Top 5 Cryptos Poised to Surge in 2025 After Trump's Return to Office

On January 20, 2025, Donald Trump will be inaugurated as the 47th President of the United States, marking a pivotal moment for the cryptocurrency market. His return to office follows a remarkable shift in his stance on digital assets, evolving from a skeptic to a vocal supporter of the industry. This shift has fueled optimism among investors, with many predicting a surge in Top 5 Cryptos Poised to Surge in 2025 After Trump's Return to Office, as the sector anticipates a regulatory environment fostering innovation and growth.

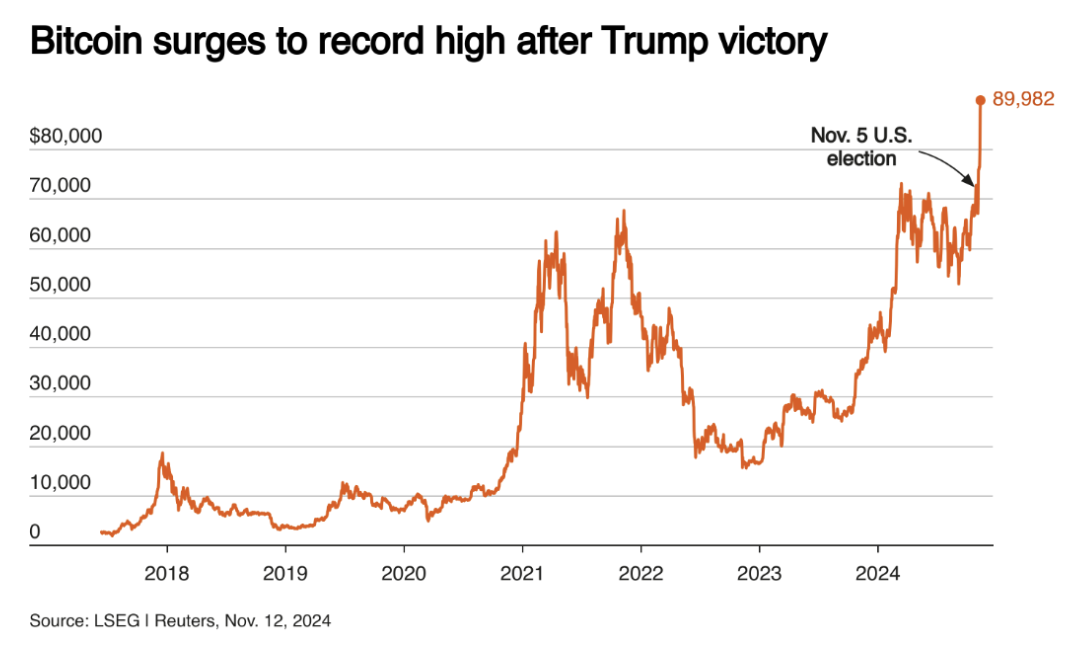

Trump’s re-election has already had a profound effect on cryptocurrency trends. Bitcoin, the world’s largest digital asset, soared to a record high of over $108,000 in December 2024, driven by expectations of the administration’s pro-crypto policies. Similarly, the broader market capitalization of digital assets has hit unprecedented levels, reinforcing the belief that the cryptocurrency will lead the next wave of institutional investment and innovation.

Source: Financial Times

Source: Financial Times

Trump’s Policies and Impact on Crypto Market

1. Policy

Trump's cryptocurrency-related promises signal a monumental shift in how the U.S. government interacts with digital assets.

-

Strategic Bitcoin Stockpile: Trump has pledged to retain government-seized Bitcoin to establish a national Bitcoin stockpile, aiming to position the U.S. as a global leader in crypto assets.

-

Domestic Bitcoin Mining: A proposed mandate for Bitcoin mining to occur exclusively within the U.S. could bolster national security and increase government oversight of the crypto industry.

-

Pro-Crypto Regulatory Environment: Trump plans to nominate pro-crypto officials to key positions and remove existing regulatory hurdles, including the dismissal of SEC Chair Gary Gensler.

2. Impact

The immediate market response highlights the potential transformative effects of Trump's policies on the cryptocurrency industry.

-

Bitcoin Price Surge: Following Trump's re-election, Bitcoin's value skyrocketed over 50%, reaching $108,000, signaling market confidence in his pro-crypto policies.

-

Broader Market Rally: The entire cryptocurrency market experienced a significant boost, with total market capitalization exceeding $4.3 trillion as investors anticipated favorable policy changes.

-

Institutional Adoption Growth: With a clearer regulatory landscape, institutions are expected to increase investment in cryptocurrencies, driving long-term growth and adoption.

Source: Reuters

Source: Reuters

Beyond Bitcoin, the demand for cryptocurrency exchange-traded funds (ETFs) has skyrocketed under Trump’s influence. As of early January 2025, U.S. Bitcoin ETFs have attracted investments exceeding $110 billion, marking a milestone in mainstream adoption. The President-elect’s embrace of the industry has also sparked optimism about reduced enforcement actions by regulatory agencies and increased clarity regarding the legal classification of digital assets, setting the stage for a more robust and innovative crypto ecosystem.

Top 5 Cryptos to Consider Investing In After Trump's Return to Office

1. Dogecoin (DOGE)

Dogecoin (DOGE) could see significant gains following Trump’s inauguration, fueled by his pro-crypto policies and efforts to establish a crypto-friendly regulatory environment. With Trump emphasizing the need for the U.S. to become the “crypto capital of the world,” Dogecoin may benefit from increased adoption and support as a high-risk, high-reward investment.

Trump's stance on digital assets could reduce regulatory uncertainty, leading to a more favorable market environment for Dogecoin. Additionally, with prominent figures like Elon Musk continuing to back the token, a more crypto-positive administration could trigger a surge in Dogecoin’s price and market activity. As the administration implements pro-crypto legislation, Dogecoin may see stronger institutional backing and renewed investor interest.

Source: Marca.com

2. Ripple (XRP)

Ripple (XRP) stands to benefit significantly from the leadership changes at the U.S. Securities and Exchange Commission (SEC), particularly with Trump's pro-crypto stance. Under the previous SEC chair, Gary Gensler, Ripple faced a lawsuit accusing it of selling unregistered securities. However, Trump's push to appoint crypto-friendly regulators like Paul Atkins and David Sacks could signal a shift in the regulatory landscape, potentially easing legal challenges for Ripple and enhancing its market performance.

Ripple’s legal victories in its ongoing case against the SEC have already sparked positive sentiment among investors. With the incoming administration’s potential to influence the SEC’s approach, Ripple could see increased market confidence. If the SEC case continues to trend in Ripple's favor, coupled with a more crypto-friendly regulatory environment under Trump, the token’s value may experience a substantial rise, further solidifying its position in the market.

Source: The Africa Logistics

3. Ethereum (ETH)

Ethereum (ETH) continues to be a major player in the crypto space, largely due to its unique features like smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs). These innovations have positioned Ethereum as a versatile platform for decentralized applications, attracting widespread adoption across various industries. Trump's pro-crypto policies, including his push for a more crypto-friendly regulatory environment, could further accelerate Ethereum’s growth by fostering a more supportive landscape for DeFi and NFTs.

Expert opinions highlight Ethereum’s long-term potential, especially as the network transitions to Ethereum 2.0, which promises improved scalability, energy efficiency, and lower transaction costs. With Trump's administration likely supporting the continued development of blockchain technologies.

▶Read more: Ethereum Price Prediction 2025: Will ETH Reach $4,000?

Source: Blockchain News

4. Cardano (ADA)

Cardano (ADA) is a blockchain project known for its focus on scalability, sustainability, and academic rigor. While it has yet to gain the same widespread attention as Ethereum, Cardano’s potential could be amplified by Trump’s administration, particularly if his pro-crypto stance translates into faster product approvals and more regulatory clarity. As Trump aims to create a favorable environment for blockchain innovations, Cardano’s approach to smart contracts and decentralized applications could position it for greater adoption, especially if it aligns with the administration's goal to position the U.S. as a leader in the crypto space.

With Cardano’s emphasis on sustainable blockchain practices, it could attract interest from industries and governments looking for eco-friendly alternatives in the cryptocurrency space. Under Trump’s administration, Cardano’s development could benefit from a supportive regulatory framework, potentially opening doors for increased partnerships and applications in various sectors. If the administration pushes for the approval of blockchain-based financial solutions, Cardano could be at the forefront of these innovations, benefiting from both regulatory support and market interest.

Source: NewsBTC

5. Bitcoin (BTC)

Bitcoin (BTC), as the leading cryptocurrency, stands to benefit significantly from Trump’s proposed policies, which focus on making the U.S. a global leader in crypto, including Bitcoin. Trump’s administration aims to create a favorable environment for Bitcoin by potentially establishing a strategic Bitcoin stockpile, where the U.S. government would hold onto seized Bitcoin rather than selling it. This could enhance Bitcoin's long-term value by reducing the market’s supply. Additionally, Trump’s push for U.S.-based Bitcoin mining could spur domestic innovation and increase Bitcoin's influence on the global stage, further solidifying its role as a store of value and a hedge against inflation.

Experts predict that under Trump’s administration, the U.S. could see increased involvement in Bitcoin mining, particularly with favorable regulatory conditions and incentives for miners. This move could stimulate job creation and technological development in the U.S. while positioning the country as a hub for the Bitcoin ecosystem.

Source: Forbes

How to Buy Crypto Currency on Bitget Wallet?

Trading Crypto Currency is easy on Bitget. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by creating a new wallet and keep the backup safe.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

-

Transferring Cryptocurrency: Send crypto from another wallet.

-

Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget, ensuring you have enough funds for trading Crypto Currency.

Step 3: Find the Crypto you want to buy

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Crypto Currency. Click on the token to view its trading page.

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as [Token Name]/USDT. This will allow you to trade Crypto Currency against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Crypto Currency you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Crypto Currency.

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Crypto Currency or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

Conclusion

As President-elect Trump takes office, the crypto market stands at a pivotal moment, with opportunities for significant growth driven by favorable policies, regulatory changes, and Trump’s pro-crypto stance. The potential for increased government involvement in digital assets, along with new initiatives like a strategic Bitcoin stockpile and pro-mining policies, may lead to a surge in prices for major cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin. However, investors should remain cautious, as the crypto market is known for its volatility and regulatory uncertainties.

Informed investing, aligned with the latest market trends and government policies, is crucial for navigating this landscape. Understanding the potential risks, such as the unpredictability of legal frameworks and market corrections, will help investors make decisions that are both strategic and sustainable. As Trump’s administration shapes the future of crypto, staying updated and making thoughtful investment choices will be key to capitalizing on the sector’s growth.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Arc (ARC) Airdrop Guide: How to Participate and Claim $ARC Rewards2025-12-03 | 5 mins