How to Avoid FOMO in Crypto: Smart Strategies for Safer Web3 Investing

How to avoid FOMO in crypto is one of the most important lessons every Web3 investor must learn. FOMO—short for fear of missing out—often strikes when prices surge suddenly or when social media hypes up “the next 100x coin.” From the 2023 Bitcoin ETF rumor spike to viral runs like Dogecoin and SHIB, countless traders have jumped in at market highs—only to regret it soon after.

This emotional cycle—driven by hype, volatility, and social pressure—leads to poor decision-making. But there’s a smarter way to navigate the crypto space. Instead of acting on impulse, investors can stay grounded using tools like Bitget Wallet, which transforms FOMO into potential rewards through features like FOMO Thursdays, a weekly, risk-free prediction event.

In this guide, we’ll break down how to recognize the signs of FOMO, practice DYOR (Do Your Own Research), and take advantage of Web3 tools and gamified campaigns like Bitget Wallet’s to build a calm, strategic, and informed investment approach.

Key Takeaways

- Crypto FOMO is driven by emotion, hype, and fear — and it leads to poor investment choices like buying high and panic selling.

- You can avoid FOMO by setting clear financial goals, doing your own research, and adopting proven long-term strategies.

- Bitget Wallet’s FOMO Thursdays transform risky FOMO behavior into a fun, risk-free way to engage with crypto and win weekly rewards.

What Is Crypto FOMO and Why Does It Affect So Many Investors?

Crypto FOMO, or the fear of missing out in crypto investing, refers to the anxious feeling that you're being left behind while others profit from rising tokens, meme coins, or NFT trends. It’s especially common among investors aged 18 to 35, who are constantly exposed to crypto news and social media influencers hyping the latest “can’t-miss” opportunity.

Psychologically, crypto FOMO taps into our fear of regret and loss aversion. When we see others posting massive gains, it activates emotional triggers like envy and urgency. We imagine what we could have earned — and that imagined reward overpowers rational thinking.

FOMO isn’t just financial—it’s emotional and behavioral. It clouds judgment, overrides research, and leads many investors into high-risk trades they later regret.

How Does FOMO Lead to Bad Trading Habits in Crypto?

FOMO doesn't just mess with your psychology - it directly leads your trading actions. Many investors rush to the top of the price, get caught up in the trend and herd mentality, and then when the market corrects, they sell off in panic. This emotional ups and downs can easily make you make the classic mistake: buy high - sell low.

Take the Bitcoin Spot 2023 ETF rumor as an example. Just a click-bait headline from a major news site caused Bitcoin price to pump nearly $2,000 in a few hours, followed by a wave of FOMO chasing the top. But when the rumor broke and the article corrected, the price dumped without stopping - leaving traders holding on to their stocks in pain.

The Dogecoin storm in 2021 is the same. Fueled by Elon Musk's tweet, Coinbase IPO hype, and the tremendous spread on Reddit/Twitter, DOGE increased by more than 400% in a week, reaching a peak of ~$0.45 (April 16, 2021). Anyone who buys at a high price hoping to make more money will suffer heavy losses when the price falls freely afterwards.

The consequences? Mental exhaustion, emotional decisions, and a collapse of confidence. Traders begin to doubt every change, trapped in a cycle of fear - regret - waiting. Without a clear strategy, FOMO becomes an account-destroying loop - once caught, the more you try to recover, the more you lose.

Read more: What is FOMO in Crypto and How FOMO Thursdays Turns It Into Weekly Rewards?

How to Avoid FOMO in Crypto?

How to avoid FOMO in crypto starts with replacing emotion with education. Rather than reacting to hype, investors should follow structured strategies, conduct proper research, and focus on long-term goals. Below are three essential ways to break free from FOMO and invest smarter in Web3.

1. Set Clear Goals Instead of Chasing Trends

Many FOMO-driven decisions stem from a lack of clarity. If you don’t know why you’re investing, you’ll end up chasing every pump and rumor you see on Twitter or Telegram.

Before entering any trade or project, ask yourself:

- Am I investing for short-term gains or long-term growth?

- What percentage of my capital am I willing to risk?

- Will this token/project still matter in 12 months?

Clarity reduces panic. With firm goals, you’ll be less tempted to jump into every coin that’s “going to the moon.”

2. Always DYOR: Do Your Own Research First

FOMO is driven by emotion and hype. DYOR, on the other hand, is about making data-backed, research-driven decisions. It helps you build conviction before entering any investment—and conviction is what keeps you calm during dips.

Here’s a quick DYOR checklist to follow before you buy:

- Read the whitepaper or project docs

- Check the tokenomics and unlock schedule

- Research the team, community, and GitHub (if applicable)

- Identify real utility or use case

- Review on-chain activity (liquidity, holders, volume)

By making research a habit, you’ll train your brain to slow down before buying—and that’s how you beat FOMO in crypto.

3. Use Proven Strategies for Long-Term Gains

The best way to reduce FOMO is to zoom out.

Long-term strategies remove the pressure to time every top or bottom. Consider this: Bitcoin has grown over 68,000% since its inception—not by trading daily pumps, but by holding through cycles.

Try these long-term approaches:

- Dollar-Cost Averaging (DCA) – Buy a fixed amount over time to reduce emotional entry points.

- Portfolio diversification – Don’t bet everything on one asset. Balance blue chips, altcoins, and stablecoins.

- Risk segmentation – Separate core investments (e.g., BTC, ETH) from speculative plays (e.g., new meme tokens).

When your portfolio has a long-term structure, sudden pumps won’t shake your strategy—and that’s how you avoid FOMO in crypto with confidence.

What Are the Signs You’re Falling Into a FOMO Trap? (Behavioral Focus)

Emotions often take over before logic has a chance to step in. Identifying early signs of FOMO in crypto is the first step in preventing poor investment decisions. Here are the most common red flags to watch out for:

- Constantly checking price charts—even hourly

- Making impulsive coin purchases without a clear plan

- Letting influencers/KOLs guide decisions instead of real data

- Feeling anxious when others post big gains online

- Panic selling just hours after buying

- Mood swings that affect your work and personal relationships

These behaviors can lead to chronic stress, insomnia, and even mild depression, according to behavioral investment psychology studies. To break the cycle of emotional investing, use Bitget Wallet as a grounding tool: it integrates on-chain analytics, real-time market data, and engaging, low-pressure activities like FOMO Thursdays.

What Is Bitget Wallet’s FOMO Thursdays and How Does It Help?

FOMO Thursdays is a unique initiative by Bitget Wallet that turns emotional FOMO into real, risk-free rewards. Instead of stressing over missed market opportunities, users can participate in a transparent, fair, and safe environment that promotes “controlled FOMO.”

Every week, Bitget Wallet users can enter a prize pool worth 888 USDT—with no deposits, no gas fees, and zero risk of capital loss.

Read more: FOMO Thursdays: No Work, No Stress, Just Free Airdrops Every Thursday!

FOMO Thursdays vs. Traditional FOMO Crypto Risks

| Criteria | Traditional FOMO | Bitget’s FOMO Thursdays |

| Financial Risk | High – may lead to total loss | None – no capital required |

| Transparency | Low – prone to whale manipulation | High – fully recorded on-chain |

| Emotional Impact | Stressful, anxious | Fun, rewarding, gamified |

| Participation Method | Complicated, technical | Simple – no blockchain knowledge needed |

Why Is Bitget Wallet’s FOMO Thursdays Better Than Other Crypto Airdrops?

Unlike traditional airdrops that require technical wallets, complex tasks, or high gas fees, FOMO Thursdays offer a more beginner-friendly and inclusive experience:

- Extremely user-friendly – Simple interface, no blockchain expertise required

- Completely transparent – All interactions are publicly recorded on-chain

- No whale advantage – Everyone has an equal chance, including newcomers

- And most importantly: it turns FOMO into fun + tangible rewards.

How to Join FOMO Thursdays Safely?

The first-ever FOMO Thursdays drop features Bombie, the highest-grossing mini-game on Telegram, LINE, TON, and Kaia. It's also the first fair-launch shooting game to distribute tokens across multiple ecosystems.

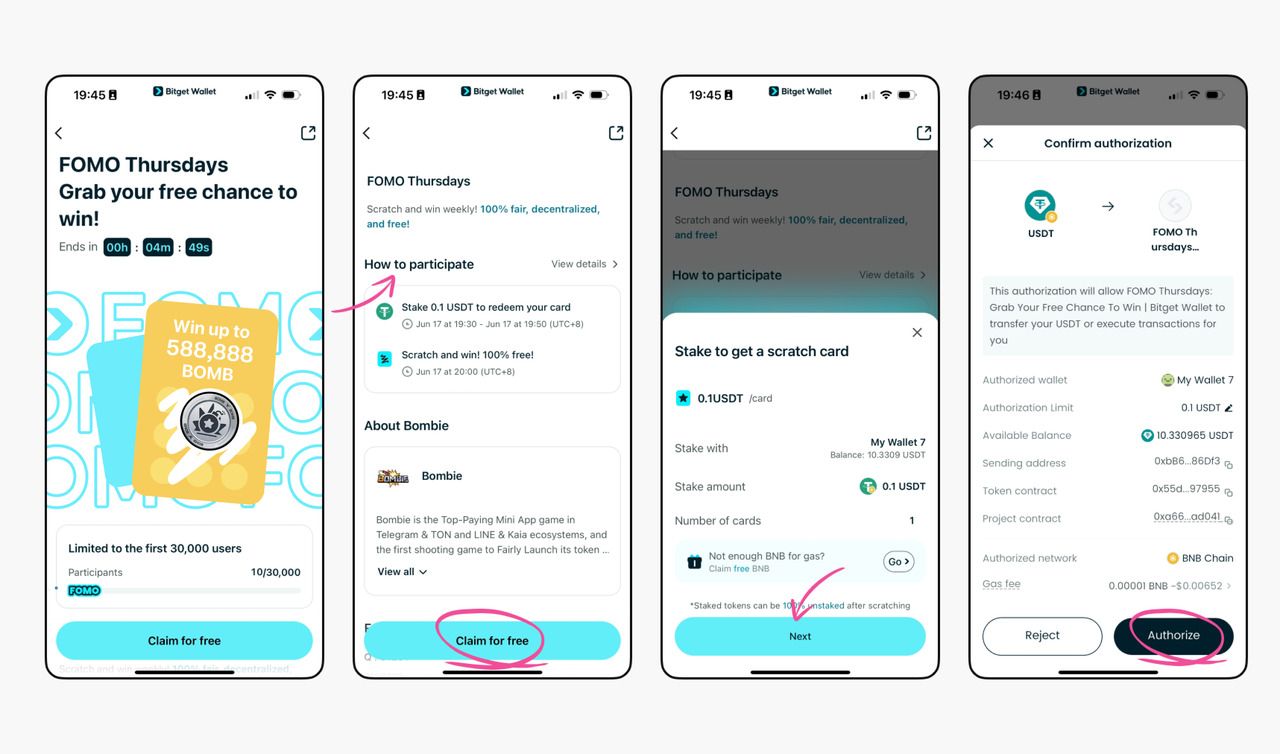

Joining FOMO Thursdays is fast and easy. Here’s how to participate in the Bombie airdrop:

Step 1: Update Bitget Wallet to V9.3

Download or update here, then open the app and tap the FOMO Thursdays banner.

Step 2: Stake 10 USDT on BNB Chain

Stake 10 USDT to receive a scratch card. You’ll need a small amount of BNB for gas—free BNB is available from the campaign page.

✅ Your 10 USDT is fully refundable after the event.

Step 3: Join the Thursday Draw

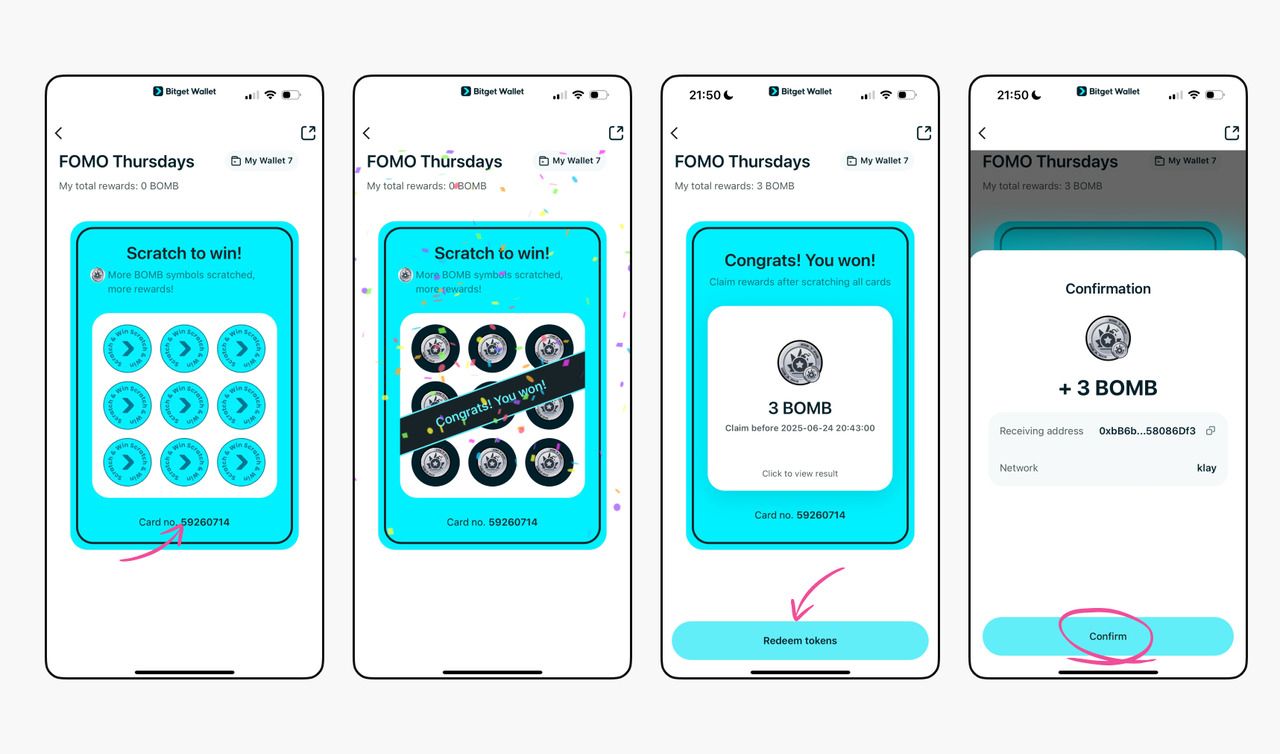

Wait for the weekly draw. Scratch your ticket to reveal if you’ve won—no work, just luck.

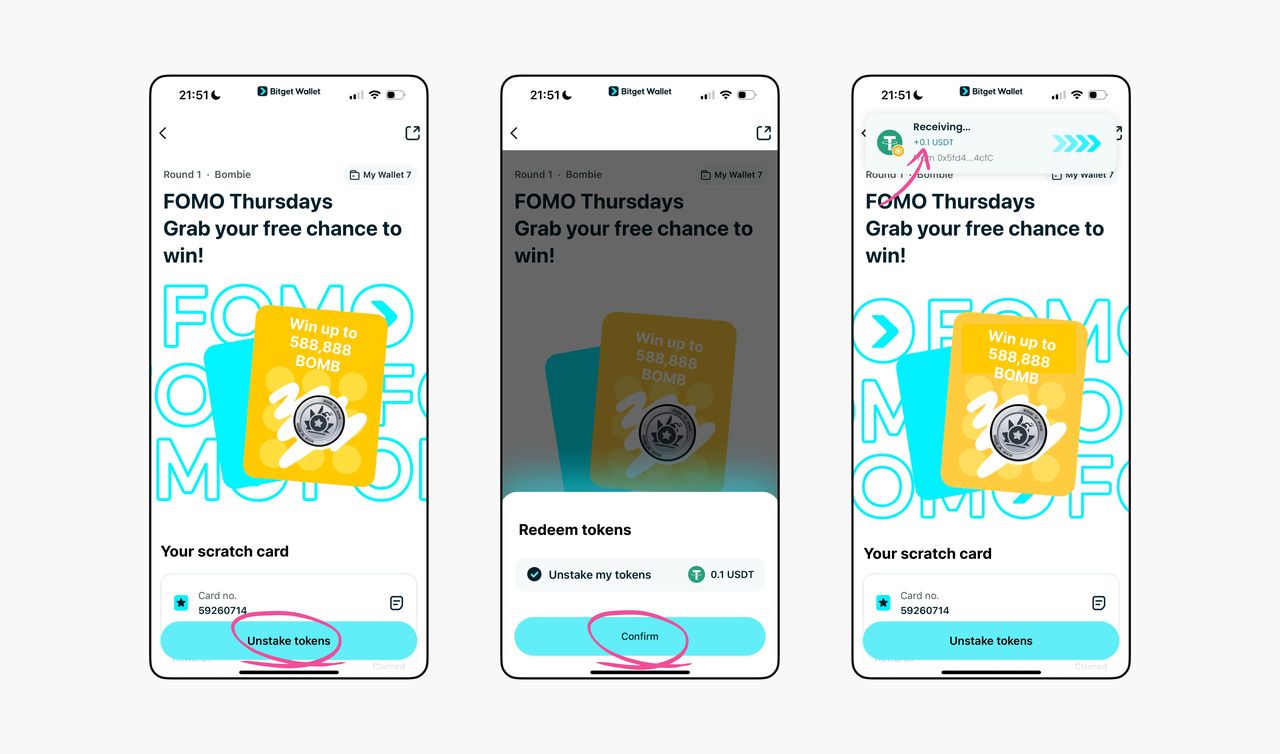

Step 4: Claim Rewards or Refund

Winners can claim up to $888 in BOMB tokens (on Kaia Chain) with no gas fee. If you don’t win, manually refund your 10 USDT (gas fee required).

- One wallet per device. No multiple entries allowed.

- Rewards must be claimed within 7 days after the draw.

This is easily one of the most innovative and user-friendly crypto airdrops of 2025, blending gamification and security through Bitget Wallet’s trusted Web3 ecosystem.

👉 Read more: FOMO Thursdays: No Work, No Stress, Just Free Airdrops Every Thursday!

Conclusion

Avoiding FOMO in crypto isn’t just about resisting hype — it’s about building a system that helps you stay grounded when emotions run high. When you set clear goals, stick to long-term strategies, and follow DYOR principles, you’re not just investing smarter — you’re becoming more resilient through every market cycle.

Bitget Wallet connects all the dots: from exploring DApps and tracking on-chain data to joining vibrant community events like FOMO Thursdays — where fear turns into fun, and decisions are backed by data, not emotion.

In crypto, success doesn’t belong to the crowd chasers — it belongs to those who stay calm, informed, and strategic.

👉 Download Bitget Wallet for seamless stablecoin and memecoin multi-chain trading!

FAQs

1. What is FOMO in crypto, and why is it so common?

FOMO (Fear of Missing Out) in crypto is the emotional response to seeing others profit from a fast-moving asset, leading you to jump in without proper research. It’s common because the crypto market is volatile, hype-driven, and fueled by viral trends on social media platforms.

2. How does Bitget Wallet help me avoid FOMO?

Bitget Wallet equips you with real-time on-chain data, DApp discovery, and secure asset control—all in one platform. These tools promote research-based decision-making (DYOR), helping you focus on facts, not fear.

3. Do I need to deposit funds to join FOMO Thursdays?

Not at all. FOMO Thursdays is a risk-free campaign. There’s no need to deposit crypto or sign transactions. You simply participate through Bitget Wallet’s event page and stand a chance to win from the $888 USDT prize pool—with zero capital at risk.

4. Can beginners join FOMO Thursdays?

Yes! FOMO Thursdays are beginner-friendly. You don’t need blockchain experience or technical knowledge. Just download the Bitget Wallet app and follow a few simple steps to get started.

5. How can I control my emotions during market volatility?

Stay focused on your long-term goals, avoid impulse trades, and use a strategy that includes DYOR, portfolio diversification, and risk segmentation. Bitget Wallet helps by offering data-backed insights and turning FOMO into fun through gamified features like FOMO Thursdays.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Key Takeaways

- What Is Crypto FOMO and Why Does It Affect So Many Investors?

- How Does FOMO Lead to Bad Trading Habits in Crypto?

- How to Avoid FOMO in Crypto?

- What Are the Signs You’re Falling Into a FOMO Trap? (Behavioral Focus)

- What Is Bitget Wallet’s FOMO Thursdays and How Does It Help?

- FOMO Thursdays vs. Traditional FOMO Crypto Risks

- Why Is Bitget Wallet’s FOMO Thursdays Better Than Other Crypto Airdrops?

- How to Join FOMO Thursdays Safely?

- Conclusion

- FAQs

- Bitget Wallet Help Center2023-11-09 | 2 minutes

- What Is a Crypto Launchpad and How Does It Work: A Beginner’s Guide2025-07-25 | 5 mins