What Are Types of Stablecoins and Which One Should You Use?

Types of stablecoins represent various models that keep steady prices through ties to reserve assets like government money, raw materials, or computer-based controls. Unlike Bitcoin and Ethereum, which jump up and down in price constantly, these coins keep their worth stable.

Stablecoins have played a key role in DeFi systems, allowing users to lend, borrow, and yield farming without facing wild price changes. They also change remittances by facilitating low-cost, instant global transfers that bypass traditional banks and their high costs.

This guide breaks down four main kinds of stablecoins, showing you what makes each one good or risky and when to use them. No matter if you plan to store them safely in your Bitget Wallet or trade them on exchanges, learning about each type helps you pick the right one for what you need.

What Are Stablecoins and Why Do They Matter?

Stablecoins are digital currencies engineered to maintain consistent value through various stability mechanisms. To achieve that, these blockchain-based assets peg their value to reserve assets, such as fiat currencies, commodities, or using algorithmic control.

They serve as crucial infrastructure for the cryptocurrency ecosystem, enabling reliable transactions, DeFi participation, and cross-border payments without the unpredictable price swings that limit traditional crypto adoption.

How Do Stablecoins Differ from Bitcoin and Ethereum?

Understanding these differences helps explain why stablecoins serve unique purposes in cryptocurrency ecosystems.

| Feature | Stablecoins | Bitcoin | Ethereum |

| Primary Purpose | Maintain price stability | Store of value and digital gold | Smart contracts platform |

| Volatility | Low, value pegged | High | High |

| Backing | Pegged to fiat, commodities, or algorithms | No backing, limited supply | No backing, utility token |

| Use Cases | Medium of exchange, DeFi stability, remittances | Long-term investment, store of value | Decentralized applications, DeFi |

| Price Stability | Collateral reserves or algorithmic control | Market-driven supply and demand | Market-driven supply and demand |

What Makes Stablecoins Less Volatile?

Several sophisticated mechanisms work together to minimize price fluctuations in stablecoin systems.

-

Asset Pegging:

Most stablecoins maintain direct links to stable assets like US dollars or gold, anchoring their market value.

-

Collateral Reserves:

Fiat-backed stablecoins hold actual currency reserves that can be independently audited for transparency.

-

Overcollateralization:

Crypto-backed versions often maintain reserves exceeding issued amounts to absorb unexpected market volatility.

-

Algorithmic Controls:

Smart contracts automatically adjust token supply by expanding or contracting circulation to maintain price stability.

-

Risk Management:

Various protocols including liquidations and reserve funds protect against extreme market events.

Why Are Stablecoins Crucial for DeFi and Cross-Border Payments?

These applications demonstrate how stablecoins bridge traditional finance with innovative blockchain-based solutions.

-

DeFi Foundation:

Stablecoins provide predictable value units essential for lending, borrowing, and liquidity pools without volatility risk.

-

Yield Generation:

Users earn interest on stablecoin holdings with significantly lower risk compared to volatile crypto assets.

-

Global Transfers:

They enable instant, low-cost international money transfers bypassing traditional banking intermediaries and fees.

-

Financial Access:

Stablecoins offer stable currency alternatives for unbanked populations in regions with unstable local currencies.

Smart Contract Safety:

Many DeFi protocols require stablecoins to prevent cascading liquidations from sudden price movements.

1. Fiat-Backed Stablecoins

Fiat-backed stablecoins connect their value to conventional government-issued currencies like dollars. Each token is typically backed 1:1 by holdings in financial institutions, with regular audits to keep things transparent.

What Are Examples Like USDT, USDC, FDUSD?

Top fiat-backed stablecoins dominate the market via their stability and widespread adoption across crypto platforms. Certain prime examples include:

-

Tether (USDT):

This largest stablecoin by market cap gets used widely on trading exchanges and DeFi apps around the globe.

-

USD Coin (USDC):

Issued by Circle and Coinbase consortium, known for high transparency standards and regular monthly audits.

-

First Digital USD (FDUSD):

Fully-backed stablecoin with strict regulatory oversight, issued by First Digital Trust Limited in Hong Kong.

What Are the Pros and Cons of Fiat-Backed Stablecoins?

Pros:

- Price stability designed to closely track underlying currency value, typically maintaining $1 per token.

- Widespread adoption across major trading sites, wallets, and DeFi apps as their values stay predictable.

- Ease of use makes crypto participation easier by cutting down on wild price swings.

- Transparent practices through regular reserve audits give extra trust in the pegging mechanism.

- Faster and cheaper cross-border transactions compared to traditional banking systems.

Cons:

- Centralization requires trusting issuers to maintain honest reserve management and redemption processes.

Source: The Coin Zone

2. Crypto-Backed Stablecoins

This second type of stablecoins maintain stability as they are backed by cryptocurrency reserves stored in smart contracts instead of regular banks. These methods allow them to absorb market volatility by using over-collateralization and automatic liquidation.

What Are Examples Like DAI, sUSD, WBTC?

Leading crypto-backed stablecoins demonstrate different approaches to decentralized stability through various collateral mechanisms.

-

DAI:

Minted by depositing multiple cryptocurrencies into MakerDAO smart contracts, governed by community votes and protocol management systems.

-

sUSD:

Issued through the Synthetix protocol by locking SNX tokens, warranting extra over-collateralization ratios over 500% to stay stable.

-

WBTC:

Tokenized Bitcoin on Ethereum that represents actual BTC holdings, enabling Bitcoin to serve as collateral within DeFi ecosystems.

How Do Platforms Like MakerDAO Use Collateralization?

MakerDAO works through collateral vaults where people put accepted digital coins like ETH or WBTC into smart contracts. They can then mint DAI against their deposited assets, keeping needed collateralization ratios around 150%.

The system sells off undercollateralized positions automatically when asset prices drop below set limits. Community governance sets risk parameters and fees, changing the protocol for market shifts while keeping strong asset backing.

What Risks Are Unique to Crypto-Collateralized Models?

Crypto-backed setups face unique problems that look very different from regular financial backing mechanisms.

-

Collateral Volatility:

Underlying crypto assets like ETH can experience dramatic price swings, triggering automatic liquidations and potentially destabilizing the system.

-

Liquidation Cascades:

Market crashes can cause mass liquidations, creating cascading losses when systems cannot auction collateral quickly at fair prices.

-

Smart Contract Risks:

Bugs or exploits in the automated contracts managing collateralization and liquidation processes can compromise entire system integrity.

-

Complexity Barriers:

Technical mechanics behind these systems remain difficult for average users to understand, making proper risk assessment challenging.

Source: FXLeaders

3. Commodity-Backed Stablecoins

Commodity-backed stablecoins derive stability from physical assets like gold, silver, and oil rather than currencies or algorithms. Each token represents direct ownership of specific quantities of tangible real-world resources.

Examples of Commodity-Backed Stablecoins

Leading commodity stablecoins focus primarily on precious metals due to their established value and global recognition.

-

Pax Gold (PAXG):

Each token represents one troy ounce of gold stored in London Bullion Market Association vaults, with regulated audits and fiat redemption options.

-

Tether Gold (XAUT):

Issued by Tether, each token provides ownership of one troy ounce of gold held in Swiss vaults, supporting worldwide trading and physical delivery.

Are Commodity-Backed Stablecoins Good for Inflation Protection?

Commodity-backed stablecoins offer unique inflation hedging properties through their connection to historically valuable physical assets.

Positive Reasons:

-

Direct Inflation Hedge:

Gold-backed stablecoins historically preserve value during high inflation periods when fiat currencies lose purchasing power significantly.

-

Safe Haven Properties:

Research shows these tokens serve as effective hedging instruments during market stress and financial crises affecting traditional currencies.

-

Real Asset Exposure:

Unlike fiat-backed alternatives, commodity stablecoins appreciate alongside underlying asset prices, potentially outpacing inflation rates consistently.

Negative Reasons:

-

Price Volatility:

Commodities like gold still fluctuate due to global supply and demand factors beyond inflation pressures alone.

-

Transparency Variations:

Effectiveness depends heavily on token stability, reserve liquidity, and issuer compliance with regular auditing standards.

Source: Medium

4. Algorithmic Stablecoins

Algorithmic stablecoins keep steady prices through coded supply changes instead of real asset backing. Smart contracts mint or burn tokens automatically when prices move to keep their dollar peg.

Why Are Algorithmic Stablecoins Risky?

These setups have special weak points that make them different from asset-backed options in many risk areas.

-

No Asset Floor:

Pure algorithmic systems lack tangible reserves, making recovery from confidence crises extremely difficult without underlying value.

-

Market Shock Vulnerability:

Sharp demand declines or coordinated selling can overwhelm supply adjustment mechanisms, causing rapid and persistent depegging events.

-

Death Spiral Risk:

When confidence collapses, feedback loops trigger hyperinflation of balancer tokens, compounding losses for all system participants.

Example Projects of Algorithmic Stablecoins

Historical and current projects demonstrate both innovation potential and inherent stability challenges within algorithmic approaches.

-

Ampleforth (AMPL):

Uses rebase mechanisms that adjust token quantities in all wallets daily, maintaining aggregate value while changing individual holdings.

-

USDD:

Employs hybrid mechanisms, including staking incentives and partial backing, though still relies on algorithmic supply adjustments for stability.

The Terra ecosystem collapse in May 2022 exemplifies these risks perfectly. TerraUSD (UST) used a dual-token system with LUNA absorbing price fluctuations, but rapid confidence loss caused both tokens to spiral toward zero value, destroying $40 billion in market value.

Source: Zeeve

How Can You Choose the Right Stablecoin to Use?

Selecting the appropriate stablecoin requires careful evaluation of multiple factors to ensure optimal safety and usability.

What Should You Consider Before Using a Stablecoin?

Many key factors decide which stablecoin works best for your exact needs and risk tolerance level.

-

Stability and Reserve Transparency:

Check that the stablecoin maintains steady dollar peg with regular, transparent audits of backing reserves.

-

Issuer Reputation:

Study the past record of stablecoin issuers, choosing known organizations with clear rule compliance in trusted jurisdictions.

-

Collateral Model Understanding:

Evaluate whether the backing mechanism (fiat, crypto, commodity, or algorithmic) aligns with your risk tolerance and use case.

-

Liquidity and Market Presence:

Pick stablecoins with high trading amounts and wide exchange connections to make buying, selling, and transfer simple.

Where Can You Buy or Use Stablecoins Easily?

Large crypto exchanges like Coinbase and Binance give complete stablecoin trading with different payment methods, including credit cards and bank transfers. These sites offer infrastructure for both new and skilled users.

New wallet apps and crypto brokerages provide direct stablecoin buying with built-in fiat gateways. Bitget Wallet stands as a top pick among these choices, giving smooth access across many blockchain networks for easy stablecoin handling.

Why Is Bitget Wallet the Best Way to Use and Store Stablecoins?

Bitget Wallet provides comprehensive stablecoin management capabilities that address the specific needs identified throughout this guide.

What Makes Bitget Wallet Ideal for Stablecoin Users?

Bitget Wallet addresses the core challenges that stablecoin users face across security, accessibility, and functionality domains.

-

True Self-Custody Control:

Users maintain complete ownership of private keys without dependence on banks or centralized platforms, ensuring maximum security.

-

Multi-Chain Unified Experience:

Seamlessly manages USDT, USDC, DAI, and other stablecoins across 130+ blockchains including Ethereum, Solana, and BNB Chain.

-

Integrated Yield Opportunities:

Access onchain earning through protocols like Kamino, Aave, and Lido with flexible deposits and real-time interest accrual.

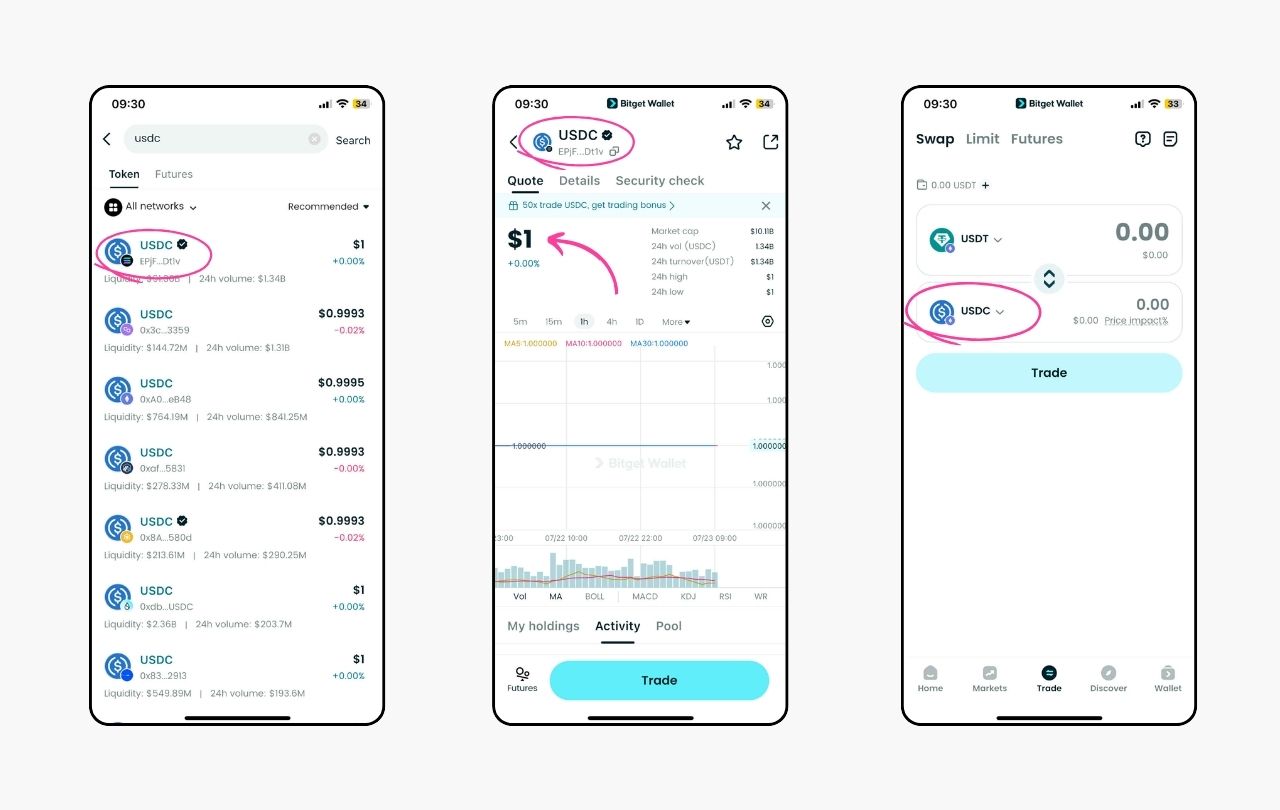

How to Store, Swap, and Manage Stablecoins on Bitget Wallet?

Bitget Wallet streamlines the three essential stablecoin operations through intuitive interfaces designed for both beginners and experts.

-

Easy Storage Setup:

Create new wallets or import existing ones using seed phrases for instant multi-network stablecoin access with recovery.

-

Optimal Swap Rates:

Built-in aggregator sources best rates from hundreds of DEXs and bridges for cross-chain stablecoin exchanges automatically.

-

Portfolio Analytics:

Monitor transaction history, price stability, and receive alerts for liquidity changes, whale activity, and depegging events effectively.

How Bitget Wallet Surpasses Other Wallets?

Bitget Wallet delivers superior capabilities compared to popular alternatives across multiple critical performance dimensions.

| Feature | Bitget Wallet | MetaMask/ Trust/ Phantom |

| Multi-Chain Support | 130+ unified networks | Limited, network-specific |

| Built-in DEX Aggregator | Optimal rates across platforms | External dApp requirements |

| Integrated Yield Access | Direct staking/ earning inside app | Manual DeFi navigation |

| Fiat Integration | 61+ jurisdictions, 25+ currencies | Limited external partners |

| User Protection Fund | $300 million coverage | No protection typically |

Read more: MetaMask vs Bitget Wallet: Which Is Better in 2025? Trust Wallet vs Bitget Wallet: Which One Is Better in 2025? Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

Types of stablecoins include four distinct approaches to achieving price stability in cryptocurrency, each offering unique advantages and trade-offs for different user needs:

- Fiat-backed options provide simplicity and regulatory clarity.

- Crypto-backed alternatives offer decentralization with complexity.

- Commodity-backed variants deliver inflation protection.

- Algorithmic models promise innovation alongside significant risks.

Understanding these fundamental differences empowers informed decision-making based on individual risk tolerance, intended usage, and technical comfort levels. The stablecoin landscape continues evolving rapidly as regulatory frameworks develop and new technological solutions emerge to address current limitations.

Secure wallet solutions like Bitget Wallet enable users to safely store, swap, and earn yield from multiple stablecoin types across diverse blockchain ecosystems. Download Bitget Wallet today to start exploring the full potential of stablecoins.

FAQs

1. What is the safest type of stablecoin for beginners?

Fiat-backed stablecoins like USDC offer the highest stability and simplest mechanisms, making them ideal for newcomers to cryptocurrency.

2. Which stablecoin type offers the best earning opportunities?

Crypto-backed stablecoins like DAI provide excellent DeFi integration for yield farming, lending, and borrowing while maintaining decentralized principles.

3. Are algorithmic stablecoins worth the investment risk?

Algorithmic stablecoins carry significant de-pegging risks and complexity, making them suitable only for experienced users who understand potential losses.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is QCAD: A Complete Guide to Canada’s Regulated CAD Stablecoin2025-11-28 | 5 mins