favor transparency and accountability.

What does this mean for Japan’s overall crypto competitiveness?

The transformation led by banks holding Bitcoin Japan could redefine the country’s role in Asia’s crypto economy. Clearer FSA Japan crypto rules will not only protect investors but also attract international fintech partnerships seeking regulatory clarity.

Institutional crypto adoption Japan is expected to accelerate under this stable legal environment, helping Japan rival innovation leaders like South Korea and Singapore.

With its balanced approach between compliance and creativity, Japan is on track to become a regional powerhouse for digital asset innovation.

Ultimately, as banks holding Bitcoin Japan integrate into the mainstream financial ecosystem, investors — from individuals to corporations — will gain both trust and opportunity in the expanding crypto market.

What Are the Benefits and Risks of Banks Holding Bitcoin in Japan?

The move toward banks holding Bitcoin Japan introduces both opportunities and challenges for investors and institutions alike. As the Financial Services Agency (FSA) finalizes its framework, Japan’s financial ecosystem stands at a crossroads—balancing innovation, stability, and investor protection.

Key benefits for investors

One of the most immediate benefits of banks holding Bitcoin Japan is credibility. When banks begin offering Bitcoin custody Japan, investors gain access to institutional-grade security and legal assurance under regulated supervision.

Unlike traditional exchanges or unregulated platforms, bank-managed custody offers multi-signature protection, insurance coverage, and continuous auditing in line with FSA Japan crypto rules.

For retail customers, this shift means simplified access to Bitcoin via familiar banking apps and interfaces. Savers may soon explore hybrid deposit accounts where Bitcoin operates alongside yen, or even lending products collateralized by BTC. These integrated products could accelerate institutional crypto adoption Japan, normalizing digital assets within the country’s mainstream financial system.

Main risks to consider

Despite these advantages, banks holding Bitcoin Japan does not eliminate market risk. Bitcoin’s volatility remains an inherent challenge—even within regulated environments.

Additionally, investors must weigh counterparty risk: while banks are trusted custodians, users no longer maintain direct control of private keys, unlike in self-custody solutions such as Bitget Wallet.

Regulatory evolution poses another uncertainty. Future updates to Japan crypto regulation could impose stricter capital requirements or trading limits, impacting profitability and liquidity. Understanding both the benefits and risks will be key for investors adapting to Japan’s new digital finance era.

Why custody matters

Strong, transparent Bitcoin custody Japan frameworks are essential for connecting decentralized and traditional finance. Reliable custody solutions ensure that institutions can safely participate in blockchain-based systems without compromising compliance.

As Japan megabanks Bitcoin custody models mature, they are expected to become reference points for global financial innovation. These systems may also inspire a wave of fintech collaborations that combine security with on-chain accessibility. Ultimately, Japan megabanks Bitcoin custody services may reshape how users store and interact with digital assets, setting a new benchmark for institutional trust worldwide.

How Banks Holding Bitcoin Could Reshape Japan’s Investment Future

As regulatory clarity unfolds, banks holding Bitcoin Japan will do more than just secure digital assets—they will redefine the nation’s investment framework. By merging banking compliance with blockchain efficiency, Japan could pioneer a hybrid model of crypto banking in Japan that strengthens both investor access and financial inclusivity.

What does this mean for retail and corporate investors?

For retail investors, banks holding Bitcoin Japan provide a familiar entry point to the crypto market. They can gain exposure to Bitcoin through the same channels used for savings or securities accounts, benefiting from bank-level risk controls.

Corporate investors, meanwhile, can adopt Bitcoin custody Japan solutions to diversify their treasuries while remaining compliant with financial reporting standards. The integration of custody into corporate banking services marks a milestone in institutional crypto adoption Japan.

What new products might appear after the reform?

The legalization of banks holding Bitcoin Japan could open doors to innovative financial products. Expect to see Bitcoin ETFs, tokenized fixed-income products, and blockchain-based settlement networks.

By aligning these innovations with Japan stablecoin regulation, banks could offer hybrid accounts where customers earn yield on both fiat and crypto balances. These developments reinforce Japan’s ambition to lead the evolution of crypto banking in Japan as a transparent, innovation-driven ecosystem.

How could crypto banking in Japan boost financial inclusion?

One of the most profound outcomes of banks holding Bitcoin Japan is the potential to expand financial participation. With digital wallets linked to traditional bank accounts, individuals previously excluded from investment opportunities can now access global markets instantly.

This model of crypto banking in Japan bridges demographic gaps—empowering younger, tech-savvy users and small businesses to benefit from digital finance.

By merging compliance, technology, and open access, banks holding Bitcoin Japan are not only reshaping how assets are stored and traded but also redefining who gets to participate in Japan’s economic future.

How to Securely Trade and Store Bitcoin with Bitget Wallet

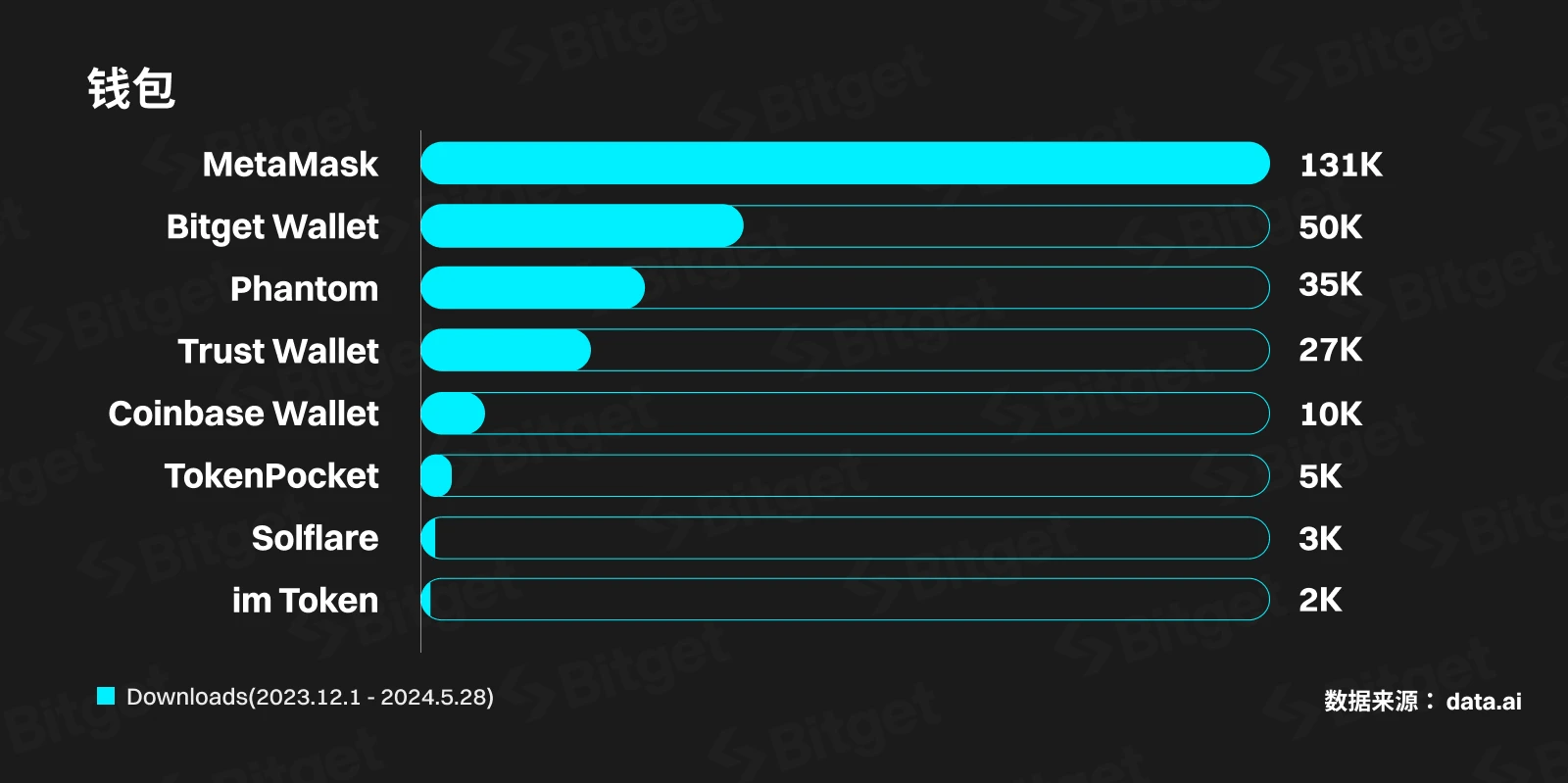

As banks holding Bitcoin Japan prepare to enter a new regulatory era, investors are increasingly looking for secure and independent ways to manage their crypto assets. While megabanks and custodial services will offer convenience and compliance, some users still prefer direct control over their private keys — and that’s where Bitget Wallet stands out.

Bitget Wallet provides users with the same level of safety and transparency as regulated institutions, but without giving up ownership of their assets. In a market where banks holding Bitcoin Japan are transforming traditional finance, Bitget Wallet empowers individuals to participate on their own terms — offering full autonomy, decentralized access, and on-chain control.

Step-by-step: How to start your Bitcoin journey

Getting started with Bitcoin in Japan has never been easier. Here’s how users can explore the same opportunities as banks holding Bitcoin Japan, directly through their phones:

- Download Bitget Wallet from Android or iOS.

- Create your wallet and securely back up your recovery phrase.

- Buy or receive Bitcoin instantly via Bitget’s on-ramp features.

- Manage, swap, or stake digital assets safely within the app.

- Track live market data and monitor portfolio performance — all in one interface.

Bitget Wallet’s clean design and advanced encryption system make it ideal for both newcomers and experienced traders. It bridges the gap between traditional banking and Web3, enabling every user to hold and manage their Bitcoin with confidence.

Why choose Bitget Wallet over custodial options?

While banks holding Bitcoin Japan will handle assets under FSA supervision, Bitget Wallet offers a self-managed, borderless alternative built for the decentralized future.

- Zero-fee trading on memecoins and RWA stock tokens

- Stablecoin Earn+ feature offering up to 10% APY on holdings

- Global crypto card support with Mastercard and Visa, enabling real-world spending

- Multi-chain integration for seamless swaps and DeFi access across multiple blockchains

By combining self-custody with institutional-grade security, Bitget Wallet lets users enjoy the freedom of blockchain without sacrificing peace of mind.

As banks holding Bitcoin Japan pave the way for a more regulated crypto landscape, Bitget Wallet ensures individuals retain control, privacy, and flexibility.

Experience secure, self-managed crypto banking in Japan with Bitget Wallet — your trusted gateway to Japan’s evolving Bitcoin economy.

Conclusion

Banks holding Bitcoin Japan marks a defining milestone in the evolution of Japan’s financial landscape. The Financial Services Agency’s reform efforts, combined with the readiness of megabanks like MUFG, SMBC, and Mizuho, show how traditional finance is adapting to a decentralized future. As FSA regulations mature, investor trust and institutional confidence are expected to grow — bridging the gap between security and innovation.

Yet, while regulated banks prepare to hold Bitcoin under strict oversight, individuals can already take part in this transformation today. With Bitget Wallet, users can buy, store, and manage their digital assets independently — enjoying the same security benefits with full control over their keys.

As Japan’s banking system embraces Bitcoin, Bitget Wallet empowers everyone to engage in this new era of digital finance securely, confidently, and on their own terms.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What does “Banks holding Bitcoin Japan” mean?

Banks holding Bitcoin Japan refers to a new Financial Services Agency (FSA) policy allowing regulated banks to own and manage Bitcoin directly. This marks Japan’s entry into institutional crypto adoption, ensuring investor protection under clear Japan crypto regulation while modernizing the country’s financial infrastructure.

2. Which Japanese banks are preparing to hold Bitcoin?

Major megabanks such as MUFG, SMBC, and Mizuho are developing Bitcoin custody Japan frameworks. These initiatives follow evolving FSA Japan crypto rules, combining traditional finance standards with blockchain technology to create safe, compliant solutions for both institutional and retail investors.

3. How can investors prepare for banks holding Bitcoin in Japan?

As banks holding Bitcoin Japan become reality, investors can get ready by using secure, non-custodial options like Bitget Wallet. It allows users to buy, store, and manage Bitcoin independently while benefiting from the same market exposure and transparency expected under Japan’s future crypto banking framework.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.