What Is a Crypto Launchpad and How Does It Work: A Beginner’s Guide

What is a crypto launchpad is a question many new crypto users ask in 2025 as token sales evolve from obscure forums to polished, high-speed platforms. A crypto launchpad is a decentralized platform that allows early-stage blockchain projects to raise capital and build communities by offering tokens to early adopters—before public exchange listings.

This guide breaks down exactly what a crypto launchpad is, how it works, the differences between traditional and memecoin launchpads, and which platforms are leading in 2025. If you’re curious about getting early access to token sales safely, platforms like Bitget Wallet offer secure and beginner-friendly ways to participate in crypto launchpads.

Key Takeaways

- A crypto launchpad lets users access early-stage token sales before public exchange listings.

- These platforms support fundraising for new crypto projects through IDOs and similar models.

- Top tools like Bitget Wallet make it easy and secure to join vetted launchpad opportunities.

What Is a Crypto Launchpad and Why Is It Important?

A crypto launchpad is a decentralized platform that enables new blockchain projects to conduct token sales, typically through models like Initial DEX Offerings (IDOs). These early-stage offerings allow users to invest in a project before its token is listed on public exchanges—often at significantly lower prices.

Launchpads have become essential to Web3 fundraising, helping startups bootstrap liquidity, build early communities, and gain visibility without relying on centralized exchanges.

There are two major categories:

- Traditional launchpads cater to infrastructure, DeFi, and utility projects focused on long-term use cases.

- Memecoin launchpads exploded in popularity after the 2023 meme token boom, offering lightning-fast listings and community-fueled hype. Projects like BONK demonstrated how virality can drive adoption—even without a strong utility layer (Cointelegraph, DappRadar).

As interest grows, platforms like Bitget Wallet now support both traditional and memecoin IDOs, giving users access to early-stage tokens with enhanced security and user-friendly UX.

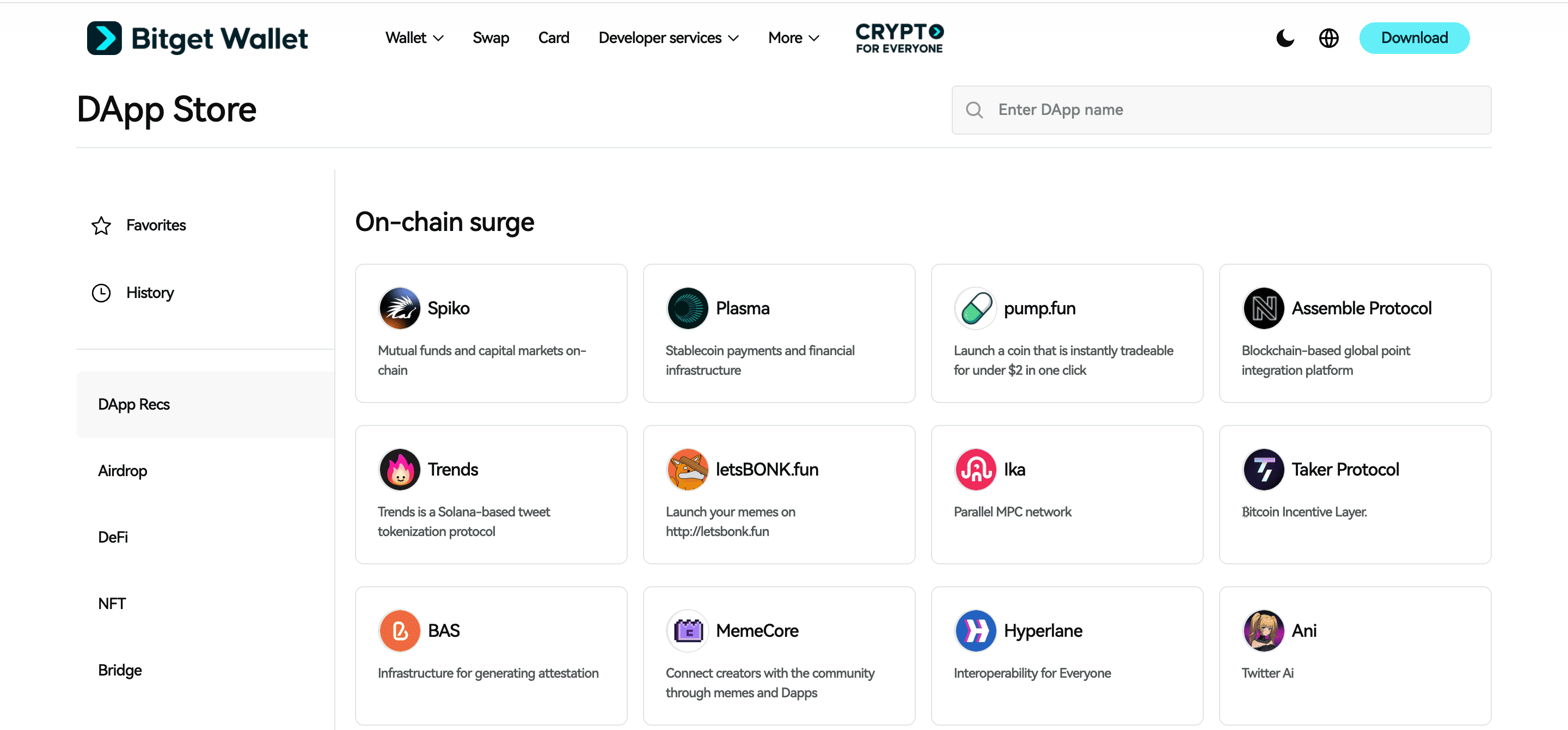

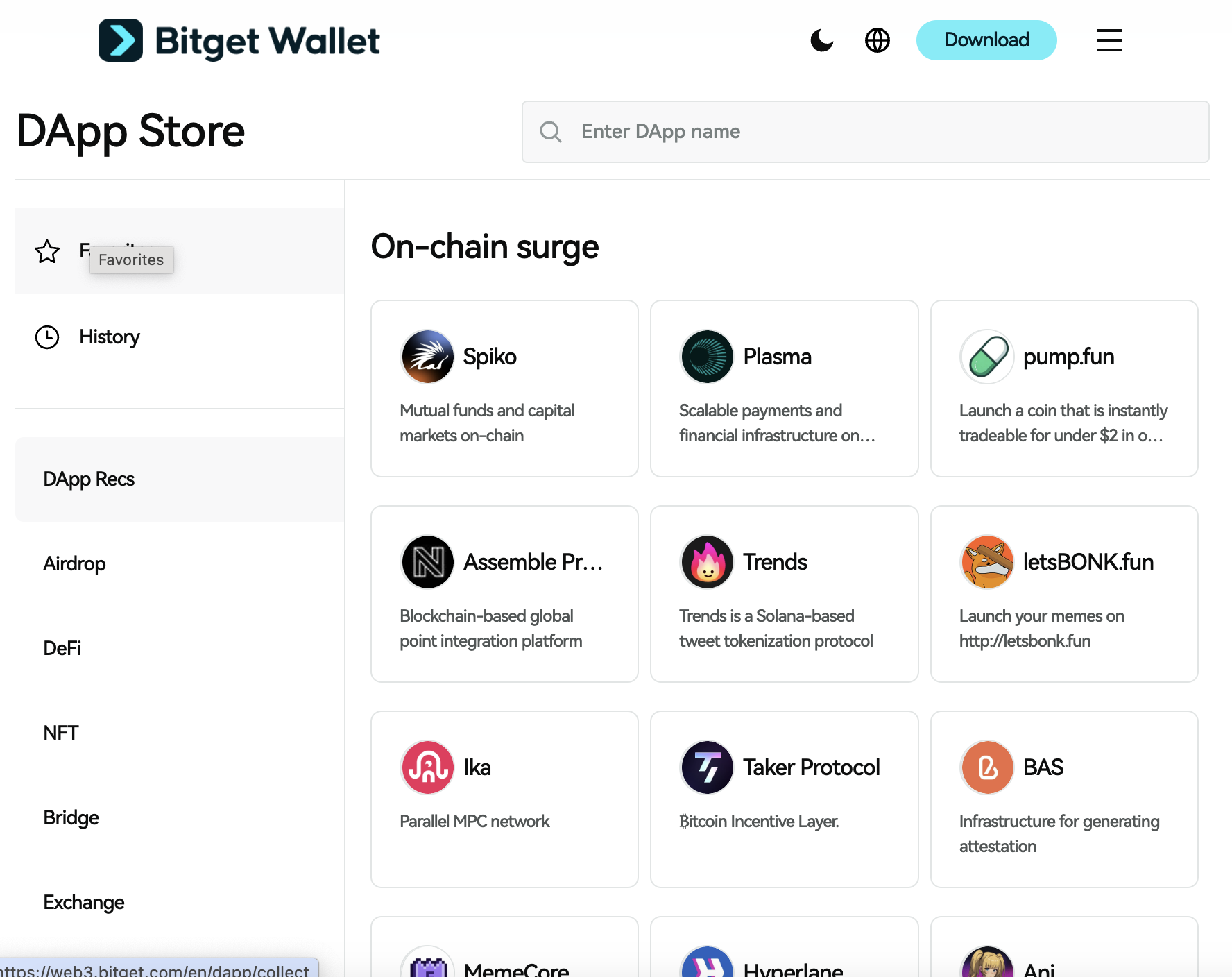

Source: Bitget Wallet DApp

Read more: What Is a Public Sale in Crypto? A Beginner’s Guide to Token Sales

How Do Crypto Launchpads Work and Help Raise Funds?

Crypto launchpads operate as decentralized fundraising platforms that connect blockchain startups with early investors. By offering tokens through mechanisms like IDOs, these platforms allow projects to raise capital quickly while giving users the chance to buy tokens at pre-market prices. This early access not only fuels project development but also creates strong community engagement before a token hits public exchanges.

How Do Crypto Launchpads Work Step by Step?

Here’s a transparent breakdown of how crypto launchpads work, covering both centralized and decentralized approaches:

-

Project Application

Projects submit proposals via a launchpad’s portal—centralized platforms (e.g., Binance Launchpad) use internal teams, while decentralized models (e.g., Polkastarter) rely on community vetting.

Source: Dribbble

-

Vetting / KYC

Approved projects undergo background checks, team verification, and smart contract audits. Centralized launchpads enforce stringent KYC/AML, while decentralized ones may only require light identity confirmation or rely on community oversight .

Source: CoinDesk

-

Token Creation / Presale

Once vetted, projects mint tokens and open presale rounds—sometimes private or invite‑only, sometimes public. Terms like price, vesting schedule, and supply are set during this phase.

Source: Medium

-

Distribution / Listing

After the presale closes, tokens are distributed to participants and often listed on DEXs (for IDOs) or centralized exchanges (for IEOs). Some launchpads lock liquidity to instill investor confidence.

Source: Medium

This step‑by‑step flow illustrates both centralized models, where the platform oversees everything—including KYC and token listing—and decentralized models, driven by community voting and smart contracts.

👉 Read more: Crypto Presale vs Public Sale: Which One Offers Better Investment Opportunities?

What Is the Token Sale Process Like on a Launchpad?

Crypto launchpads offer structured sale formats that give investors early access to new tokens. The specific process depends on the sale type, but all aim to balance fairness, transparency, and effective token distribution.

Fixed Price Sale

Tokens are sold at a set price (e.g., $0.02 per token).

- Typically first-come, first-served

- Often includes a staking requirement to access

- Simple and fast, but can be oversubscribed

Auction Model

Buyers submit bids, and token price is determined by demand.

- Favored in decentralized launchpads

- Helps reduce bots and whale manipulation

- Can include hard caps or dynamic pricing curves

Tiered Rounds

Access is based on how many launchpad-native tokens a user has staked.

- Higher tiers receive larger allocations or earlier entry

- Encourages longer-term platform loyalty

- Examples: BSCPad uses a tier-based structure with guaranteed allocations, while TrustSwap requires staked SWAP for eligibility

Across these models, token distribution may include vesting periods, cliffs, or immediate partial unlocks at the TGE (Token Generation Event).

Do Crypto Launchpads Require KYC or Staking?

Most centralized launchpads and many regulated decentralized platforms require some form of Know Your Customer (KYC) verification. This ensures compliance with anti-money laundering (AML) laws and adds a layer of security for both the project and its investors.

KYC: Why It Matters

- Prevents fraud, bot entries, and identity manipulation

- Helps ensure regulatory compliance

- Enables whitelisting, allowing only verified wallets to participate

- Required by most launchpads that operate in jurisdictions with strict securities laws

Staking Requirements

Staking is a standard feature for gaining access to token sales.

- Investors must stake the launchpad’s native token (e.g., BSCPAD, SWAP)

- Allocation often scales with the amount staked

- Creates a financial commitment to reduce speculative churn

Some platforms allow non-KYC participation for smaller tiers or through decentralized pools, but most require at least staking and wallet whitelisting to participate in meaningful allocations.

What Is the Difference Between Traditional and Memecoin Launchpads?

The landscape of crypto launchpads has undergone a significant transformation—from structured platforms like TrustSwap, designed for regulated fundraising, to rapid-fire, community-driven systems like Pump.fun. For those seeking a memecoin launchpad explained in clear terms, the distinction lies in governance, process, and purpose: traditional launchpads prioritize compliance and investor protection, while memecoin platforms are built around speed, virality, and accessibility.

-

Traditional = Compliance, Capital Raise

Traditional launchpads require identity verification (KYC), smart contract audits, and vesting schedules. They cater to serious projects focused on long-term development and transparent fundraising strategies.

-

Memecoin = No KYC, Viral/Gimmick Culture

A typical meme coin IDO launchpad, such as Pump.fun or LetsBonk, enables instant token creation with no formal approval process. These platforms rely heavily on community engagement, meme culture, and viral appeal—often at the expense of due diligence.

How Do Memecoin Launchpads Like Pump.fun and LetsBonk Work?

Platforms like Pump.fun and LetsBonk have redefined token launches. Here’s how they work:

-

Fair launch, no presale:

Memecoin launchpads typically follow a fair launch model—no presales, no whitelists, and no team allocations. Anyone can submit a token name, ticker, and meme image, and the platform auto-generates the token using bonding curves or fixed pricing. This approach removes entry barriers and allows for instant, permissionless token creation.

-

Examples: Pump.fun, LetsBonk, Seipex:

Platforms like Pump.fun on Solana enable one-click token launches with automated liquidity via bonding curves. LetsBonk adds a community voting layer—users submit memes, and winning entries are minted as tokens. Seipex, on the Sei blockchain, mixes DeFi staking with meme mechanics, offering a more experimental format.

-

Risks and community gimmicks:

While these platforms encourage creativity, they carry high risk. Most tokens are unaudited, launched anonymously, and often abandoned within hours. Liquidity rugs are common, and long-term utility is rare. Despite the humor and viral appeal, users should approach memecoin launchpads with caution.

Read more: What Is LetsBonk? Complete Guide to the Top Solana Meme Coin Launchpad

Are Crypto Launchpads Safe and Worth Using?

Crypto launchpads have unlocked early access to token sales, but safety varies greatly depending on the type of platform. Some offer strong investor protections, while others—especially in the memecoin space—leave users fully exposed to risk. Understanding the differences is essential for anyone navigating this space.

Are Memecoin Launchpads Safe for New Crypto Users?

Are memecoin launchpads safe? In most cases, no—especially not for beginners.

Memecoin launchpads such as Pump.fun, Believe, and LetsBonk are designed for speed and virality, not security. These platforms typically allow anyone to launch a token with no KYC, no audit, and zero oversight. They embrace a "buyer beware" culture, where users trade memes—not fundamentals.

Key Concerns:

- No KYC: Anyone can launch a token anonymously

- No audits: Smart contracts are rarely reviewed for vulnerabilities

- Unregulated: No safeguards, no investor recourse

- Rug pulls: Tokens often vanish after initial pump cycles

Examples:

- On Pump.fun, dozens of tokens have hit $1M+ market caps only to crash 80–99% within hours.

- Some creators have openly admitted to rug pulls after cashing out LP tokens.

In contrast to regulated platforms, memecoin launchpads operate in an unfiltered, speculative environment. While they offer massive upside potential, they are not safe for users who lack experience, exit strategy, or risk tolerance.

What Security Features Should You Look for in a Launchpad?

To evaluate whether a crypto launchpad is safe and trustworthy, users should look for the following core features:

-

Audit Reports

Ensure the platform and listed projects are reviewed by a reputable third-party security firm (e.g., CertiK, Hacken, PeckShield).

-

Liquidity Locks

Projects should lock liquidity for at least 6–12 months to prevent founders from removing funds post-launch.

-

Token Vesting Schedules

Developer and team tokens should be vested over time. Instant unlocks are a red flag for exit scams.

-

Team Transparency

Look for doxxed team members with verifiable identities and project history.

-

Social Credibility

Healthy community engagement on platforms like Twitter and Discord helps signal project legitimacy.

These features can help retail users avoid scams, protect capital, and identify credible opportunities on both traditional and decentralized launchpads.

What Are the Best Crypto Launchpads to Watch in 2025?

Crypto launchpads in 2025 range from secure, KYC-driven platforms to fast-paced meme token engines. Whether you're looking for audited IDOs or high-risk viral launches, the tables below break down each launchpad’s focus, strengths, risks, and ideal users—so you can choose the right fit at a glance.

BSCPad

| Feature | Description |

| Name | BSCPad |

| Website | https://bscpad.com |

| Focus | Regulated fundraising, KYC, token vesting |

| Strengths | Tiered model, secure ecosystem, vetted projects |

| Risks | High entry cost, fewer viral/fast launches |

| Token | BSCPAD |

| Best For | Serious retail investors, BSC-native projects |

Source: X

TrustSwap

| Feature | Description |

| Name | TrustSwap |

| Website | https://trustswap.org |

| Focus | Smart contract IDOs, vesting tools, token locks |

| Strengths | Compliance-first, trusted by serious teams |

| Risks | Slower pace, high due diligence threshold |

| Token | SWAP |

| Best For | Vetted project teams, VCs, and secure presales |

Source: X

Pump.fun

| Feature | Description |

| Name | Pump.fun |

| Website | https://pump.fun |

| Focus | Solana memecoin fair launches with bonding curves |

| Strengths | Instant token creation, no KYC, extreme virality |

| Risks | No audits, rug-pull risk, ultra-high volatility |

| Token | N/A |

| Best For | Meme creators, degens, Solana-native traders |

Source: X

LetsBonk

| Feature | Description |

| Name | LetsBonk |

| Website | https://letsbonk.io |

| Focus | Meme voting & launch gamification on Solana |

| Strengths | Viral community tokens, growing user base |

| Risks | Early-stage risks, lack of project filtering |

| Token | BONK |

| Best For | Community-driven meme projects & influencers |

Source: X

Seipex

| Feature | Description |

| Name | Seipex |

| Website | https://seipex.io |

| Focus | Meme x DeFi hybrids on the Sei blockchain |

| Strengths | Experimental launch models, early mover |

| Risks | Unproven traction, low user base |

| Token | N/A |

| Best For | Builders testing new models on emerging chains |

Source: X

GamesPad

| Feature | Description |

| Name | GamesPad |

| Website | https://gamespad.io |

| Focus | IDOs for GameFi, NFTs, and the metaverse |

| Strengths | Curated Web3 gaming focus, niche partnerships |

| Risks | Limited scope, smaller market cap potential |

| Token | GMPD |

| Best For | Web3 gaming studios and early-access GameFi investors |

Source: X

Which Traditional Launchpads Offer the Most Security and Track Record?

If you're looking for trusted crypto launchpads in 2025, start with the platforms that have built a reputation on transparency, user protection, and consistent delivery. These launchpads offer robust KYC, third-party audits, and structured token distribution.

Top Picks for Security and Reliability:

- Binance Launchpad – Backed by the largest centralized exchange, Binance’s launchpad supports high-profile projects with full KYC and liquidity protection. It remains one of the safest options for retail investors.

- TrustSwap – Offers time-locked smart contracts, token vesting automation, and a history of successful IDO launches. Ideal for projects needing security-first infrastructure.

- BSCPad – The first decentralized IDO platform on Binance Smart Chain with a tiered staking model. Known for guaranteed allocations and low-barrier access.

These platforms are favored by investors who value compliance, stable returns, and early access token sales without exposure to unvetted projects. If you're asking “what are the best crypto launchpad platforms 2025,” these names top the list for a reason.

What Are the Top Memecoin Launchpads for Viral Token Launches?

The rise of meme coin culture has fueled a new generation of launchpads focused on speed, community, and virality. While they lack the structure of traditional platforms, these launchpads dominate social buzz and meme-driven momentum.

Best Memecoin Launchpads in 2025:

-

Pump.fun – A leading Solana-based meme launchpad that allows instant token creation and trading with no presale or KYC. It’s the go-to platform for spontaneous, viral token launches.

-

SunPump – A newer platform focused on fast memecoin deployment with gamified minting mechanics. It's gaining traction for its liquidity curve model and Telegram-native UX.

-

LetsBonk – Built for the Solana community, LetsBonk blends meme aesthetics with a leaderboard system, Bonk Points, and community-driven listings.

You can explore tokens launched through these platforms directly via Bitget Wallet, which supports fast token swaps and multi-chain access for both traditional and meme-centric ecosystems.

If you’re searching for the best crypto launchpad platforms 2025 to ride the next meme wave, these are the ones defining the culture and chaos of Web3.

How to Launch Your Own Memecoin Using a Launchpad?

You don’t need to be a Solidity developer—or even know what that is—to create your own memecoin in 2025. Thanks to the rise of no-code meme launchpads, anyone with an idea, a meme, and five minutes can deploy a token and potentially go viral. Whether you want to experiment, build a real community, or just troll the internet, knowing how to launch a memecoin on a launchpad is step one.

How Do You Launch a Memecoin on a Launchpad Without Coding?

Launching a meme token no longer requires custom smart contracts or blockchain development experience. Platforms like Pump.fun, Deployyyyer, and Seipex have simplified the process with intuitive interfaces designed for non-technical users.

Step-by-step: how to launch a memecoin on a launchpad

- Choose your launchpad: Select a no-code platform (e.g., Pump.fun for Solana, Deployyyyer for Base or ETH, Seipex for Sei Network).

- Name your token: Pick something short, punchy, memeable.

- Set the total supply: Usually between 420M–69B tokens. Keep it on-brand.

- Upload a logo: You can even use AI-generated art.

- Configure tokenomics: Decide whether to burn tokens, set tax fees, or keep it pure.

- Click launch: The platform automatically deploys the contract, adds liquidity, and makes your token tradable.

These tools allow anyone—literally anyone—to deploy a token with zero coding, no DevOps, and no blockchain background. Just bring your meme game.

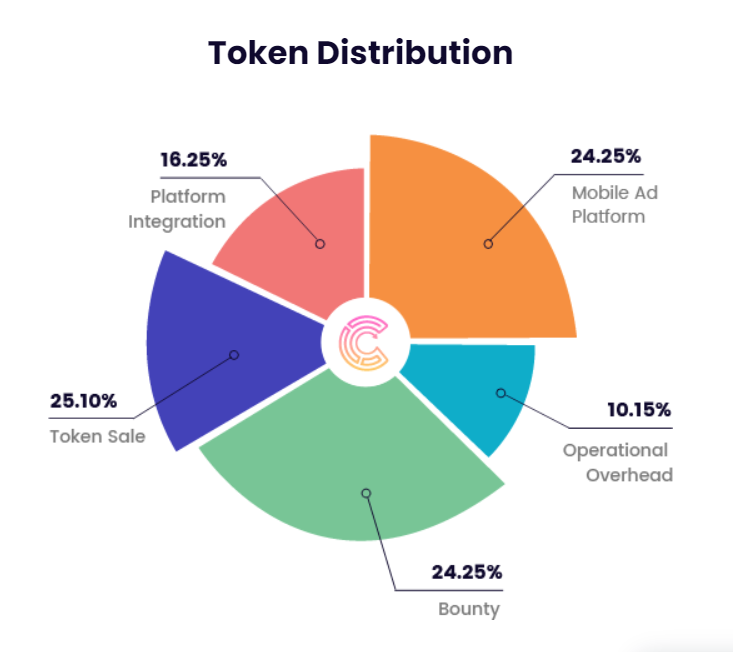

What Tokenomics Should You Set for a Successful Meme Token?

Tokenomics can make or break your memecoin. It’s more than just numbers—it’s part of the narrative.

Key elements to plan:

- Total Supply: Keep it meme-aligned (e.g., 69B, 420M). Too high, and you risk making the token feel worthless.

- Burn Mechanism: Optional. Burning a percentage per transaction creates scarcity but adds complexity.

- Tax Fees: Many meme tokens go zero-tax. But if you use tax, be transparent and allocate it to liquidity or marketing.

- Distribution Model: Choose between:

- Fair launch (most common for memes)

- Airdrops to community or NFT holders

- Team allocations (keep these locked or vested)

Examples to study:

- FARTCOIN – Zero tax, all meme, full virality

- BONK – Widely distributed via airdrops, no presale

- SUNDOG – Leveraged fair launch + creator lore to boost traction

Avoid common mistakes like:

- Excessive supply with no burn plan

- Confusing or exploitative tax systems

- Hidden dev allocations

Meme tokens need meme math—but smart meme math.

Why Is Community More Important Than Code for Memecoin Success?

In memecoin culture, the code rarely matters—the community is the product. The most successful meme coins exploded not because of their tech, but because of their storytelling, humor, and relentless posting.

What drives traction:

- X/Twitter engagement: If you’re not farming likes, you’re invisible.

- Memes and virality: Use meme formats, pop culture, and trend-hacking.

- Word-of-mouth: Early Telegram and Discord users act as evangelists.

- Platform example: Believe lets users launch tokens directly through X replies—pure meme-native deployment.

Community is also where Bitget Wallet comes in. It allows users to:

- Instantly track trending community tokens

- Trade new meme coins across chains

- Store them securely without needing MetaMask setup

If you're wondering how to grow your memecoin project, the answer isn't better contracts—it's better memes and a louder army.

How to Trade or Explore Memecoins on Bitget Wallet DApp?

The Bitget Wallet DApp browser is the ultimate gateway for crypto users looking to explore and trade the latest memecoins. Whether you’re tracking Solana-based tokens like BONK, deploying your own meme asset on Base, or diving into viral launches on BNB Chain, Bitget Wallet provides seamless, mobile-first access to the full meme ecosystem.

Source: Bitget Wallet DApp

With full support for Solana, Base, Ethereum, BNB Chain, and more, the Bitget Wallet DApp connects you to top-tier meme token launchpads like Pump.fun, LetsBonk, and Seipex—without needing to manually copy contract addresses or juggle wallets. You can explore memecoin launchpads, track new listings, and execute trades all in one place.

Read more: What Is a dApp? Complete Guide to Decentralized Applications

What Makes Bitget Wallet a Perfect Tool for Memecoin Traders?

The Bitget Wallet DApp isn’t just a browser—it’s an all-in-one command center for discovering, launching, and trading memecoins across multiple chains.

Key Benefits of Using Bitget Wallet DApp:

✅ Multi-chain support: Full compatibility with Solana, Base, Ethereum, and BNB Chain, allowing users to access memecoins across ecosystems.

✅ Launchpad integration: Direct access to top meme-focused platforms like Pump.fun, SunPump, and LetsBonk—no bridge hopping required.

✅ MPC-level security: Enhanced wallet protection using multi-party computation, giving users high-grade security without private key risk.

✅ Real-time price tracking: Instantly monitor meme token price swings and volume without needing third-party tools.

✅ Built-in Swap functionality: Trade supported meme tokens directly inside the app—no DEX hunting, no slippage guesswork.

✅ Mobile-first experience: Optimized for iOS and Android, with a sleek UI that makes it easy to manage and trade on the go.

Whether you're launching your own meme token or jumping into the latest viral chart, the Bitget Wallet DApp offers everything you need to trade memecoins on Bitget Wallet with confidence and speed.

For users serious about memecoin discovery and fast execution, this tool is unmatched. It’s not just a wallet—it’s your launchpad to the wildest corners of Web3.

Final Thoughts

What is a crypto launchpad has become a pivotal question for new crypto investors in 2025—especially as token sales, IDOs, and meme coin launches dominate the early-stage market. Launchpads are the infrastructure behind these launches, offering users early access to tokens, while giving projects a platform for visibility and capital.

We’ve covered:

- What crypto launchpads are: Platforms for token distribution and early investment access

- How they work: Through KYC, staking, whitelisting, and structured sale mechanisms like fixed price, auctions, and tiered rounds

- Key differences: Traditional launchpads offer compliance and investor protection, while memecoin launchpads like Pump.fun and LetsBonk prioritize speed, culture, and virality

- Essential tools: From tokenomics and no-code launchpads to the Bitget Wallet DApp—the ideal way to explore memecoins, access top launchpads, and track performance in real time

If you're ready to discover promising tokens or want to track memecoin launches easily, explore Bitget Wallet today—your all-in-one tool for Web3, DeFi, and launchpad investing.

FAQs

1. What is a crypto launchpad and why is it important?

A crypto launchpad is a platform that helps new blockchain projects raise funds by offering early access to token sales. It’s important for investors because it provides early entry into potential high-growth tokens—often before they hit public markets.

2. Are memecoin launchpads safe to use?

Memecoin launchpads like Pump.fun and LetsBonk offer speed and virality but often lack KYC, audits, or security measures. While they’re easy to use, they come with higher risks—including scams, rug pulls, and zero investor protection.

3. What is the best way to explore and trade memecoins?

The Bitget Wallet DApp is the most efficient way to explore memecoin launchpads, track new tokens, and trade across Solana, Base, and BNB Chain. It’s mobile-friendly, secure, and supports built-in swaps for meme tokens.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.