What Are Real-World Assets (RWAs): A Complete Guide To Asset Tokenization

What are real-world assets (RWAs)? Tokenizing real-world assets means turning physical and financial items into digital tokens on blockchain networks.

The RWA space has grown fast, hitting $24 billion in 2025 after a huge 380% jump from 2022. RWA in blockchain projects work well with stablecoins, which hold $224 billion in value as the biggest tokenized asset group.

This complete guide covers asset tokenization basics, looks at main RWA types, reviews pros and cons, and shows major trends driving tokenization in 2025. For beginners exploring this space, Bitget Wallet offers a safe vault for tokenized assets across multiple blockchain networks.

What Are Real-World Assets (RWAs)?

Real-world assets (RWAs) are tangible and intangible assets from the physical world that have been transformed into digital currency on blockchain networks. These items, which typically exist outside the cryptocurrency ecosystem, include:

- Real estate properties and commercial buildings.

- Government treasury bonds and corporate debt.

- Gold and precious metals commodities.

- Public and private company stocks.

- Artwork and intellectual properties.

RWA tokenization creates digital representations where each token represents claims on underlying assets with intrinsic value. This process combines blockchain liquidity and transparency with traditional asset stability, distinguishing RWAs from purely digital cryptocurrencies.

Understanding tokenized real-world assets requires a comparison of conventional and blockchain-based ownership structures.

| Traditional Assets | Tokenized Assets |

| Paper-based ownership certificates | Digital tokens on blockchain networks |

| Limited trading hours and geographic access | 24/7 global trading capabilities |

| High minimum investment requirements | Fractional ownership with low barriers |

| Weeks or months for settlement | Near-instantaneous settlement |

| Multiple intermediaries required | Direct peer-to-peer transactions |

| Limited liquidity for illiquid assets | Enhanced liquidity through tokenization |

How Does RWA Tokenization Work?

The RWA tokenization process transforms physical assets into digital tokens through systematic steps. Understanding how to tokenize real-world assets warrants examining four critical stages below:

-

Legal Structuring:

Special Purpose Vehicles (SPVs) are established to hold physical assets, providing legal separation and investor protection while maintaining clear ownership structures.

-

Asset Verification:

Professional valuators assess asset worth, verify authenticity, and integrate data feeds to establish accurate pricing and legal title documentation for tokenization.

-

Smart Contract Deployment:

Automated contracts are developed to manage ownership transfers, dividend distributions, compliance checks, and governance mechanisms for the tokenized RWAs.

-

Custody Management:

Professional custodians hold physical assets, while blockchain networks keep immutable ownership records. This approach provides asset security and digital transparency.

How to tokenize real-world assets depends on choosing appropriate token standards that enable compatibility across blockchain platforms and exchanges. While ERC-20 tokens represent fungible assets like commodities or securities, ERC-721 tokens handle unique assets, such as real estate properties.

What Are The Major Types of Real-World Assets Being Tokenized?

The RWA token market encompasses diverse asset categories, each serving different investment needs and market segments.

1. Financial Securities and Treasury Assets

Examples:

- Government treasury bonds and corporate debt instruments.

- Public and private equity tokenization.

- BlackRock's BUIDL fund and Franklin Templeton's BENJI products.

- Private credit reaching $14.7 billion by 2025.

Financial securities represent the most mature segment in Real-World Asset tokenization. These tokenized RWAs offer yield-bearing alternatives to traditional stablecoins, with treasury products leading at $5.6 billion in assets under management, demonstrating institutional adoption success.

Source: Small Caps

2. Physical Assets and Commodities

Examples:

- Real estate property tokenization and fractional ownership.

- Precious metals tokenization, particularly gold-backed tokens like PAX Gold.

- Art collections, luxury goods, and collectible assets.

- Energy resources including oil and renewable energy credits.

Physical commodities enable fractional ownership of traditionally expensive assets. These RWA DeFi examples allow smaller investors to access premium real estate and precious metals markets previously restricted to wealthy participants.

Source: BTCC

3. Stablecoins as RWA Leaders

Examples:

- USDT and USDC as primary examples of successful asset tokenization.

- Newer innovations like USDtb by Ethena and USD0 by Usual.

- Cash and Treasury securities backing regulated custodians.

- $4 trillion monthly transaction volume processing.

Stablecoins represent the largest category in the RWA token market. What are Real-World Assets without mentioning these fiat-backed tokens dominating with $224.9 billion combined market capitalization, proving tokenized RWAs viability at massive scale for RWA examples in DeFi applications.

Read more: What is Stablecoin? A Beginner’s Guide to Price-Stable Cryptocurrencies

Source: Financial Times

What Are Real-World Assets’ Benefits?

The benefits of tokenizing RWAs transform traditional asset management through blockchain technology innovation.

-

Enhanced Liquidity:

Assets previously requiring months to sell can now be traded instantly on blockchain marketplaces. Settlement occurs in minutes rather than traditional T2 or T3 cycles, enabling continuous price discovery.

-

Democratized Access:

Fractional ownership allows investments as small as $50-$1,000 in premium assets. This democratizes access to real estate and fine art historically reserved for wealthy investors through tokenized RWAs.

-

Improved Transparency:

Blockchain's immutable ledger provides transparent ownership records and transaction histories. All stakeholders can verify asset ownership without relying on intermediaries, reducing fraud risk significantly.

-

Cost Efficiency:

Smart contracts reduce middle and back-office costs by up to 85%, translating to $15 million savings per $10 billion in assets under management through automated processes and compliance.

What Are The Challenges and Risks in RWA Tokenization?

Despite significant potential, Real-World Asset tokenization faces substantial challenges that must be addressed for widespread adoption. These challenges create barriers that tokenized RWAs must overcome to achieve mainstream acceptance.

-

Regulatory Uncertainty:

The regulatory landscape remains fragmented across jurisdictions, creating compliance complexity for multi-jurisdictional offerings. Different regions have varying approaches to securities laws and cross-border restrictions.

-

Technical Security Risks:

Smart contract vulnerabilities pose significant risks, as coding errors can lead to asset loss. The immutable nature of blockchain means errors are difficult to correct once deployed.

-

Limited Market Liquidity:

Secondary markets for many tokenized RWAs remain limited, potentially creating liquidity challenges during market stress. Token values may not reflect underlying asset values consistently.

-

Infrastructure Complexity:

Maintaining connections between physical assets and digital tokens requires robust custody solutions and regular verification. Oracle dependency introduces additional risk points for accurate pricing updates.

What Real-World Asset Trends To Watch in 2025?

The RWA token market is experiencing rapid evolution driven by technological advances, regulatory clarity, and institutional adoption in 2025.

-

Institutional Mainstream Adoption:

Major financial institutions like BlackRock and JPMorgan are launching tokenized funds. BlackRock's BUIDL fund leads with significant institutional backing, while Wall Street giants integrate blockchain infrastructure.

-

Regulatory Framework Maturation:

Europe's MiCA regulation provides much-needed clarity for institutional participation. The U.S. GENIUS Act and similar legislation are enabling compliant tokenization while ensuring investor protection.

-

Accelerating Market Growth:

The sector has expanded 85% year-over-year with major institutional players entering. This growth foundation positions tokenization to become standard practice in global financial markets.

-

Technology Infrastructure Evolution:

Multi-chain ecosystems and Layer-2 solutions are improving scalability. Chainlink RWA solutions and Algorand RWA use cases demonstrate specialized blockchain networks supporting diverse tokenization requirements efficiently.

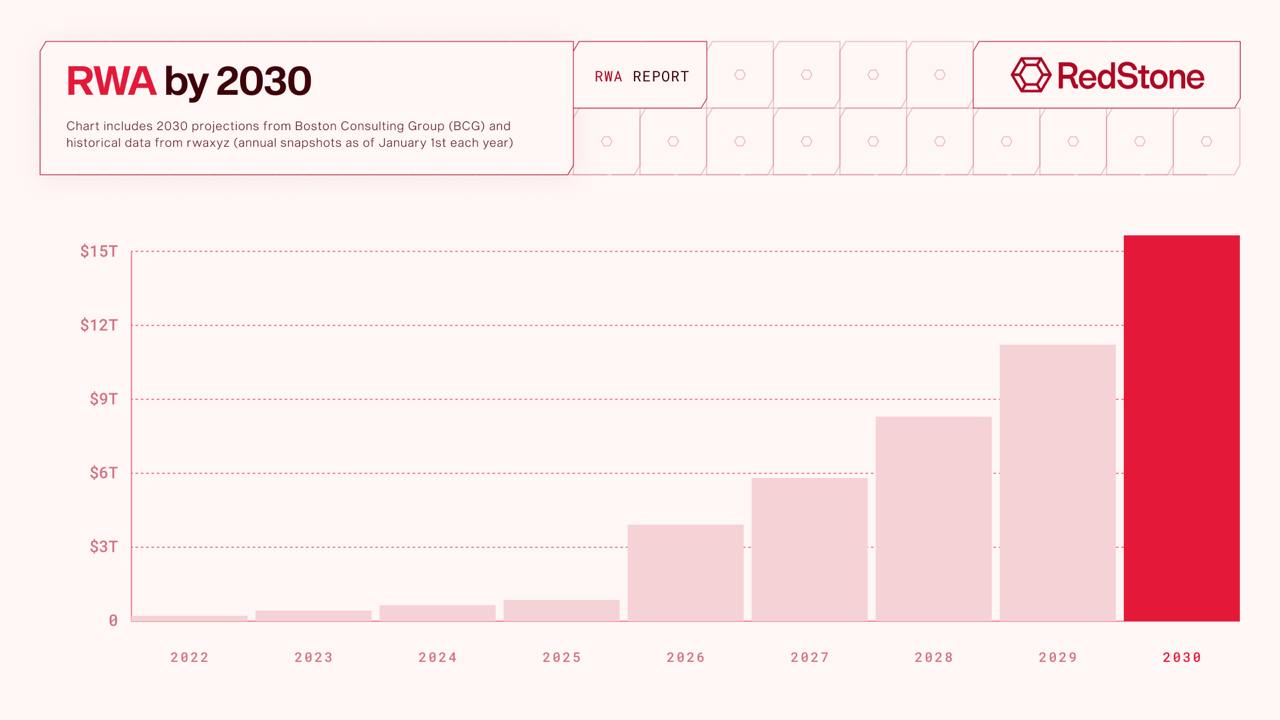

Industry projections consistently point to massive growth potential. Conservative estimates suggest tokenized assets could reach $16 trillion (nearly 10% of global GDP) by 2030, while optimistic forecasts approach $30 trillion by 2034. These figures demonstrate institutional recognition of blockchain's transformative capabilities.

Source: RedStone Blog

Conclusion

What are real-world assets (RWAs)? Real-world asset tokenization delivers enhanced liquidity, democratized access, and operational efficiency that traditional markets cannot match. The $24 billion market demonstrates proven viability at scale.

Institutional adoption by BlackRock and regulatory clarity through MiCA regulation signal mainstream acceptance. Tokenized RWAs are also positioned to capture conservative projections of $16 trillion by 2030, with stablecoins leading at $224.9 billion market capitalization.

Experience the future of asset tokenization with Bitget Wallet's comprehensive RWA support across multiple blockchain networks. Safely store and use stablecoins like USDT and USDC across chains with this beginner-friendly application. The secure vault manages all tokenized assets in one seamless interface.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What are real-world assets (RWAs) in cryptocurrency?

What are Real-World Assets? They are digital tokens representing physical assets like real estate, bonds, and commodities on blockchain networks, enabling global trading and fractional ownership.

2. How does the RWA tokenization process work?

The RWA tokenization process involves three stages: legal structuring off-chain, asset verification and valuation, then smart contract deployment to create digital tokens representing ownership rights.

3. What are the main benefits of tokenizing RWAs?

Tokenizing RWAs offers better liquidity with round-the-clock trading, wider access through shared ownership, greater clarity, and lower fees.

4. Can Bitget Wallet store RWA tokens safely?

Yes, Bitget Wallet provides secure storage for various tokenized RWAs and stablecoins across multiple blockchain networks with institutional-grade security features.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- On-chain RWA Market 2025: Growth, Risks, and Investment Opportunities2025-09-09 | 5 mins

- Which Assets Can Be Tokenized?2025-08-21 | 5 mins