What is Tokenized Stock? A Complete Guide to the Future of Blockchain-Based Equities

What is tokenized stock? These blockchain-based digital assets represent partial or complete ownership of actual company shares like Apple, Tesla, or Google. Smart contracts enable these tokens to mirror the price of real securities. Investors can buy and sell stock through blockchain technology using this system.

Unlike traditional stock markets bound by business hours, tokenized stocks offer various benefits, including:

-

24/7 trading with instant settlement and complete transparency:

Every trade gets logged on a public blockchain, building an unchangeable record that stops unauthorized edits.

-

Smart contracts:

These elements automatically manage settlements and company actions, cutting human mistakes and operating expenses.

This guide examines how tokenized stocks work, their benefits and risks, plus leading tokens for 2025. For beginners ready to explore multi-chain investing and stablecoin management, Bitget Wallet offers a seamless way to trade, store, and explore Web3 in one beginner-friendly app.

Key Takeaways

- Tokenized stocks transform traditional shares into digital tokens on blockchain, letting investors access global equity markets anytime with fractional ownership and instant settlement.

- Traders encounter unclear rules between countries, security threats, restricted voting rights, and possible price manipulation dangers that demand smart platform choices and complete research before joining.

- TSLAX, MSTRX, and NVDAX show the largest market value among tokenized shares, with Tesla, MicroStrategy, and NVIDIA tokens driving usage through high price swings and strong tech narratives.

What is Tokenized Stock and How Does It Work?

Tokenized stocks are digital versions of traditional company shares that exist on blockchain networks rather than conventional stock exchanges. The tokenization process begins when a licensed custodian purchases real shares and creates corresponding digital tokens on a blockchain platform.

What role does the blockchain play in tokenized trading?

Blockchain technology serves as the foundation that makes tokenized trading possible and secure.

-

Transparent Record-Keeping:

All tokenized shares transactions are recorded on an immutable public ledger, creating complete transparency and preventing unauthorized modifications to ownership records.

-

Smart Contracts Automation:

Automated smart contracts handle trade settlements, compliance checks, and corporate actions without requiring manual intermediaries, reducing costs and processing time significantly.

-

Decentralized Trading:

Blockchain enables direct peer-to-peer tokenized trading without relying on traditional brokers or centralized clearinghouses, providing global accessibility.

-

Enhanced Security:

Cryptographic protection makes transactions more resistant to fraud and manipulation compared to traditional trading systems.

Source: SOMA.finance

How is a tokenized stock different from traditional shares?

Several key differences distinguish tokenized stocks from conventional equity ownership.

| Feature | Tokenized Stock | Traditional Share |

| Trading Hours | 24/7 availability | Business hours only |

| Settlement Speed | Near-instant through blockchain | T+2 days typically |

| Fractional Ownership | Micro-shares readily available | Usually whole shares only |

| Global Access | Worldwide, no broker required | Limited by jurisdiction, broker needed |

| Shareholder Rights | Price exposure only, no voting | Full legal ownership with voting rights |

| Ownership Registration | Decentralized blockchain ledger | Centralized transfer agent registry |

Why Are Investors Turning to Tokenized Securities?

Tokenized equity has several great benefits that conventional stock markets can't match. These include the ability to trade all the time, lower transaction costs, and the ability to own a little share of a company.

Why is 24/7 Access and Low-Fee Trading Attractive?

Round-the-clock trading and minimal fees address major limitations in conventional equity markets.

-

Unrestricted Trading Hours:

Traditional stock markets operate within limited time frames, excluding evenings, weekends, and holidays. Tokenized shares enable investors worldwide to respond to global events instantly rather than waiting for markets to open.

-

Reduced Transaction Costs:

Smart contracts eliminate multiple intermediaries in the trading process. Blockchain transactions typically incur lower processing and settlement costs compared to standard brokerage fees, making tokenized trading more accessible to retail investors.

How does Fractional Ownership improve Liquidity?

Liquidity means how easily assets turn into cash, which forms the base for strong market health in the blockchain-based investment ecosystem. Fractional ownership boosts this liquidity by:

-

Lowering Investment Barriers:

Fractional ownership allows investors to purchase small portions of expensive stocks rather than full shares. This opens doors to valuable stocks, letting people with limited budgets join in.

-

Expanding Participant Pool:

More individuals can purchase and sell if the minimum investment amounts are lower. This higher level of involvement immediately makes the secondary market more liquid by bringing together more traders and making the market more active.

-

Enhancing Exit Options:

Blockchain-based fractional shares trade fast on digital platforms. This provides immediate liquidity to rebalance portfolios, making it easier to convert holdings into cash compared to many traditional investments.

What Are the Risks and Challenges of Tokenized Stocks?

Even with their helpful benefits, digital securities bring special dangers and working problems that traders must study closely before joining.

-

Regulatory Uncertainty:

Rules controlling digital stocks differ greatly between countries and change quickly. Mixed SEC rules can impact trading rights, access, or legal status of digital stocks in certain areas.

-

Cybersecurity Threats:

Tokenized stock platforms and wallets remain targets for cybercriminals. Successful attacks can result in theft or loss of digital assets, especially on inadequately secured platforms with smart contract vulnerabilities.

-

Lack of Digital Identity Standards:

No widely accepted standard exists today for checking and handling digital identity in token markets. This builds problems in keeping clear ownership records and stopping identity theft.

-

KYC and AML Gaps:

Insufficient Know Your Customer protocols and Anti-Money Laundering compliance can increase illicit activity risks. Some platforms lack robust verification or only apply KYC at issuance but not in secondary trading.

-

Custody and Asset Backing Concerns:

Investors sometimes have limited visibility into whether tokens are fully backed by underlying shares and whether assets are held with licensed, regulated custodians, creating counterparty risks.

Navigate these challenges safely with Bitget Wallet's secure multi-chain infrastructure for stablecoins and tokenized assets across Ethereum, Solana, and BNB networks.

Top Tokenized Stock Tokens by Market Capitalization to Watch in 2025

Several tokenized equity projects dominate the digital asset landscape, offering direct exposure to major companies through blockchain technology.

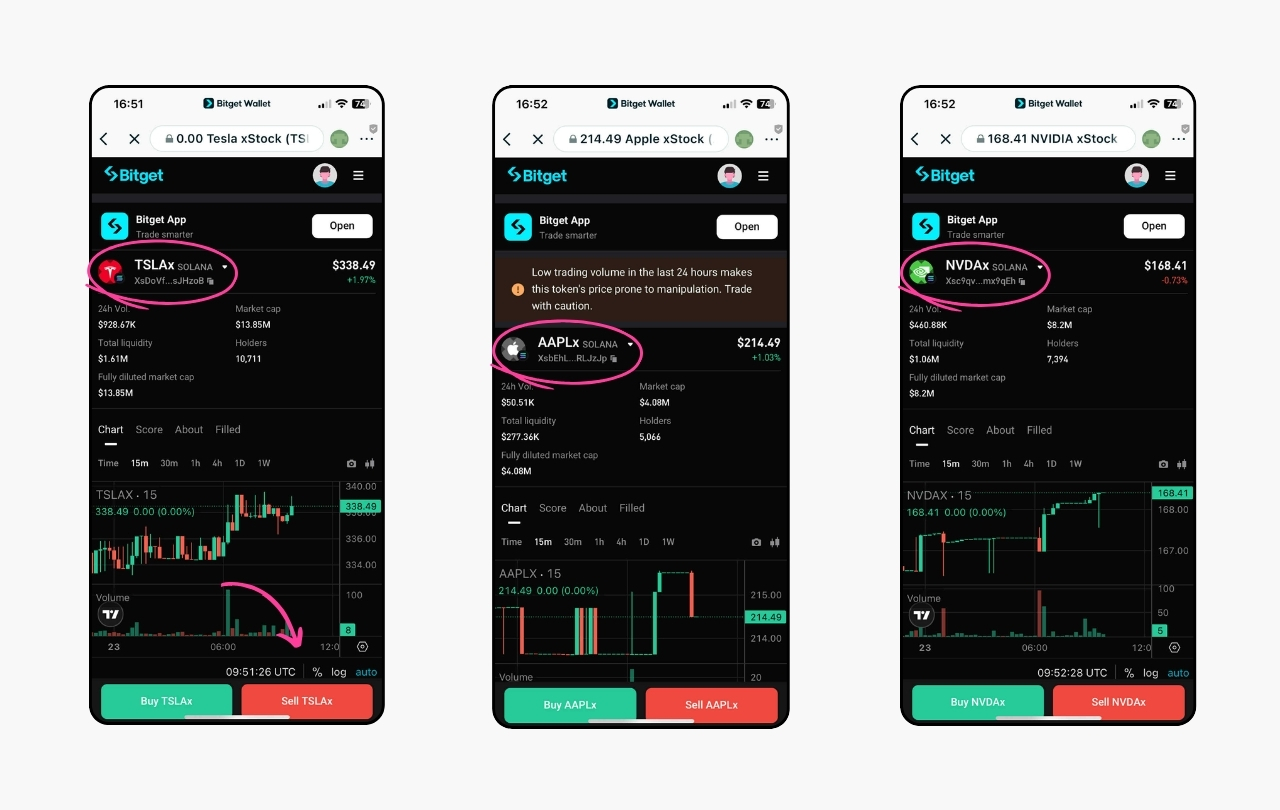

1. TSLAX (Tesla Tokenized Stock)

- Market Capitalization: $3.64M-$3.66M (as of July 2025).

TSLAX represents Tesla Inc., the electric vehicle and clean energy pioneer, issued as a tracker certificate on Solana and Ethereum blockchains. Tesla's constant innovation and market volatility make TSLAX among the most actively traded examples of tokenized stocks.

2. MSTRX (MicroStrategy Tokenized Stock)

- Market Capitalization: $2.54M-$2.71M.

MSTRX tracks MicroStrategy Corporation, known for pioneering Bitcoin treasury integration within public company operations. MicroStrategy's role makes MSTRX valuable during crypto market surges. Investors use this token to gain exposure to both corporate equity performance and Bitcoin's price appreciation.

3. NVDAX (NVIDIA Tokenized Stock)

- Market Capitalization: $1.26M-$1.33M.

NVDAX provides digital exposure to NVIDIA Corporation, the global leader in artificial intelligence and graphics processing hardware. NVIDIA's dominance in AI chip manufacturing and robust 2025 performance metrics drive significant interest in NVDAX.

4. COINX (Coinbase Tokenized Stock)

- Market Capitalization: $2.1M.

COINX tracks Coinbase Global Inc., the top known US crypto exchange service. This token captures crypto adoption growth patterns while staying available through decentralized trading systems that match digital investment plans.

5. AAPLX (Apple Tokenized Stock)

- Market Capitalization: $1.86M-$1.88M.

AAPLX represents Apple Inc., the globe's highest-valued consumer tech firm, offering partial ownership of this top-tier stock via blockchain systems. Apple's strong brand power and steady money results make AAPLX appealing for traders wanting regular stock access inside decentralized investment collections.

6. SPYX & QQQX (Tokenized ETFs)

- Market Capitalizations:

- SPYX: $3.77M-$5.01M.

- QQQX: $1.95M-$1.97M.

SPYX tokenizes the S&P 500 ETF while QQQX represents the Nasdaq-100 ETF, bringing broad market index exposure to blockchain platforms. These tokens enable instant portfolio diversification through single transactions on decentralized exchanges.

7. HOODX & AMZNX

- Market Capitalizations:

- HOODX: $1.04M.

- AMZNX: Data unavailable for July 2025.

HOODX follows Robinhood Markets, the fee-free trading service favored by everyday traders, while AMZNX shows Amazon's online shopping and cloud business empire. These tokens mirror key market shifts, with HOODX showing everyday trader access growth and AMZNX showing wide-reaching tech business changes.

Is This the Future of Equities or Just Another Trend?

The sustainability of tokenized equity depends on several interconnected factors spanning technology, regulation, and market adoption.

What makes Tokenized Stocks Sustainable in DeFi?

Several fundamental characteristics position tokenized shares for long-term viability within decentralized finance ecosystems.

-

Composability in DeFi:

Tokenized stocks function as building blocks that integrate seamlessly with lending protocols, yield farming, and liquidity pools, creating new financial opportunities impossible with traditional shares.

-

24/7 Access and Settlement:

These assets trade continuously and settle instantly via smart contracts, giving global investors rapid responses to market events while attracting both active traders and institutional algorithms.

-

Borderless Participation:

Blockchain deals eliminate location and money limits by providing straight investment entry without needing central brokers, while fractional ownership opens top-stock access to everyone.

-

Transparency and Security:

Public blockchain ledgers show full deal clarity, while smart contracts reduce human mistakes and business dangers versus regular settlement methods.

-

Liquidity Bridge Formation:

These tokens link standard stocks with DeFi systems, adding new liquidity to both markets, creating vital connections between legacy and decentralized financial ecosystems.

How does Tokenized Stock fit into Broader Web3 Adoption?

Tokenized equity marks a crucial step in merging standard finance with the decentralized digital economy. Known assets like Apple or Tesla stocks become reachable to Web3-focused traders without middlemen, thereby speeding up regular blockchain use.

Big firms like BlackRock and Circle now offer regulated tokenized asset products, showing that tokenization has earned wide acceptance and growth potential for business investment collections.

Should Retail Investors consider Tokenized Shares?

Everyday traders gain from lower entry barriers through fractionalization, round-the-clock trading access, and potential investment diversification by joining standard and blockchain-based assets. These benefits match current DeFi moves toward opening financial reach.

Still, traders must think carefully that tokenized shares usually give only economic exposure without traditional owner rights like voting or dividends, plus possible rule uncertainties and online safety dangers.

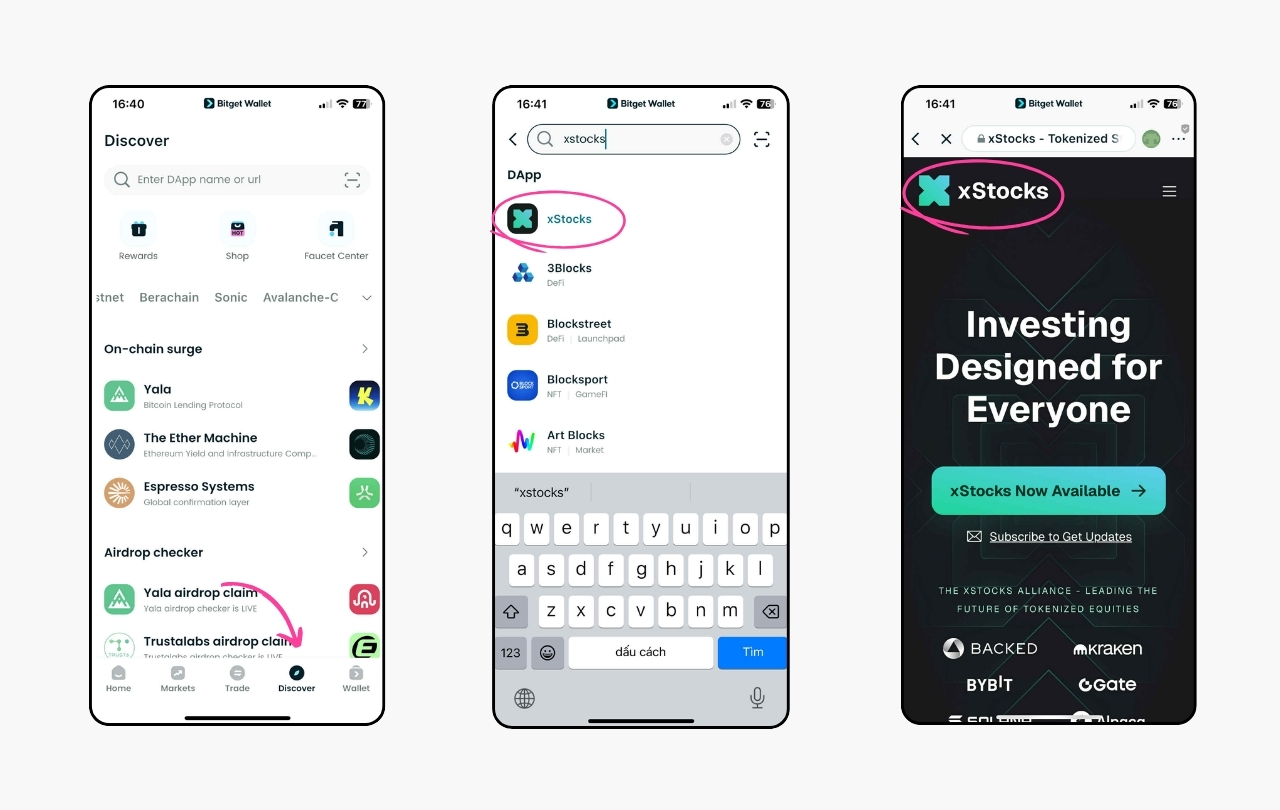

How to Trade Tokenized Stocks on Bitget Wallet?

Trading tokenized stocks through Bitget Wallet requires following specific steps to access blockchain trading safely and effectively.

Step 1: Download and Install Bitget Wallet

Start by downloading the official Bitget Wallet application from your mobile app store or the verified website.

Create a new decentralized wallet or import an existing one using your recovery phrase. Store your seed phrase securely as this controls access to all funds.

Step 2: Fund Your Wallet with Supported Currencies

Transfer supported stablecoins, such as USDT, USDC, or SOL from another wallet or exchange into your Bitget Wallet address.

Ensure you maintain a small balance of the network's base token like ETH or SOL to cover transaction fees during trading.

Step 3: Navigate to the xStock Trading Section

Open your Bitget Wallet and locate the xStock section, typically found in the DeFi or trading interface.

Connect to the appropriate blockchain network that supports the tokenized stocks you want to trade, such as Solana or Ethereum.

Step 4: Select Your Desired Tokenized Stock

Browse available tokenized stocks including TSLAx for Tesla, AAPLx for Apple, or NVDAX for NVIDIA.

Review real-time prices, token descriptions, asset backing information, and current trading volumes before making your selection.

Step 5: Execute Your Trade Order

Enter the amount of tokenized stock you want to purchase, keeping in mind that fractional amounts are supported.

Review all transaction details carefully, then confirm the trade through your wallet interface for automatic smart contract execution.

Step 6: Secure and Monitor Your Holdings

All tokenized stocks appear in your wallet dashboard for portfolio tracking.

Enable two-factor authentication, protect your recovery phrase, and only use official Bitget Wallet versions to maintain security of your blockchain trading activities.

Step 7: Explore Advanced DeFi Options

Many tokenized stocks can be used as collateral in DeFi protocols or supplied to liquidity pools for earning yield.

These advanced features unlock additional opportunities within the same wallet interface, expanding beyond basic trading functions.

Read more: What is xStocks and How to Trade Tokenized U.S. Stocks on Bitget Wallet?

Conclusion

What is tokenized stock? They are digital blockchain representations of traditional equity shares that allow investors to gain exposure to stock markets without the limitations of conventional trading systems. Despite promising advancements, the sector faces important challenges including regulatory uncertainty, custody risks, and potential market manipulation concerns.

Investors interested in exploring tokenized equities should consider secure platforms like Bitget Wallet, which offers:

- Seamless trading experience with instant settlements and fractional investing capabilities

- Strong security features including two-factor authentication and private key protection

- Direct access to global equity markets through a user-friendly crypto-native interface

The future of tokenized investing requires tools that can handle the complexity of multiple blockchain networks while maintaining the simplicity that beginners need. Experience seamless tokenized trading with Bitget Wallet, supporting stablecoins and trending tokens across Ethereum, Solana, and major chains.

FAQs

1. What is tokenized stock?

Tokenized stock is a digital token on blockchain. Each token represents exposure to the value of a real-world stock.

2. How do tokenized stocks provide 24/7 trading?

Tokenized stocks exist on decentralized networks. This allows trading at any hour, regardless of traditional exchange schedules.

3. Can anyone buy tokenized stocks on Bitget Wallet?

Anyone with internet access and a Bitget Wallet may buy, sell, or hold tokenized stocks globally using supported cryptocurrencies.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- On-chain RWA Market 2025: Growth, Risks, and Investment Opportunities2025-09-09 | 5 mins

- Which Assets Can Be Tokenized?2025-08-21 | 5 mins