Etherfi Wallet | Bitget Wallet

Unlock the power of liquid staking with EtherFi! Go beyond traditional Ethereum staking – earn rewards while retaining flexibility on the Ethereum network. Access EtherFi's innovative platform and tap into the full potential of DeFi with your Bitget Wallet. Own your staking journey the smarter way – start exploring EtherFi today!

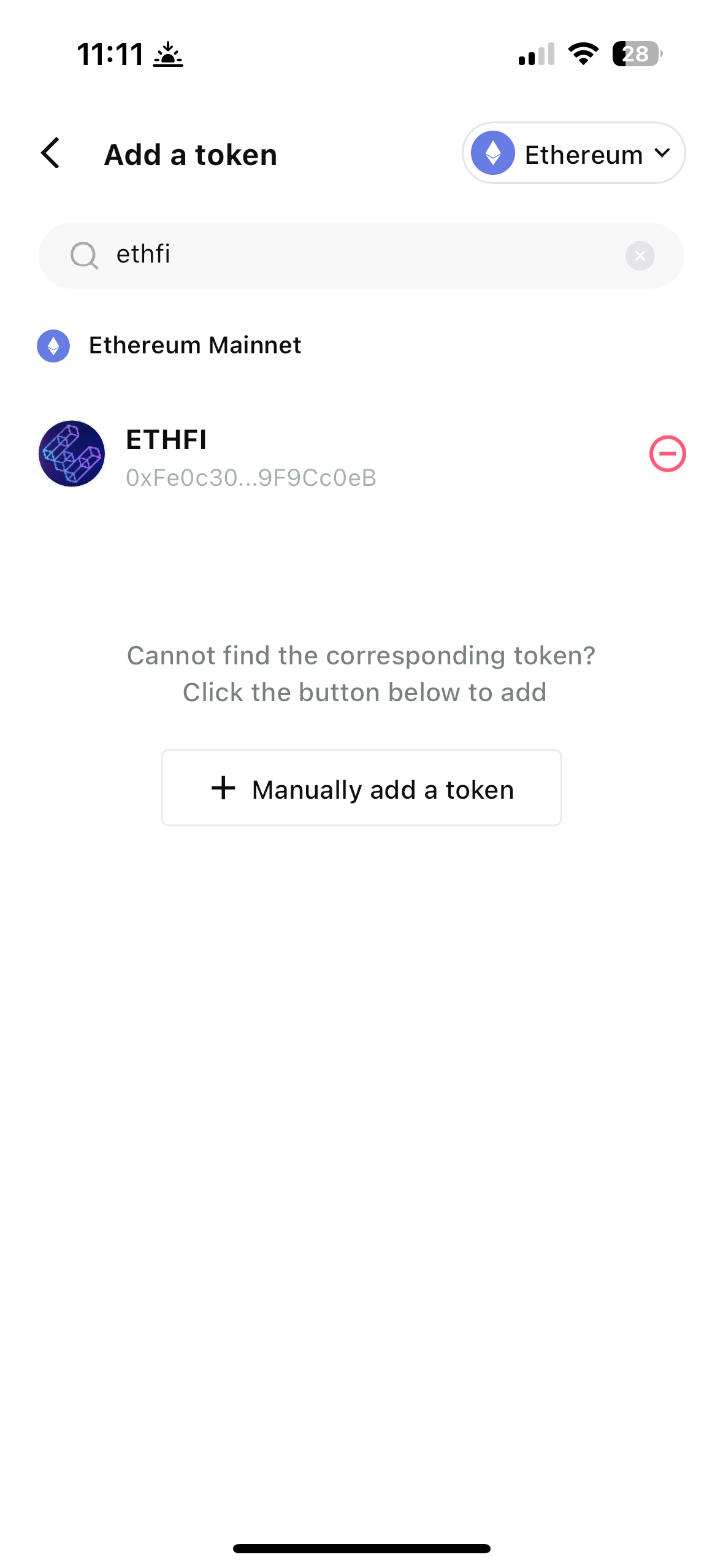

How to Create a Etherfi Wallet in Bitget Wallet

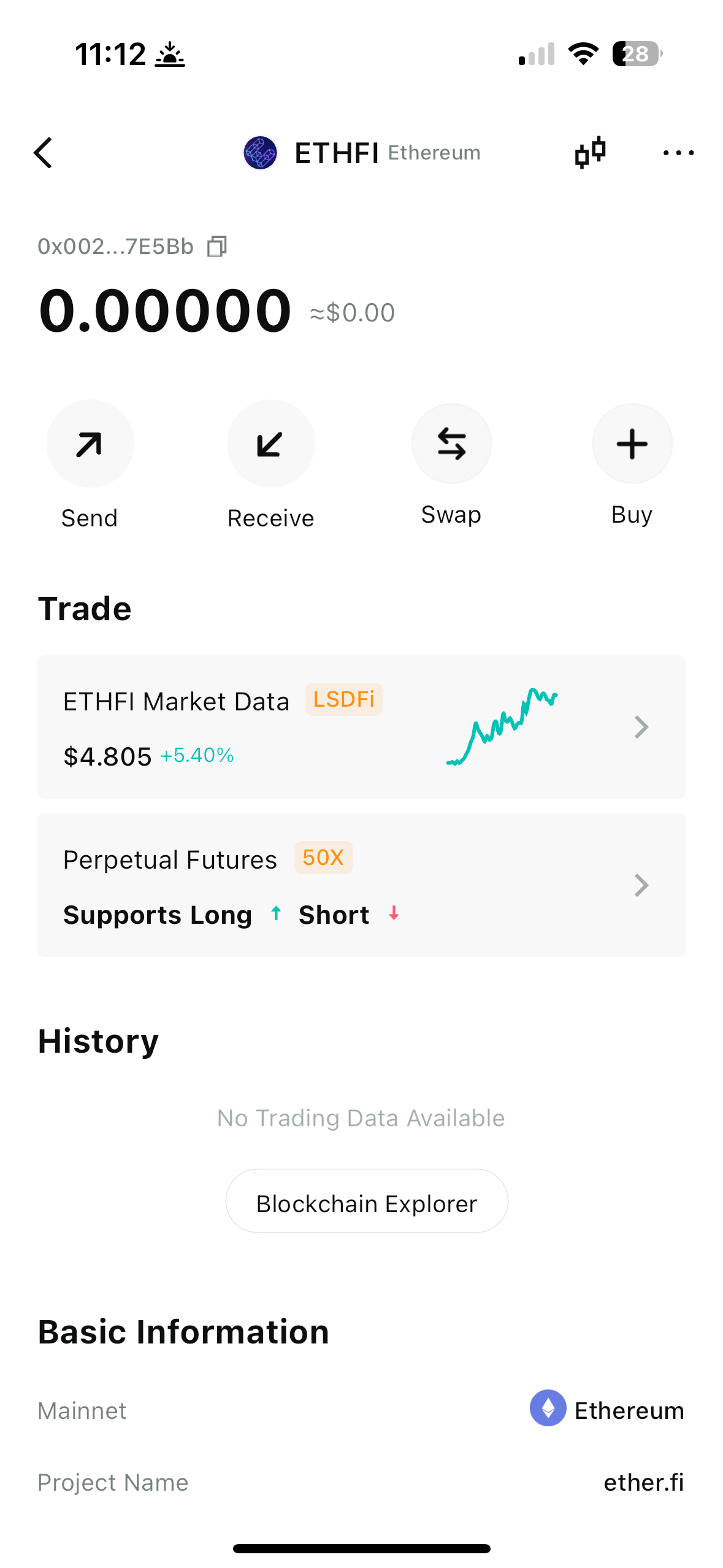

How to buy Etherfi ?

What's the best Etherfi Wallet?

How do you download Bitget Wallet and create a Etherfi Wallet?

Why should you use Etherfi Wallet

Withdrawing Etherfi to Your Bitget Wallet

How to safely store your Etherfi?

Withdrawing Etherfi to Your Bitget Wallet

Earn Exciting Etherfi Airdrops

About EtherFi

What is EtherFi?

Why makes EtherFi unique?

What is the future potential of EtherFi?

Which crypto narrative does EtherFi leverage?

Project Partners