BTC $40,000: What's Fueling the Pump?

Following the 2022 cryptocurrency crash, Bitcoin has endured a US government crackdown that resulted in Sam Bankman-Fried being imprisoned for fraud at FTX, along with fines imposed on Binance and its founder, Changpeng Zhao.

Yet the market gave Bitcoin (BTC) holders a reason to celebrate the past week. The token recently surged to $40,000, reaching its highest level since April 2022, marking a substantial 19-month high. This significant milestone comes as Bitcoin continues its recovery from the lows experienced earlier this year and stands as a testament to the ongoing enthusiasm surrounding cryptocurrencies, particularly Bitcoin.

The recent surge in Bitcoin's price has sparked optimism among traders and investors, reflecting a renewed interest in the digital asset. The climb from under $39,334 to surpassing $40,000 represents a resurgence, highlighting a 5% increase in just 24 hours, according to Bitget Swap.

Bitcoin's current value marks a new year-to-date high, demonstrating an impressive upward trend, with an over 140% increase since the start of the year. However, it remains approximately 42% below its all-time high of over $69,000 recorded in November 2021.

The token traded at US$40,099 as at 6.35am on Dec 4 in Singapore, taking its 2023 jump to 142%.

But what exactly is causing this pump? Let's take a closer look.

BTC Halving

Markus Thielen, head of research at Matrixport, predicted Bitcoin to potentially reach over $60,000 by April 2024 and soar to an astounding $125,000 by the end of the same year. Thielen's analysis indicates historical patterns, where Bitcoin's price surged significantly following mining reward halvings. He suggested that Bitcoin reaching $125,000 could be anticipated due to previous trends of miners hoarding Bitcoin before each halving, leading to substantial price increases.

The quadrennial event is part of the process of capping Bitcoin supply at 21 million tokens, which have led to a consistent trend of Bitcoin prices rallying following these events. In 2012, for instance, BTC prices surged from $12 to $126 within a span of six months. Similarly, post the second halving in 2016, Bitcoin's value climbed from $654 to $1,000 within seven months. The same happened for the 2020 halving, where the token witnessed a substantial increase, soaring from $8,570 to an impressive $18,040 within the same time frame.

Read more: What is the BTC Halving and Why Should you Care?

However, mining is currently still not as lucrative as it was during its peak in 2021.

The earnings measure for miners utilizing 1 petahash per second of computing power in a day has increased to over $81 from $70 at the beginning of November. However, it remains significantly below the peak of $127 observed in early May, as reported by mining data platform Hashrate Index.

As the countdown to the miners' reduced share of rewards continues, there's a concerted effort among miners to sustain their profit margins in this fiercely competitive landscape.

"Each halving event tends to eliminate miners who aren't operating at a sufficiently high level," remarked William Szamosszegi, CEO of mining company Sazmining.

BTC Spot ETF

Furthermore, market speculation revolves around the anticipated approval of a spot Bitcoin exchange-traded fund (ETF) in the United States. Reports and predictions from financial institutions, including Standard Chartered, suggest that Bitcoin could reach a six-figure valuation before the end of next year, attributing this optimism to the expected introduction of spot ETFs in the U.S. This anticipation has triggered multiple bids for a spot Bitcoin ETF, involving prominent entities such as BlackRock and Grayscale, awaiting approval from the Securities and Exchange Commission (SEC). Bloomberg ETF analysts have provided a 90% likelihood that all pending ETF bids will receive simultaneous approval by January 10, 2024.

“Bitcoin continues to be supported by optimism around SEC approval for an ETF and Fed rate cuts in 2024,” Mr Tony Sycamore, a market analyst at IG Australia, notes.

Numerous analysts view the efforts to suppress dubious practices and the surge in ETF applications as indicators of an evolving industry, highlighting the potential for the digital asset sector to draw a more extensive investor community.

U.S. Interest Rate Decline

The surge in Bitcoin's price is also influenced by a combination of factors beyond just speculation. The broader market enthusiasm about potential U.S. interest rate cuts and expectations regarding U.S.-stockmarket traded Bitcoin funds has further bolstered the momentum of the cryptocurrency. This positive sentiment has also extended to Ethereum (ETH), which achieved a 1-1/2 year high, reaching $2,218.

The ongoing rally in Bitcoin's price signifies a notable recovery from the challenges faced during the "crypto winter," reflecting a newfound confidence and a resurgence of interest in the cryptocurrency markets.

However, while these factors have contributed to the recent surge in Bitcoin's price, the volatile nature of cryptocurrencies makes market predictions inherently uncertain. It's important for investors to approach the crypto landscape with caution and understand the potential risks associated with such market movements.

Bitcoin and smaller tokens such as ETH and BNB are still some way below the all-time highs achieved during the pandemic-era crypto bull run. The largest token peaked at almost US$69,000 in November 2021.

Purchase Bitcoin using Bitget Swap!

Thinking of hopping on to the BTC trend? Hop on over to Bitget Swap to purchase some today!

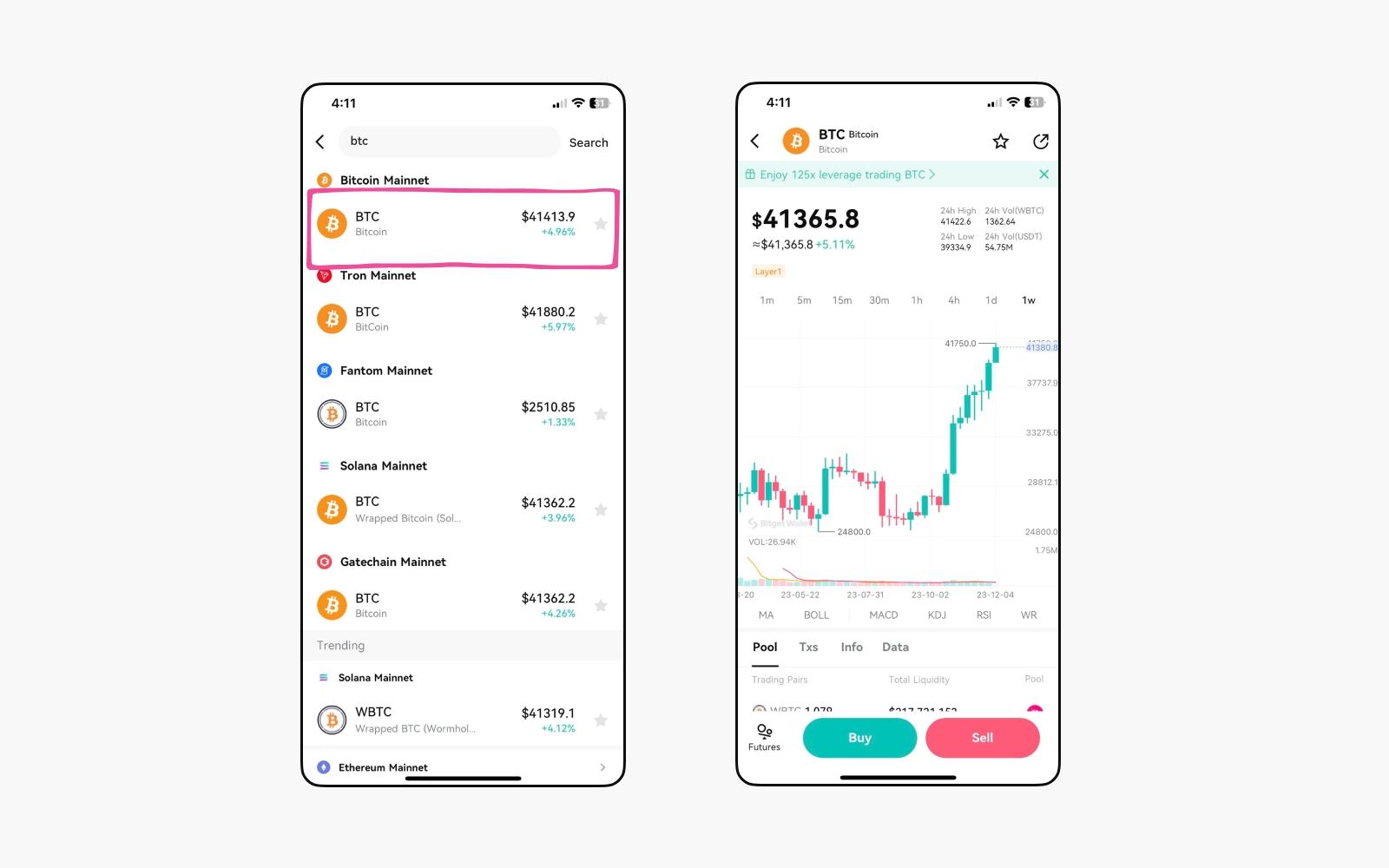

Step 1: Select "All Mainnets" at the top of your main homepage.

Step 2: Enter "Bitcoin" into the search field and add the Bitcoin network to your Bitget Wallet.

Step 3: Return to your main homepage and tap on "Swap", which will bring you to the Bitget Swap dashboard.

Step 4: Tap on "Swap" again and fill in the details of your swap.

Step 5: Select "Confirm" and proceed with the on-screen instructions to complete your BTC purchase.

Moving ahead, Bitget Wallet will continue to pay close attention and make strategic investments in BTC ecosystems such as Lightning Network, Nostr, and Taproot to provide users with full access to the Bitcoin network.

On the product front, both the mobile and browser extension versions of Bitget Wallet are now compatible with Taproot address formats and provide display and transfer services for BRC-20 tokens and NFTs, allowing users to manage their BTC assets, various BRC-20 tokens, and NFTs right from the convenience of their Bitget Wallet.

On the application level, Bitget Wallet recently introduced a dedicated Bitcoin zone within its DApp browser, showcasing dozens of popular Bitcoin ecosystem applications. This includes useful tools such as UniSat, BTCTool, OrdSpace, as well as NFT markets like BitPad and Ordinals Market. Users may also easily search for and access specific DApps using DApp URLs.

Closing

Bitcoin's recent price hike underscores the evolving landscape of digital assets, driven by a mix of economic factors, market sentiment, and regulatory developments. As the cryptocurrency market continues to evolve, investors remain vigilant, closely monitoring the developments that could shape the future trajectory of Bitcoin and the broader crypto space.

Follow Bitget Wallet to stay up-to-date with all of our latest events, findings, and promotions, and let Bitget Wallet be your premier gateway into the Web3 space.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

For media inquiries, please contact: media.web3@bitget.com

For business inquiries, please contact: business.web3@bitget.com