What Is FDIC Stablecoin and the GENIUS Act Means for Global Crypto Markets in 2026

FDIC stablecoin regulation is rapidly reshaping the global digital asset landscape, marking 2026 as a pivotal transition year for stablecoins, financial institutions, and retail users. The introduction of the GENIUS Act—America’s most comprehensive U.S. stablecoin framework to date, signals a profound shift in how stablecoin issuers must operate, reserve assets, and comply with federal oversight. With the FDIC defining new rules, stablecoin reserve requirements are becoming more transparent and stringent, influencing not only U.S. markets but also highly regulated regions like Japan.

This article breaks down how these rules work, what they require, how issuers are impacted, and why users need safer tools like Bitget Wallet to navigate regulated stablecoin environments.

Key Takeaways

- The FDIC stablecoin regulation under the GENIUS Act introduces federal oversight for stablecoin issuers for the first time.

- Strict reserve, audit, and disclosure rules may influence global stablecoin standards.

- Japan’s regulatory environment offers a contrasting, bank-focused model.

- Bitget Wallet provides a compliant-friendly environment for managing stablecoins securely across multiple chains.

What Is the FDIC Stablecoin Regulation Under the GENIUS Act?

The GENIUS Act effectively integrates stablecoins into a regulated financial-services framework. Under the law, only certain approved entities may issue what the law calls “payment stablecoins,” and those coins must meet stringent backing, transparency, and operational rules — making the term FDIC stablecoin regulation more than just a catchphrase: it reflects real, binding oversight.

How Does the GENIUS Act Define Payment Stablecoin Issuers?

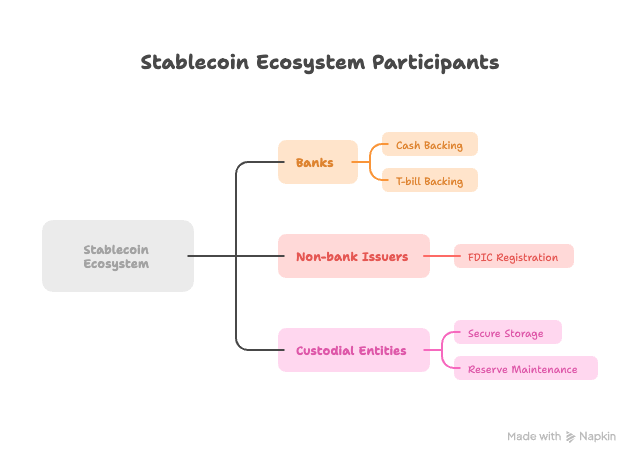

Under the GENIUS Act, payment stablecoin issuers are entities that mint or manage stablecoins designed for payments, settlements, or value transfer. This includes:

-

Banks issuing stablecoins fully backed by cash or T-bills

-

Non-bank issuers operating under FDIC registration

-

Custodial entities maintaining the secure storage of reserves

The GENIUS Act establishes which organizations qualify as payment stablecoin issuers and what responsibilities they carry, including reserve management, disclosures, and consumer protection.

👉 Read more:

What Is the GENIUS Act? U.S. Stablecoin Regulation Explained (2025 Guide)

How Does the GENIUS Act Define Payment Stablecoin Issuers?

The GENIUS Act restricts issuance of stablecoins to certain approved issuers. These include:

- Subsidiaries of insured depository institutions (banks or credit unions). CBH+1

- Non-bank entities that obtain a federal license (e.g. regulated under the Office of the Comptroller of the Currency) or a certified state license if under a certain issuance threshold.

- Qualified foreign issuers — under special conditions.

Decentralized, anonymous, or loosely organized issuers (e.g. DeFi protocols without license) are effectively excluded unless they comply with licensing, governance, and oversight requirements — disincentivizing unregulated issuance.

As a result, the pool of valid “payment stablecoin issuers” becomes narrow and regulated - reducing the risk of under-collateralized or shady stablecoins proliferating in the U.S. market.

Source: Tokeny

Why Did the FDIC / U.S. Government Create a New U.S. Stablecoin Framework?

Historically, stablecoins operated in a regulatory grey area — neither traditional bank deposits nor fully securities or commodities. The GENIUS Act aims to change that by:

- Protecting consumers: requiring safe backing, clear redemption, transparency to avoid surprises or sudden depegging.

- Managing systemic risk: as stablecoins grew in volume, regulators saw potential for “crypto-bank runs,” uninsured exposure, and contagion across crypto and traditional finance.

- Clarifying legal classification: stablecoins under the GENIUS Act are defined as payment instruments — not securities or commodities — reducing regulatory ambiguity.

In short: the law balances innovation and growth with safety — giving stablecoins room to thrive, while protecting users and financial stability.

What Reserve Requirements Do Stablecoin Issuers Need to Meet?

A cornerstone of the GENIUS Act’s stablecoin regulation is its strict reserve and backing rules — preventing under-collateralization, rehypothecation, or risky reserve investments.

How Do Stablecoin Reserves Work Under Regulation?

Under the law, each payment stablecoin must be backed at a 1:1 ratio: for every $1 stablecoin issued, there must be at least $1 in eligible reserve assets.

Eligible reserve assets include:

- U.S. dollars or deposits at insured depository institutions

- Short-term U.S. Treasury securities (e.g. with maturities near 3 months)

- Other government securities or similarly liquid, low-risk instruments approved by regulators

- In some cases, tokenized equivalents of approved reserve assets (if permitted by regulators)

Issuers are prohibited from rehypothecating or reusing those reserves for risky investments — the reserves must live segregated, safe, and ready for redemption at any time.

This structure aims to ensure that stablecoins behave like digital cash — fully backed, redeemable, and financially safe.

Are Cryptocurrency Exchange Reserves Impacted by These Rules?

Though the GENIUS Act primarily regulates stablecoin issuers, its rules have ripple effects for exchanges, custodians, and platforms handling these coins:

- Exchanges may need to segregate user stablecoins from operational funds to prevent commingling

- Reserve attestation and audit reports could become prerequisites for listing or supporting regulated stablecoins

- Transparency and reserve backing may become part of exchange due diligence before integrating stablecoins

In essence, the law raises the bar for all participants — not just issuers — pushing the entire ecosystem toward stronger financial hygiene and accountability.

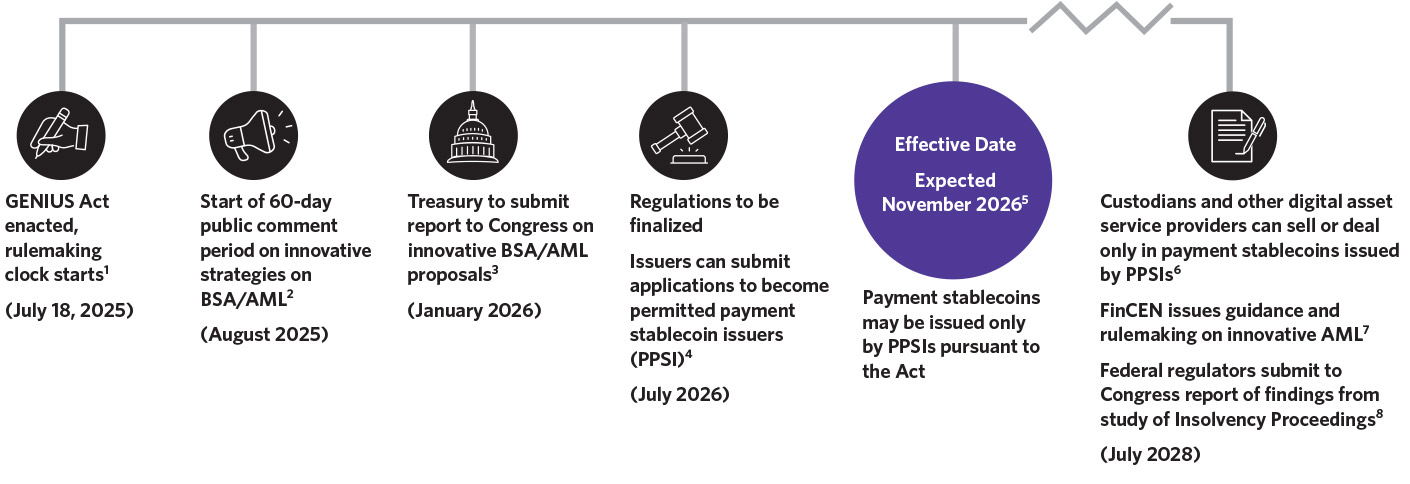

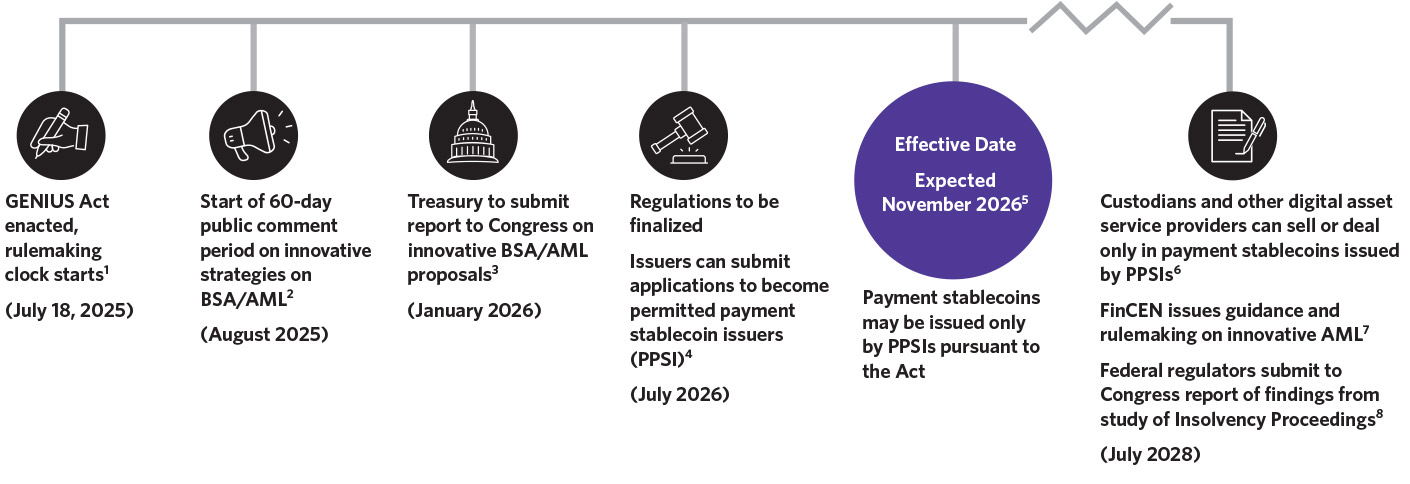

How Does the GENIUS Act Regulate Stablecoins in 2026?

Now that GENIUS is law (signed in July 2025), we’re entering a phase where regulators and issuers build out actual operational frameworks. Here’s what compliance will require, and what non-compliance could bring.

Source: X

What New Compliance Standards Must Issuers Follow?

Under the GENIUS Act, issuers must meet multiple compliance obligations:

- Licensing & supervision: Banks, credit-unions or specially chartered nonbank firms must register and will be supervised by regulators (e.g. OCC, FDIC, state regulators) before issuance begins.

- Reserve backing & segregation: 1:1 backing with eligible assets, reserve segregation, no rehypothecation.

- Transparency & reporting: Monthly public disclosure of reserve composition; for large issuers, annual audited financial statements.

- AML / KYC / compliance controls: Issuers considered financial institutions under the Bank Secrecy Act must implement robust AML / sanctions compliance and transaction monitoring.

- Operational restrictions: Issuers cannot pay interest or yields “solely in connection with holding or using stablecoins,” hindering high-yield marketing tactics.

- Redemption guarantees: Holders must be able to redeem stablecoins at fixed value; issuers must clearly disclose redemption procedures and fees.

Collectively, these rules turn stablecoin issuance into something structurally similar to regulated money-market or banking products — rather than speculative tokens.

What Happens if Issuers Fail to Meet FDIC Stablecoin Regulation Requirements?

If an issuer fails to comply — e.g., lacks proper reserves, fails audits, misleads consumers, or mixes reserve and corporate funds — consequences can include:

- Loss of licensing or registration to issue payment stablecoins

- Legal penalties (e.g., fines, cease-and-desist orders)

- Forced redemption freeze or forced liquidation of reserves

- Loss of consumer trust, massive outflows, and possible insolvency

- For stablecoin holders: risk of depegging, delayed redemption, or losses

Hence, abiding by FDIC stablecoin regulation is not optional for compliant participation. For issuers, compliance becomes a core business function — not an afterthought.

How Does FDIC Stablecoin Regulation Compare to Japan’s Stablecoin Rules?

With strong stablecoin regulation now legal in the U.S., it’s useful to compare with other major markets — particularly Financial Services Agency (FSA)-regulated jurisdictions like Japan.

What Are the Key Differences Between U.S. and Japan Stablecoin Compliance?

In Japan, stablecoins are regulated under revisions to the Payment Services Act (PSA), requiring that:

- Issuance is limited to licensed banks, trust companies, or regulated money-transfer agents — decentralized or unlicensed issuers are generally not permitted.

- Reserves must be fully backed (100% backed) by cash or deposits; custody rules are strict and user funds are segregated.

- Redemption rights are guaranteed — holders must be able to redeem stablecoins at face value.

- Regular reporting, audits, and AML/CFT compliance are required for issuers and intermediaries.

Comparing to the U.S. under the GENIUS Act: both systems share core principles — full backing, segregation, transparency — but differ in permitted issuer types, especially non-bank / nonbank-chartered issuers. The U.S. allows regulated non-bank firms under strict licensing, whereas Japan tends to require traditional licensed financial institutions.

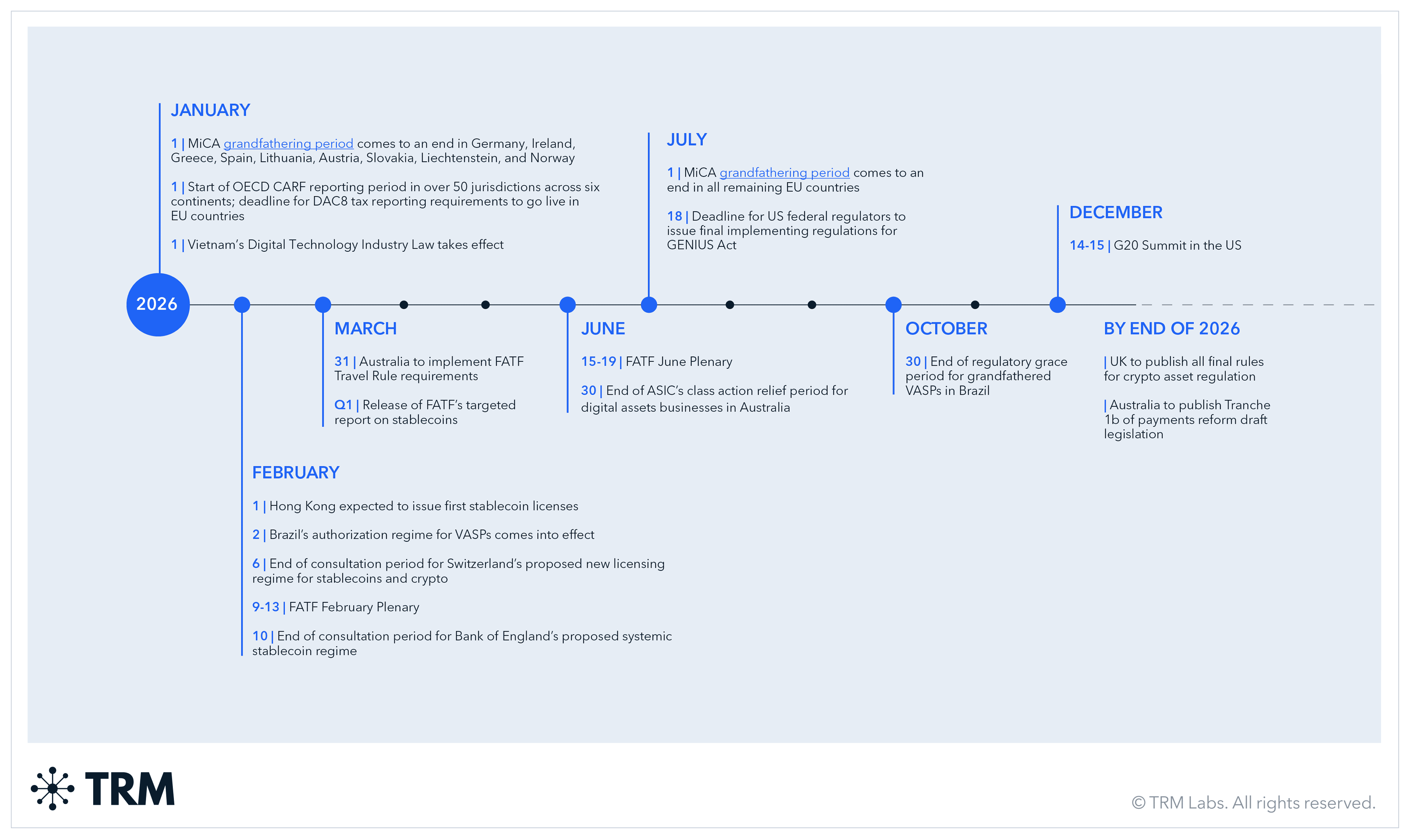

Why Do These Differences Matter for Global Markets in 2026?

These regulatory differences shape:

- Capital flows and adoption strategy — stablecoins issued under U.S. regulation may be more widely accepted globally due to perceived safety, pushing cross-border stablecoin demand.

- Arbitrage and jurisdiction shopping — issuers may pick jurisdictions based on flexibility, cost, and compliance burden.

- Institutional interest — jurisdictions with robust frameworks may attract more institutional capital, given lower perceived risk.

- User trust and stability — harmonized regulation breeds confidence among users, developers, payment services, and remittance companies.

As stablecoin regulation spreads, global stablecoin standards are likely to converge toward high-reserve, transparent, and regulated models.

How Will FDIC Stablecoin Regulation Impact Global Crypto Markets in 2026?

The introduction of the GENIUS Act — and thus FDIC-backed stablecoin regulation — has far-reaching implications for investors, institutions, and everyday users worldwide.

Source X

What Are the Potential Benefits for Investors and Institutions?

- Increased trust & legitimacy: Fully backed stablecoins with transparent reserves make stablecoins more like traditional money or money-market funds — reducing volatility and risk.

- Institutional adoption: Pension funds, fintechs, payment providers — previously cautious — may now enter stablecoin markets under regulated conditions.

- Liquidity and stability: 1:1 reserve backing and redemption guarantees reduce depegging risk, improving stablecoin reliability globally.

- Cross-border payments & remittances: With regulatory clarity, stablecoins become viable tools for international payments, remittance corridors, and cross-border trade.

Overall: stablecoins stand to become more mainstream — bridging traditional finance and Web3.

What Challenges Could the Global Market Face Under Stricter Rules?

- Compliance cost and burden: For smaller issuers, meeting reserve, audit, licensing and reporting standards may be expensive. Some may exit, reducing competition.

- Reduced decentralization: The requirement that only licensed financial-type entities may issue stablecoins could stifle decentralized stablecoin innovation.

- Regulatory fragmentation: Different countries (U.S., Japan, EU, Singapore, etc.) may adopt different standards — complicating cross-jurisdiction use.

- Dependence on U.S. assets: Heavy reliance on U.S. dollars and Treasuries may increase demand for U.S. debt — with macro-economic implications. Some observers warn of destabilisation risk.

Thus while regulation brings benefits, it also introduces trade-offs between safety and decentralization or innovation.

How Can Users Manage and Use Stablecoins Safely with Bitget Wallet?

In this new regulated stablecoin environment, using a secure, compliant wallet becomes more important than ever. Bitget Wallet stablecoin management is well-suited for 2026 and beyond — offering features that match regulatory demands while preserving ease of use.

Features include:

- On-chain security and self-custody: Users retain control over their private keys — their assets are isolated from issuers’ operational risks.

- Multi-chain stablecoin support: Ability to hold and transact stablecoins on multiple blockchain networks, providing flexibility and resilience.

- Transparent asset visibility: Users can view holdings clearly, track stablecoins and tokenized assets.

- Segregation and safekeeping: Assets are stored separately from corporate funds, aligning with regulatory requirements for asset segregation.

Whether you’re a retail user or institutional investor, Bitget Wallet helps you manage stablecoins under a compliance-aware but user-friendly framework.

Why Bitget Wallet Is a Secure Tool for Compliant Stablecoin Usage in 2026?

As regulators, especially under the GENIUS Act — tighten oversight, Bitget Wallet offers a stable, transparent, and secure environment:

- It aligns with regulatory expectations around custody and asset segregation.

- It gives users control and visibility — essential when stablecoin issuers are subject to audits, reserve attestations, and regulatory scrutiny.

- It supports multi-chain flexibility — important if users operate across different jurisdictions or blockchains.

- It reduces risk compared to keeping funds on unregulated exchanges or wallets.

For users seeking a compliant, safe, and user-friendly platform to store and transact stablecoins — Bitget Wallet is well-positioned for 2026’s regulated stablecoin ecosystem.

Read More:

- What Is the GENIUS Act? U.S. Stablecoin Regulation Explained (2025 Guide)

- What is stablecoin?

- Navigating the Multi-chain Era: A Web3 Beginner's Guide to Asset Management, Trading & Ecosystem Interaction

- Everything You Need to Know to Manage BTC on Bitget Wallet

Conclusion

The advent of FDIC stablecoin regulation via the GENIUS Act represents a major milestone for the global stablecoin ecosystem. By enforcing 1:1 reserve backing, transparent disclosures, strict issuer licensing, and consumer protections, the U.S. has established a blueprint for how stablecoins can be safely integrated into mainstream finance.

When compared to other jurisdictions like Japan, the differences highlight trade-offs between regulatory inclusivity and strict financial oversight — yet both converge toward responsible, transparent stablecoins.

As stablecoin markets grow, driven by institutional adoption, global payments, and cross-border liquidity, understanding these regulatory changes will be essential. For individual users seeking a reliable, regulation-aware way to manage stablecoins, Bitget Wallet offers robust features that align with the new landscape.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is the FDIC stablecoin regulation and why does it matter in 2026?

The FDIC stablecoin regulation refers to the U.S. framework introduced under the GENIUS Act, which places strict requirements on stablecoin issuers, reserves, and compliance procedures. It matters in 2026 because the framework sets global standards for transparency, asset backing, and consumer protection—impacting how stablecoins are issued, traded, and stored worldwide.

2. How does the GENIUS Act regulate stablecoin issuers?

The GENIUS Act regulates stablecoin issuers by defining them as “payment stablecoin issuers” and enforcing rules on reserve composition, audits, redemption processes, cybersecurity standards, and operational controls. Issuers must maintain fully backed reserves and follow FDIC-aligned consumer protection rules, or risk losing their registration.

3. How do FDIC stablecoin rules compare to stablecoin compliance in Japan?

Compared to Japan, where the PSA and JVCEA require only banks and licensed institutions to issue stablecoins—the FDIC stablecoin regulation allows both banks and qualified non-bank issuers under strict oversight. Japan focuses heavily on banking oversight, while the U.S. emphasizes reserve quality, issuer transparency, and systemic risk reduction. Both work toward safer global stablecoin use but take different regulatory approaches.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.